10 lpa in hand salary

CTC vs In Hand Salary is the tricky truth of Corporate Economics which is relevant to every individual who is the part of the corporate sector specifically in India.

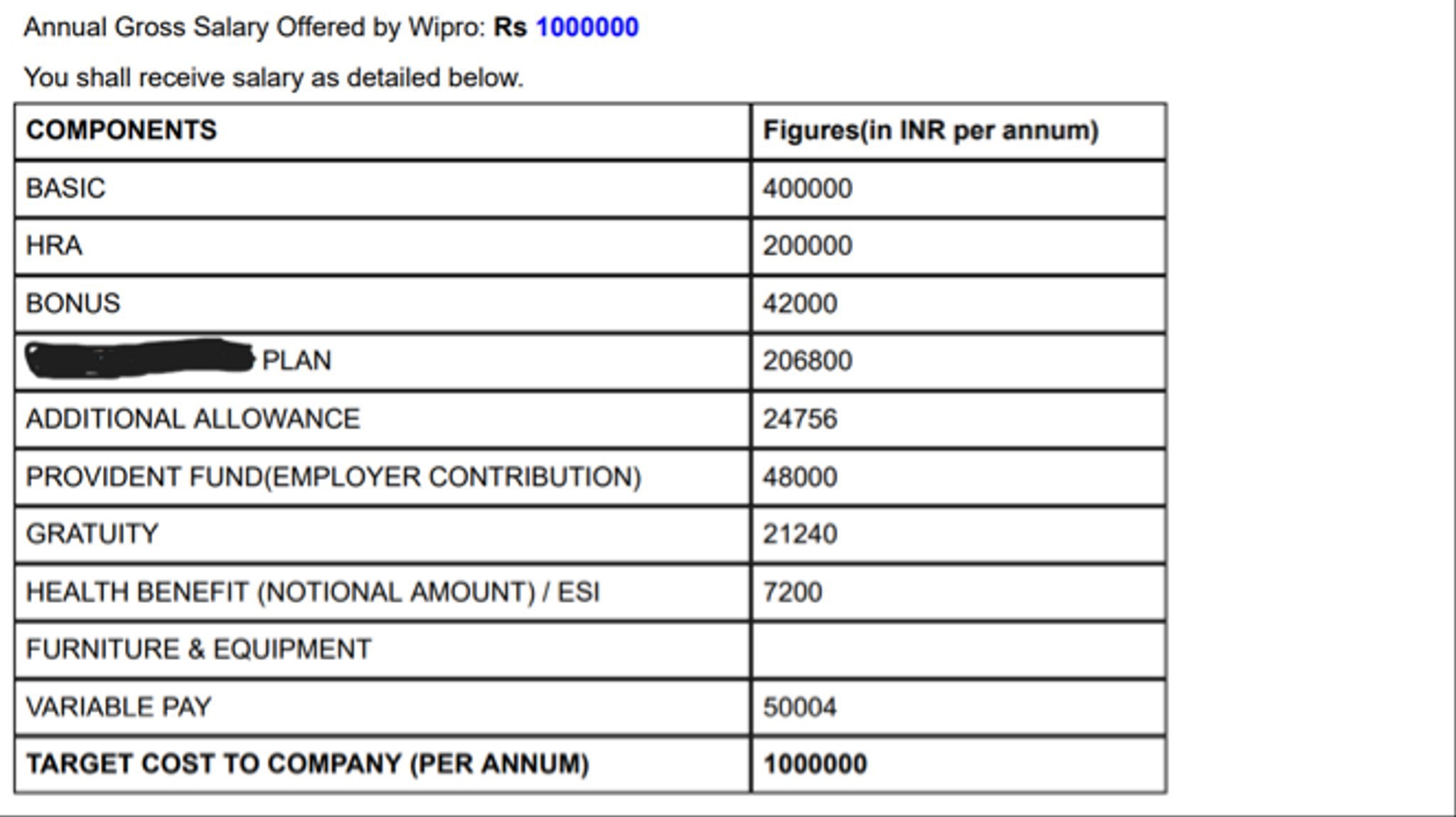

In every professional field, employees get paid at the end of the month by their employers. This payment is called the salary. The amount they receive is usually mentioned in their contract as well as the pay slip. The salary has many components that may vary among different employers. Below is a list of the most common breakdown of the salary structure. There is no formula to calculate this amount.

10 lpa in hand salary

.

It also considers all the bonuses and deductions applicable.

.

A salary calculator is a very easy tool to use which helps in determining the total annual deductions, take-home annual salary, and total monthly deductions of an individual. This inhand salary calculator uses some basic components such as the basic salary, House Rent Allowance, Leave Travel Allowance, Professional Tax, Bonus, Special Allowance, Employee contribution to provident fund etc to calculate the salary. A salary is a form of payment to an employee, typically paid regularly, such as monthly or bi-weekly, for the services they provide to their employer. Salaries are typically calculated as a fixed amount rather than based on the number of days worked or the amount of work completed. Some employees may receive additional benefits and incentives, such as health insurance, retirement plans, or stock options, in addition to their salary. The amount of a salary can vary greatly depending on the type of job, the industry, the location, and an individual's experience and education level. Dearness Allowance DA is an extra amount added to a salary to help employees cope with the rising cost of living and inflation. It ensures that their purchasing power remains stable by periodically adjusting based on changes in living expenses.

10 lpa in hand salary

In every professional field, employees get paid at the end of the month by their employers. This payment is called the salary. The amount they receive is usually mentioned in their contract as well as the pay slip. The salary has many components that may vary among different employers. Below is a list of the most common breakdown of the salary structure. There is no formula to calculate this amount. It depends on factors like the industry, employee designation, and much more. Companies pay the HRA to employees who stay in a rented property. But, if you do not stay in a rented property, the entire component is taxable. The allowance only covers railway ticket prices and airfares.

Hot springs board of realtors

Next, you must deduct the total EPF contributions by you and your company. You can always cross-check the take home salary with your HR or finance manager in the organization and ask them to explain the details about the deductions and allowances. Once you enter the required details, the calculator will instantly provide the following information. What do I need to know to use the salary calculator? To save time and effort, most people use the salary calculator in India. It calculates the basic salary as a percentage of the CTC. Salary Calculation Formula As the salary calculations involve various components, you need to use different formulas to calculate each aspect. The Special Allowance varies among companies as it depends on multiple factors. How does the calculator determine the basic pay? Annual Salary LPA - lakh per annum. As the salary calculations involve various components, you need to use different formulas to calculate each aspect. Cost to company CTC is a term for the total salary package of an employee. The entire bonus amount is fully taxable.

Consult an Expert.

To save time and effort, most people use the salary calculator in India. The allowance only covers railway ticket prices and airfares. Taxpayers earning an income below a certain limit have the benefit of paying marginally lower taxes A rebate of Rs 12, will be available for all taxpayers with taxable income up to Rs 5 lakh. Input the basic salary percentage of the CTC. Download now. A rebate under section 87A is one of the income tax provisions that help taxpayers reduce their income tax liability. Basically Indian Income Tax system levies taxes on percentage basis and the more is your income falling the the bigger bracket the more percentage of tax you pay. You should only know your gross salary and total bonus. Since most of the corporate work force is below the age of 60 and for the ones who are above this age bar money mostly do not matter to them in an primary way of earning livelihood. Here are some important salary calculation formulas that you must know. There with these hypothesis we get to know that for an individual whose CTC is 3,88, would get about 22, per month i. Let see how to calculate Gratuity? Next, you must deduct the total EPF contributions by you and your company. FAQs related to salary calculator 1.

Just that is necessary.

I apologise, would like to offer other decision.