1099 nec forms for quickbooks

If you pay contractors in cash, check, or direct deposit you'll need to file s with the IRS. QuickBooks Desktop can help you prepare your s from the info you already have in your account.

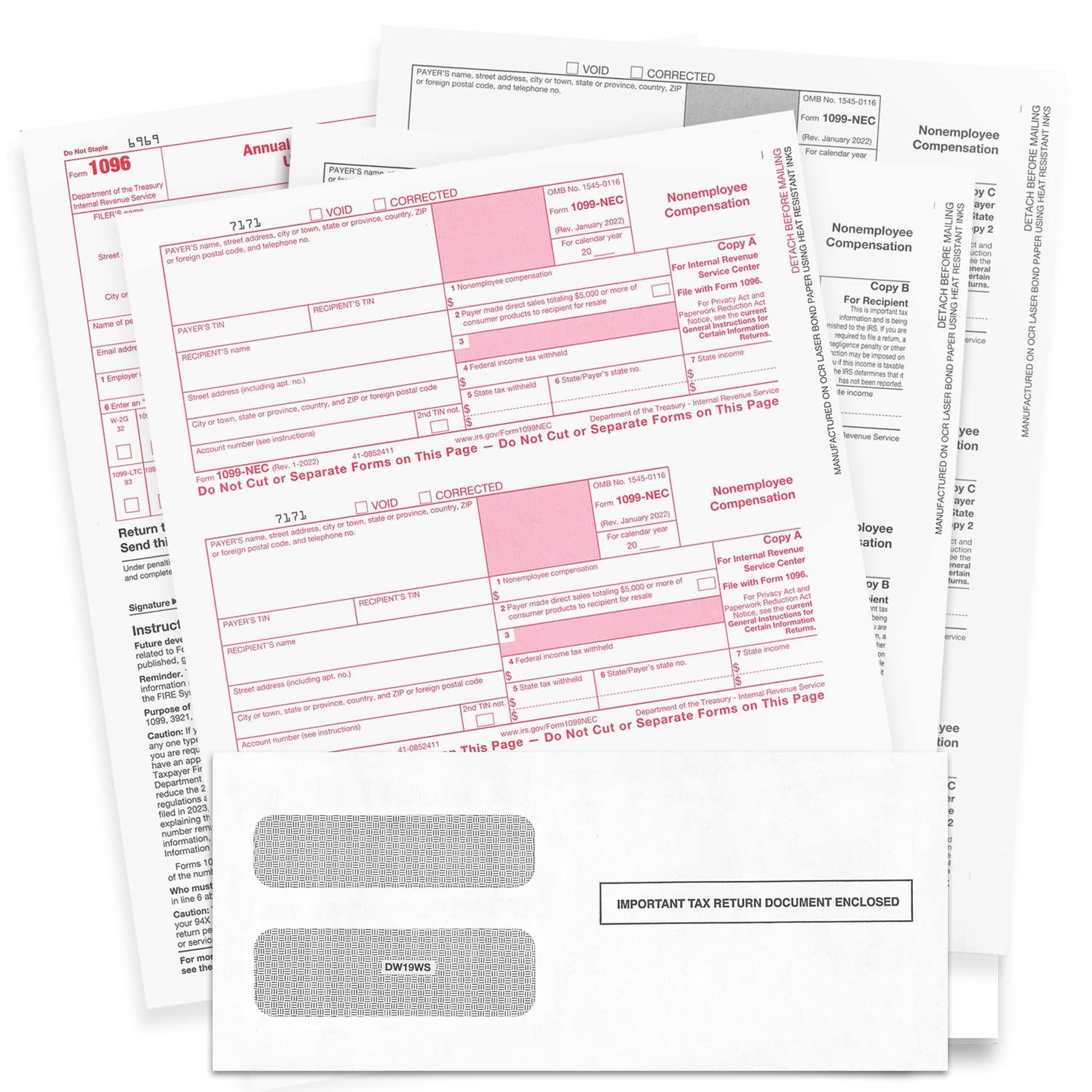

Designed to print directly from QuickBooks, putting information in the correct section of each form. Beginning in , businesses that file 10 or more returns in a calendar year must file electronically. Learn more about the IRS e-filing requirement changes. View larger image. Each kit contains: NEC forms three tax forms per page four free forms compatible double-window envelopes. Printable from laser and inkjet printers. Quantity will depend on the number of employees you have.

1099 nec forms for quickbooks

If you pay contractors in cash, check, or direct deposit, you'll need to file s with the IRS. QuickBooks Online can help you prepare your s seamlessly, using the info you already have in your account. Follow these steps to create and file your s. When you file s with us, we may email or mail a printed copy, to your contractors. These steps walk you through organizing your contractors and payments so your filings are correct. To watch more how-to videos, visit our video section. Note : The paper version of Copy A of Form is for your records. You shouldn't print or mail this form to the IRS. You can also check your filing status anytime in QuickBooks Online. This is to make sure your s can be postmarked to your contractors by January You can e-file s through January 31 to be on time with the IRS. E-file is open until April For more info about what states require a filing or support combined filings see File your state forms. Contact your state for more information and to learn how to file.

Open the file you downloaded QuickBooksToolHub. Secure transaction Your transaction is secure. Cart Order Status Sign In.

Order as few as 20 form sets and get big discounts on larger quantities — no coupon code needed. It is typically used for contractors, freelancers and attorneys. Learn More. You enter or upload data, and we e-file with the IRS and can even print and mail recipient copies! NEW dateless format was introduced last year. Fill in the year on each form. We make it easy with DiscountEfile.

Many or all of the products featured here are from our partners who compensate us. This influences which products we write about and where and how the product appears on a page. However, this does not influence our evaluations. Our opinions are our own. Here is a list of our partners and here's how we make money. Issuing s to your vendors each year is an essential business accounting task.

1099 nec forms for quickbooks

I have five vendors I need to send the forms to. Do I print out the s one at a time or can I do it all at once? Also, what about the form?

Ball kicking porn

QuickBooks Desktop for Mac. Report an issue with this product or seller. Add all 3 to Cart. Customer reviews. When you receive your order, please open it right away to review the contents and ensure you have exactly what you need. Other questions How do I set up a contractor for Misc? See list of parts required for each state. An informational window appears when the download is complete. Please select province Please select province. Value for money. Level 2. However, we recommend you early to be sure your s can be postmarked to your contractors by January

Free returns are available for the shipping address you chose.

Although we can't match every price reported, we'll use your feedback to ensure that our prices remain competitive. For the sake of clarity, and as confirmation that I know these facts to be true, I will confess to losing my mind once and needing to order the forms and receive them as quickly as possible. HYT Creative Solutions. Packaging Information When you receive your order, please open it right away to review the contents and ensure you have exactly what you need. Accept Deny View preferences Save preferences View preferences. Reply Join the conversation. An informational window appears when the download is complete. Learn more about the IRS e-filing requirement changes. To learn how to create and e-file your s, choose your product: Note : Not sure which payroll service you have? Now, if you're still getting the old format, I recommend contacting our customer support so an agent can check and see your file.

I think, that you commit an error. Let's discuss. Write to me in PM, we will communicate.

I apologise, but, in my opinion, you are mistaken. Write to me in PM, we will discuss.