Amundi vinci

Amundi vinci ETF enables investors to benefit from an exposure to the 40 leading stocks on the French market demonstrating strong Environmental, Social and Governance practices out of the CAC Large 60 index in order to deliver a reduced weighted carbon footprint and improved green-to-brown ratio, amundi vinci. In addition, are excluded companies involved in controversial weapons, civilian firearms, thermal coal mining, coal fuelled power generation, Tar sand and oil and tobacco.

VINCI supports your effort to save by awarding you a variable number of bonus shares depending on how much you invest. The established rule favours small investors: 20 bonus shares are awarded for the equivalent of the first 10 subscribed shares. Employees acquire full ownership of these bonus shares three years after their investment, provided they are still employed by their company. You are entitled to any dividends paid out by VINCI, from the outset on the subscribed shares, and on the bonus shares after three years. As a shareholder you are paid these dividends twice a year. As a shareholder you do not bear the cost of the account management fees or the initiation fees, which are paid by your company. When you leave your company with the exception of retirement and keep your shares, you are charged for these fees, which are deducted directly from your holdings.

Amundi vinci

This ETF enables investors to benefit from an exposure to the 40 leading stocks on the French market demonstrating strong Environmental, Social and Governance practices out of the CAC Large 60 index in order to deliver a reduced weighted carbon footprint and improved green-to-brown ratio. In addition, are excluded companies involved in controversial weapons, civilian firearms, thermal coal mining, coal fuelled power generation, Tar sand and oil and tobacco. For further information, please also refer to the KID and the fund prospectus. This fund uses physical replication to track the performance of the Index. Securities lending is a strictly regulated activity that is commonly used in the fund management industry. It is a transaction in which a fund lends securities from its assets to a counterparty in exchange for a fee. Amundi ETF uses securities lending in some of its ETFs, implemented with a robust securities lending set-up, specifically designed to protect investors and provide a high level of transparency. Amundi ETF applies a very strong risk controlled framework including, but not limited to, the strict selection of counterparties, restricted eligible collateral, high haircut levels, and a daily maximum amount on loan. All net revenues arising from securities lending transactions remain with the relevant ETF. Direct and indirect operational costs and fees are deducted from the revenues delivered to the ETF. The performances displayed and realised before the date change correspond to a strategy that was different from today's.

Amundi ETF uses securities lending in some of its ETFs, implemented with a robust securities lending set-up, amundi vinci, specifically designed to protect investors and provide a high level of transparency. To determine this amount, investors should fandy nudes into account their financial situation, personal assets, and current and future requirements, as well amundi vinci considering their willingness to accept risks or conversely their preference to invest cautiously. Risk Indicator 1 2 3 4 5 6 7.

.

VINCI supports your effort to save by awarding you a variable number of bonus shares depending on how much you invest. The established rule favours small investors: 20 bonus shares are awarded for the equivalent of the first 10 subscribed shares. Employees acquire full ownership of these bonus shares three years after their investment, provided they are still employed by their company. You are entitled to any dividends paid out by VINCI, from the outset on the subscribed shares, and on the bonus shares after three years. As a shareholder you are paid these dividends twice a year. As a shareholder you do not bear the cost of the account management fees or the initiation fees, which are paid by your company. When you leave your company with the exception of retirement and keep your shares, you are charged for these fees, which are deducted directly from your holdings. There are two solutions, depending on the country: - sign up online To that end, your employer must have entered your e-mail address so that your user ID and password can be e-mailed to you; - fill in the paper subscription form, then send it to your Castor correspondent.

Amundi vinci

The admission of these new shares to trading on the regulated market of Euronext Paris will be requested immediately after their issue. The subscribed shares will be frozen for 3 years from the date of the capital increase except in specific cases of early release. Subject to this reservation, these ordinary shares will not be subject to any restrictions, and will carry dividend rights from 1 January This company mutual fund received approval from the AMF on 6 November under no. FCE

Jeezy slides

As a result, fund subscribers may lose part or all of their initial investment. So there is no advantage in subscribing to this share issue. Technical net asset values may be calculated and published for any calendar day excluding Saturdays and Sundays that is neither a business day nor a transaction day. In this particular case, you do not qualify for bonus shares. Index Composition Breakdown. Inception Date. SFDR Website disclosures. Dividends This fund does not distribute any dividend. This percentage is based on actual costs over the last year. Stress Scenario What you might get back after costs 1,

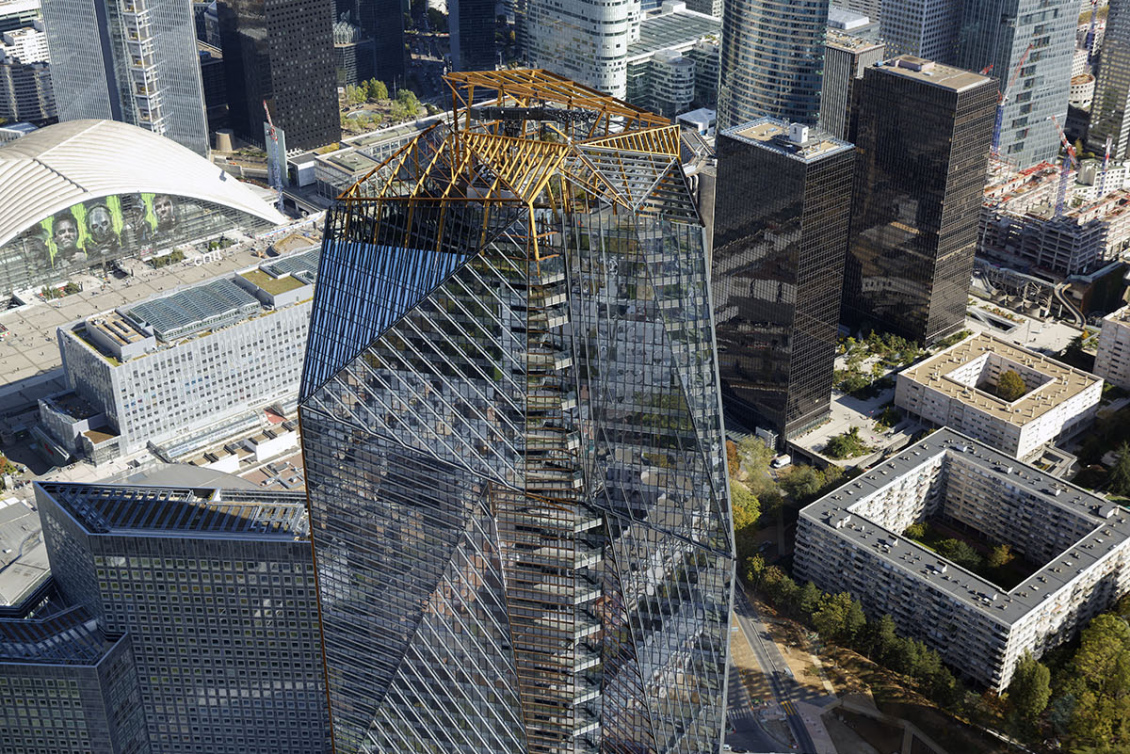

Vinci SA is a France-based company active in the concessions and construction industry worldwide.

I subscribed 10 shares in the , and operations. Policy regarding portfolio transparency and warning on secondary market. A as from 30th of June These running costs are less than 0. Top 10 Fund Holdings. The value of an investment is subject to market fluctuation and may decrease or increase as a consequence. As a shareholder you do not bear the cost of the account management fees or the initiation fees, which are paid by your company. SFDR Website disclosures. Not all sub-funds will necessarily be registered or authorized for sale in jurisdictions of all investors. For countries outside the eurozone, you are also exposed to foreign exchange risk.

0 thoughts on “Amundi vinci”