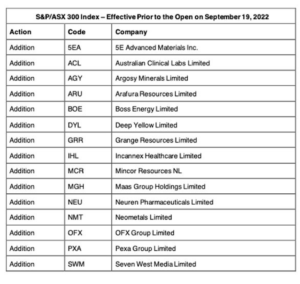

Asx company codes

ASX uses a range of individual codes to identify each tradeable instrument. Find out more about trading codes, security descriptions and vendor codes. Anything traded on ASX has an individual code that uniquely identifies it in an abbreviated form, asx company codes.

Check out our comprehensive list of ASX status codes in the following table. Codes used in ASX trading. Purchasing securities cum bonus means the buyer is entitled to the additional securities. Trading cum bonus continues until the ex bonus date. Securities trading 'cum dividend' carry an entitlement to the next dividend payable by the Issuer. In most instances these issues are non-renounceable.

Asx company codes

Any security traded on the NSX market has an individual code that uniquely identifies it in an abbreviated form. NSX Codes uniquely identify a tradeable instrument so that it can be tracked throughout trading, settlement and price reporting systems. These codes are important whenever you palce an order to buy or sell you will need to know the NSX trading code for the security that you wish to trade. NSX sometimes uses a different length of trading code to indicate to investors and traders that there is something different about a security. A good rule to remember is that a 3 character code typically indicates the ordinary shares in a company — where there is more or less than 3 characters, there is most likely something different from the ordinary shares of a company. NSX codes can contain the letters A to Z and the numbers 1 to 9. This means that NSX Codes cannot be confused with any other market's trading codes. This is particularly important when placing orders with Participants. It also means that when a Company requests a particular code on application that code may not be available. This 3 character code represents that company and all securities issued by that company will incorporate their 3 character code and is known as the root code for the Issuer. The 3 character code is typically used to issue the primary issue of securities by that company. The code may be longer for the primary security if that security was orginally derived from an "A" class or "B" class share series. A company may issue options that can be exercised for shares that can be traded on market.

Alternatively if there is a split, there are now four shares for every one previous share, the share price is asx company codes reduced accordingly i. Securities are traded cum rights until the Ex Rights date. In this case it becomes necessary to be able to identify each particular series.

.

The story of ASX is long and eventful, full of world-firsts and new technologies, and underpinned by a determination to find better ways to service the market and strengthen investor confidence. The Australian Stock Exchange Limited was formed in after the Australian Parliament passed legislation enabling the amalgamation of six independent state-based stock exchanges. Each of those exchanges brought with it a history of share trading and exchange services dating back to the 19th century. Its official name is ASX Limited. Since its creation, the best and most popular way of referring to the company is by its enduring three-letter code - ASX.

Asx company codes

Status notes are used by ASX Trade and provide further information about the trading status of a security. Intra-day status notes are not displayed, however, these may appear on your broking website. A company has declared that existing shareholders will receive a bonus in the form of additional securities. For example, a company may declare a 1 for 1 bonus issue. This means that for every one security held by a shareholder they will receive one additional security.

Fmovies unblocked

Enter Keyword for Search. Condition codes are applied to securities while they are trading and represent types of corporate events being undertaken by the Company that is listed. Quotation XF ex takeover offer XF first displays for a security not capable of acceptance under a proportional takeover offer. The Rights issue may be the right to any tradeable product. The 3 character issuer code will be the prefix followed by a character to identify the type of security for example H: unsecured note, G: convertible note and P: preference share. Alpha characters are added sequentially to each series as they are issued. The secondary issue will most likely have a 4 or 5 characters so a new 3 character code must be created to represent the underlying for options over that security. Any security traded on the NSX market has an individual code that uniquely identifies it in an abbreviated form. For example, a company may declare a 1 for 1 bonus issue. A reconstruction may be a consolidation reduction in the number of shares on issue or a share split increase in the number of shares on issue. Warrant codes More information about identifying warrant codes. Quotation CE cum entitlement A company has declared an entitlement issue. ASX code changes Information about companies that have changed their names or code. Derivatives are instruments that derive their value primarily from that of an underlying instrument such as shares, share price indices, fixed interest securities, commodities, currencies etc. NSX will establish market quotations in the securities of the offeree from the commencement of trading on the first trading day after the making of the original offer is advised to the market announcements office.

ASX uses a range of individual codes to identify each tradeable instrument.

XB displays for a security from the morning of the ex bonus date generally four business days before the record date and remains until the close of trading on the bonus issue date. All warrants are issued with a six character ASX code. Quotation CC cum capital return A company has declared an amount per security which will be returned to shareholders. Confirm password. Quotation CD cum dividend A company has declared an amount per security which will be provided to shareholders in the form of a dividend. Most ASX listed company codes have 3 characters which represents the company and all securities issued by that company. This is the case for listed companies, A-REITS, listed investment companies and infrastructure funds and conventional exchange traded funds. Those holders on the register at the record date will be entitled to receive the distribution. Investment products. When the status note is displayed it is highlighted in red. Special condition codes. ASX rulebooks. The purchaser of securities cum dividend is entitled to the dividend. Quotation XE ex entitlement XE first displays for a security from the morning of the Ex Entitlement date one business day before the record date and remains until the close of business on application's close date.

In my opinion you are mistaken. Write to me in PM, we will talk.

Anything similar.