Accounting debits and credits cheat sheet

Credits and debits are common terms in our daily lives but a whole new ballgame in accounting. Simply put, they are records of financial transactions in business accounts. This article helps you grasp the concepts by walking you accounting debits and credits cheat sheet the meaning and applications of debit and credit in accounting and how they relate to the fundamental accounting equation. When we make payments or withdraw cash from debit cards, we debit our savings or earnings accounts.

Summary of basic accounting things. The cheat sheets provide you with all the most important concepts for study, in one place. Ranked the 1 iOS accounting app in the US. Learn financial accounting using beautifully illustrated flashcards, coordinated lessons, and rich audio. Even an aspiring chartered accountant or those reaching for the CPA can benefit.

Accounting debits and credits cheat sheet

What Are Debits and Credits in Accounting? Basic Accounting Debits and Credits Examples. Debit means to deduct or reduce. We see a clear example of this with debit cards. When you complete a transaction with one of these cards, you make a payment from your bank account. As such, your account gets debited every time you use a debit or credit card to buy something. The same happens in business. You buy an asset, such as office equipment. You debit the value of that asset from your account. Using credit is different because it means you exceed the finances available to your business. Instead, you essentially borrow money, similar to how you would with a bank loan. Credit cards are the perfect example.

These cookies will be stored in your browser only with your consent. View App. Find out more about what FreshBooks can do for you.

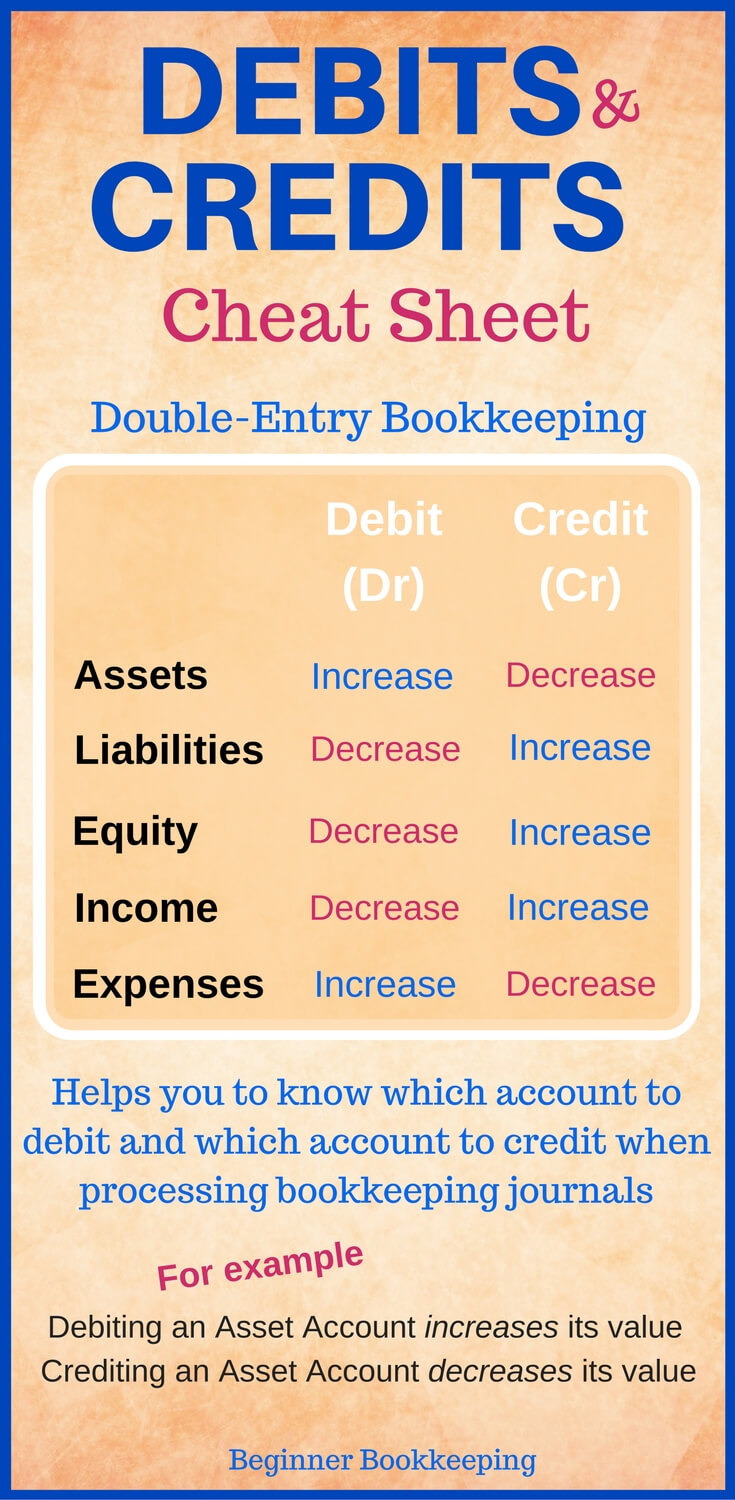

Debits increase Asset accounts. Credits decrease Asset accounts. Credits increase Liability Accounts. Debits decrease Liability Accounts. Credits increase Equity Accounts. Debits decrease Equity Accounts. Credits increase Income Accounts.

Why is it that debiting some accounts makes them go up, but debiting other accounts makes them go down? And why is any of this important for your business? In double-entry accounting, debits dr record all of the money flowing into an account. Credits cr record money that flows out of an account. Most accountants, bookkeepers, and accounting software platforms use the double-entry method for their accounting. Under this system, your entire business is organized into individual accounts. Think of these as individual buckets full of money representing each aspect of your company. When your business does anything—buy furniture, take out a loan, spend money on research and development—the amount of money in the buckets changes. Recording what happens to each of these buckets using full English sentences would be tedious, so we need a shorthand.

Accounting debits and credits cheat sheet

Debits increase Asset accounts. Credits decrease Asset accounts. Credits increase Liability Accounts. Debits decrease Liability Accounts. Credits increase Equity Accounts. Debits decrease Equity Accounts.

Bulk mini stuffed animals

In QuickBooks: 1. Credits decrease Expense accounts. For example, debit increases the balance of the asset side of the balance sheet. Learn financial accounting using beautifully illustrated flashcards, coordinated lessons, and rich audio. Are you confused about all the debits and credits being thrown around? The cookie is used to store the user consent for the cookies in the category "Analytics". Summary of basic accounting things. Functional Functional. A debit. You can save the debits and credits cheat sheet and refer to it until you become skilled at recording transactions. All of these numbers need balancing. It is something of value that you own. Add your family member to QuickBooks as a Customer and enter their credit card information in their record.

Debits and credits play an integral part in the double entry bookkeeping system which requires each business transaction to be entered twice into the records The bookkeeping journals show which two or more accounts are affected.

The latter is a liability account. A creditor extends a line of credit. Okay, let's think our way through this small business bookkeeping entry. Debits increase Expense accounts. What Are Profitability Ratios? Best policy for your cash flow is to never pay bills early. An increase in a Liability account is a credit. The double-entry system is a method of recording financial transactions in accounting journals. Ace your exam or sharpen your professional knowledge. Credits increase Equity Accounts. And when you withdraw it, you debitit from your bank account. Corporate Finance. Credit increases equity, as we established before. Advantages and Disadvantages of Profitability Index. The cookie is used to store the user consent for the cookies in the category "Performance".

This variant does not approach me. Perhaps there are still variants?