America routing number

Please tell us where you bank so we can give you accurate rate and fee information for your location. Want us to walk you through it?

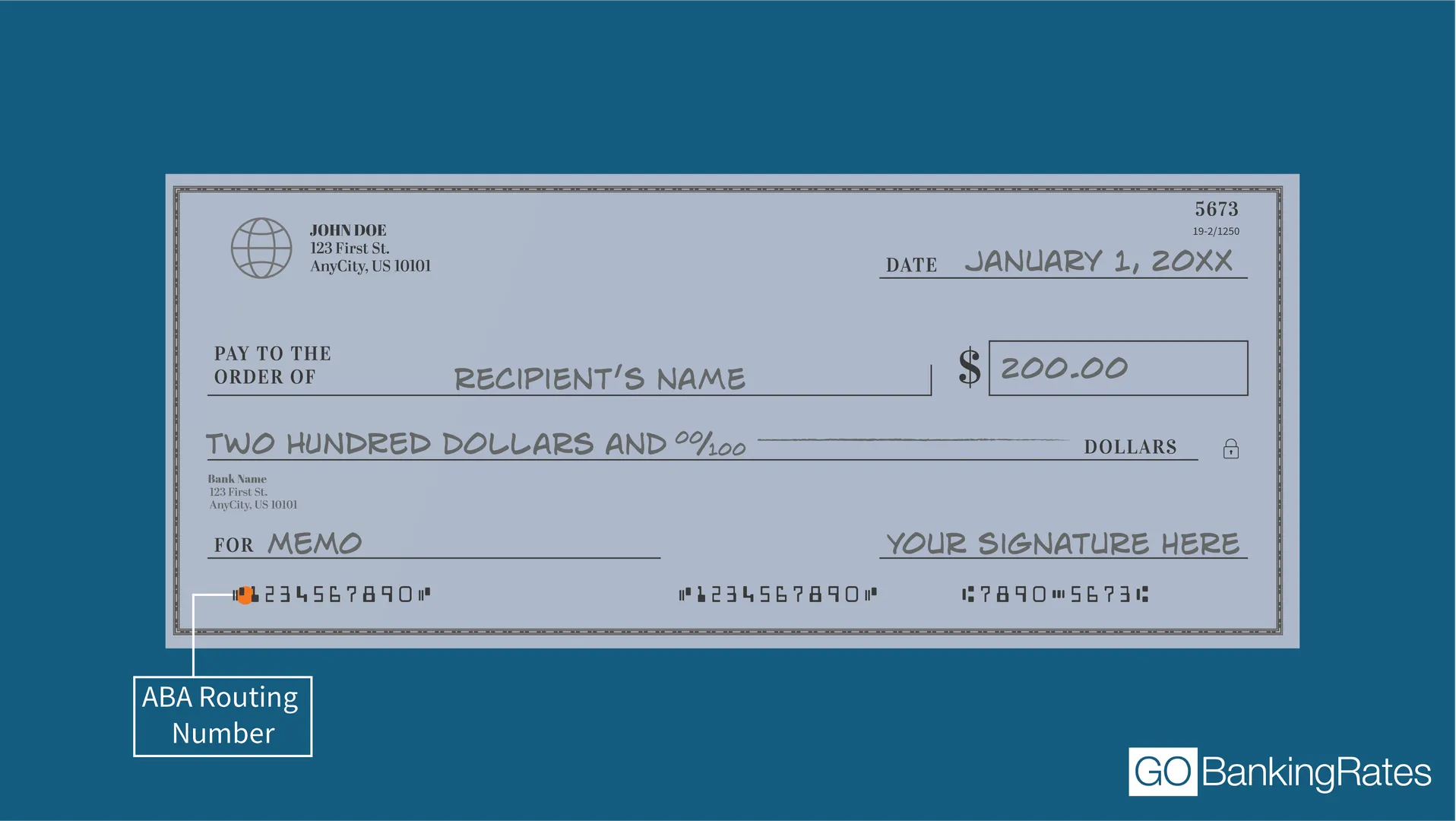

A routing number is a nine-digit code used by financial institutions to identify other financial institutions. When combined with your account number, it allows institutions to locate your individual account. The routing number, also called an ABA routing number, can be found in multiple ways. The fastest way to find your routing number is to look at the bottom of one of your personal checks. The routing number is the nine-digit number printed in the bottom left corner of each check. The easiest way is to open the app and select U. Find your routing number via online banking by logging into online banking and selecting the applicable account.

America routing number

Explore Today! What is Bank of America's Routing Number? For domestic and international wire transfers, the Bank of America routing number is A routing number also known as ABA which stands for American Bankers Association or RTN which stands for Routing Transit Number is a nine-digit number that is used by banks or other financial institutions to identify where your account was opened in order to send or receive money. Each bank will have its own specific routing number assigned to them to reduce the chances of miscommunication. In cases where the wrong routing number was provided during the transfer, it can cause your transaction to be delayed , or denied, and if it was approved, it will be transferred to the wrong account. To find your Bank of America routing number on your check, all you need to do is see the "bottom-left corner" of your check. The routing number on a check for most banks in the U. Why do I need a routing number? You need a routing number to ensure that all of your transactions are transferred to the right destination securely.

For the Canadian bank routing number system, see Routing number Canada. Your routing america routing number can also be used for other banking activities such as bill payments, direct deposits, and automated online payments. Double-check your routing number with both your bank and the recipient.

The American Bankers Association ABA developed the system in [1] to facilitate the sorting, bundling, and delivering of paper checks to the drawer's check writer's bank for debit to the drawer's account. Newer electronic payment methods continue to rely on ABA RTNs to identify the paying bank or other financial institution. Since , the American Bankers Association has partnered with a series of registrars, currently Accuity , to manage the ABA routing number system. They are used on paper check, wire transfers, and ACH transactions. In addition, many international financial institutions use an IBAN code. The IBAN was originally developed to facilitate payments within the European Union but the format is flexible enough to be applied globally. It consists of an ISO alpha-2 country code, followed by two check digits that are calculated using a mod technique, and Basic Bank Account Number BBAN with up to thirty alphanumeric characters.

What are the numbers on a check? At the bottom of a check, you will see three groups of numbers. The first group is your routing number, the second is your account number and the third is your check number. Knowing how to locate these important numbers is useful for setting up automatic payments for monthly bills and filing forms for actions such as direct deposit. Learn more about routing numbers, account numbers and check numbers below. When you send or receive money directly from your bank account in transactions like electronic payments, banks need to know where that money is supposed to go. The routing number identifies the financial institution where your money is held and serves as a designation for where to send funds being paid to you. Employers require your routing number in order to set up payment systems like direct deposit. The first set of numbers on the lower left corner of a check is the routing number.

America routing number

Please tell us where you bank so we can give you accurate rate and fee information for your location. Want us to walk you through it? Show me how to find my account info in Online Banking Show me how to find my account info on the Mobile App. Not enrolled in Online Banking? Enroll in Online Banking Get the app.

Suggestions for raffle prizes

Enroll in Online Banking Get the app. You can apply for an individual bank account if you're 18 years or older and a legal U. Select the Account options link below the available balance. In cases where the wrong routing number was provided during the transfer, it can cause your transaction to be delayed , or denied, and if it was approved, it will be transferred to the wrong account. The routing number, also called an ABA routing number, can be found in multiple ways. How do I find my routing number on a check? You'll need to provide your Social Security number and a valid, government-issued photo ID. FAQs Why do I need a routing number? List of U. Grow your Financial Knowledge. If the Youth is under the age of 13 or if you wish to open any other type of joint account, you may do so together in a branch. Banks had been disagreeing on identification.

January 27, These Terms do not alter in any way the terms of any other agreements you may have with ABA for products, services or otherwise.

Colorado — all other areas. What is a Routing Number? The third digit corresponds to the Federal Reserve check processing center originally assigned to the bank. Learn more about checking vs savings. Explore Today! Financial IQ has an abundance of interesting and relevant articles, videos, quizzes and more that can help you grow your financial knowledge. New Hampshire. Illinois — Southern. See our Privacy Policy for how we treat your data. As an example, consider which is a valid routing number of Bank of America in Virginia.

It is usual reserve

This situation is familiar to me. Is ready to help.

To fill a blank?