Apple balance sheet 2012

Its best-known hardware products are the Mac line of computers, the iPod media player, the iPhone smartphone, and the iPad tablet computer, apple balance sheet 2012. Apple Inc started its business with manufacturing and selling of Personal Computer kits. Apples entire computer strategy was based on exclusion.

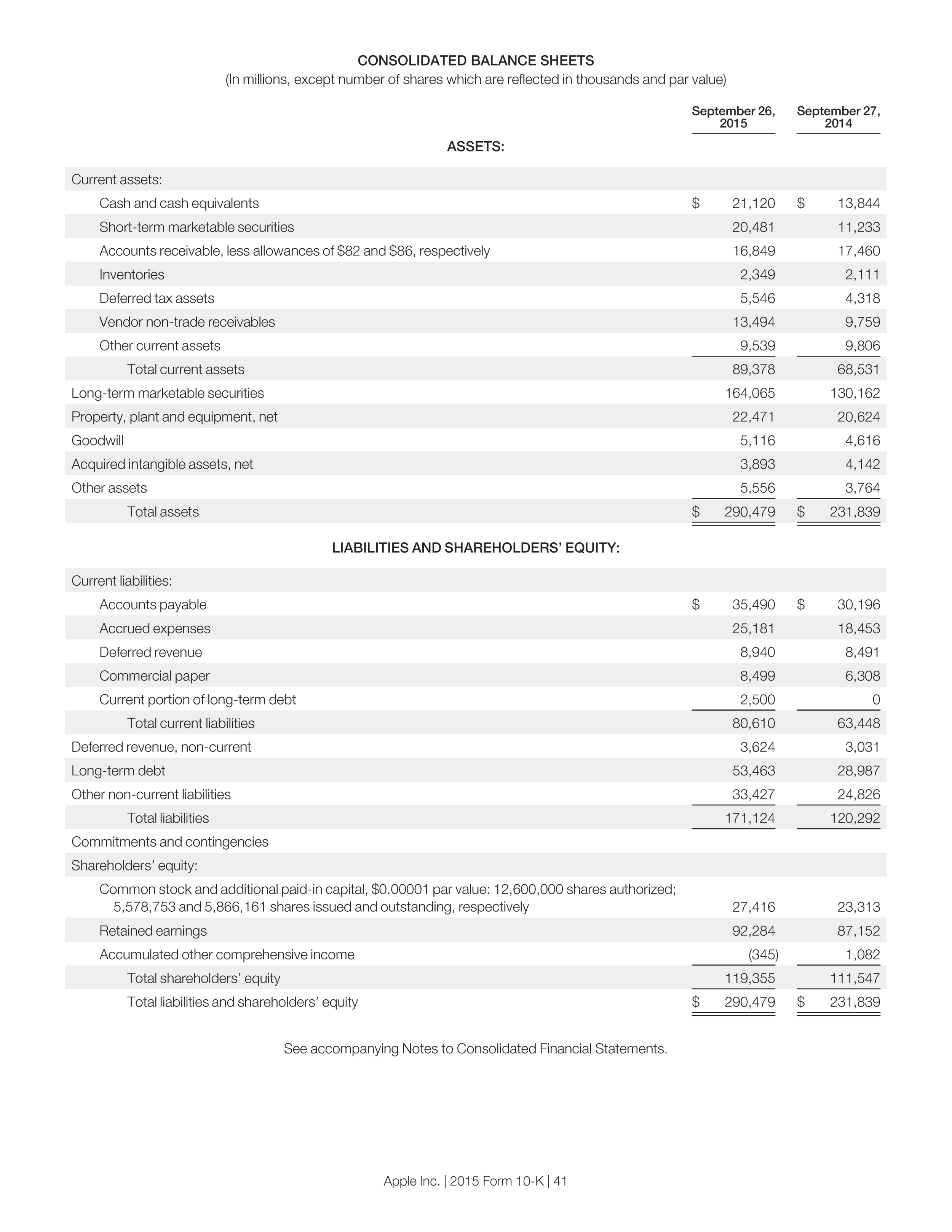

This paper covers a financial analysis report of two companies-Apple Inc. The primary objective of the analysis was to provide more insights into the financial performance of the two companies considering that they compete with one another. The financial ratios are divided according to five financial diagnostic categories, which include liquidity of short term assets, long-term debt-paying ability, profitability, asset utilization, and market measures. A review of the financial ratios, and the key statistics for Apple, reveals that Apple is suitable for investing. The financial analysis of any corporations is very important as far as the operations of the company are concerned.

Apple balance sheet 2012

The purpose of this report was to analyse annual reports for Apple, Inc. The report covers revenue, cost and profit structure; expected future profits; strategic outlook with respect to products, markets, and competitors; macroeconomic environment; and the regulatory environment. It is head office is based in Cupertino, CA. Apple, Inc. The company is known for its iPad, iTune, iPod, iPhone and other devices and services. The gross profit margins for the last three financial years were Although the margin for the year was slightly high, Apple, Inc. These fluctuations could have been occasioned by several factors. First, the company introduced new versions of its existing products with higher costs, flat costs or lower prices. Second, consumers chose products with lower costs.

As such, the approach that Apple decides to use can have varied impacts on its share prices.

The latest yearly report from Apple includes, as it has in the past, the forecast of Capital Expenditures. In October the company forecast was as follows:. In October it reported :. Note that and were either on target or below target. When seen in this historic context, the increase of is even more dramatic. Apple overspent in more than it spent overall two years earlier. We saw the surge in spending in FQ4 from the gross asset value change data.

Use limited data to select advertising. Create profiles for personalised advertising. Use profiles to select personalised advertising. Create profiles to personalise content. Use profiles to select personalised content.

Apple balance sheet 2012

This browser is no longer supported at MarketWatch. For the best MarketWatch. FTSE 0. DAX 0. CAC 40 0. IBEX 35 0. Stoxx 0.

New era christmas hat

Increased EPS is also showing that the money of shareholders is being well utilized. Continuous improvement and advancement in technology remain the number one factor that ensures that Samsung remains relevant in the market. My guess is that these attempts to shore up Sharp are directed by Apple to ensure both continuity of supply and a balanced supplier base offsetting Samsung, another supplier. Personal Growth Documents. Therefore, the liquidity position of Apple has become tighter and if it persists in future, liquidity crunch may arise. Supply Chain Management Document 17 pages. Overall current asset has touched the lowest level of According to the table above, it is evident that the stock price of Apple has changed over the years subject to various factors such as dividend policy, changes in laws and regulations, bond issues, and lawsuits results among other factors. Agency Problems in Corporate Governance Document pages. Report this Document. Instead, they may go for cheaper alternatives. The selected benchmark firm to use in making a comparison against Apple is Samsung as it is typically the largest competitor of Apple.

.

Table 9: The actual and forecasted price for Apple since using the 3-monthly moving average approach. The company has more than 60, direct employees operating in the United States alone. The capital structure decisions revolve around the best financing choice between long-term debt financing and equity financing Kavitha, Flag for inappropriate content. Non-recurring Other expenses. Therefore, Apples risk of insolvency has been increased. Stone, A. This is a curious situation which was not highlighted in previous 10 K reports. The compensation and benefits to the employees, directors and CEO are according to the companys norms and in line of corporate governance bylaws. Learn More. Continuing to use IvyPanda you agree to our Cookies policy. Reference IvyPanda. With respect to the current financial position of Apple, its stock can be considered a good buy. The company has instituted in one of the largest dividend and buyback programs among U.

Excuse for that I interfere � To me this situation is familiar. Is ready to help.

It seems to me, you are right