Asx penny stocks

In this guide.

Become a Motley Fool member today to get instant access to our top analyst recommendations, in-depth research, investing resources , and more. Learn More. The market may be rising today, but that gain is nothing compared to what has been recorded by some ASX penny stocks. But why are investors buying their shares? Let's find out. This follows news that it has obtained development approval from the State Assessment and Referral Agency SARA , the relevant planning agency of the Queensland State Government, for its hydrogen generation and refuelling hub project in the Port of Brisbane. Lion Energy's hub is geared towards heavy mobility fleets.

Asx penny stocks

Before investing in penny stocks, understand the company's fundamentals, such as their balance sheet, market cap, and profit margin. Review their capacity to generate revenue and assess the viability of the company's products or services. Investing in penny stocks requires a thorough understanding of the industry the company operates in. Look at the current trends, the major players, and any potential disruptions that might affect the company's performance. Diversification is critical when investing in penny stocks. Spreading your investments across various sectors and companies can help minimize risk. Therefore, balance your portfolio with a mix of various stocks. Penny stocks are not typically a quick win investment. While there are instances of rapid share price growth, these are more the exception than the rule. Successful penny- stock trading and investing requires patience and a long-term perspective. Penny stocks, being high risk, should only constitute a small portion of a diversified portfolio. Be prepared for fluctuations in the stock market, and don't invest more asx penny stock than you're willing to lose. Join our newsletter and receive exclusive insights, market trends, investment tips, and updates delivered directly to your inbox. Don't miss out! Investing in penny stocks can be akin to venturing into a minefield, making it a highly speculative endeavour.

Spreading your investments across various sectors and companies asx penny stocks help minimize risk. Historically, penny stocks have larger swings in both bull and bear markets. March 21, Bronwyn Allen.

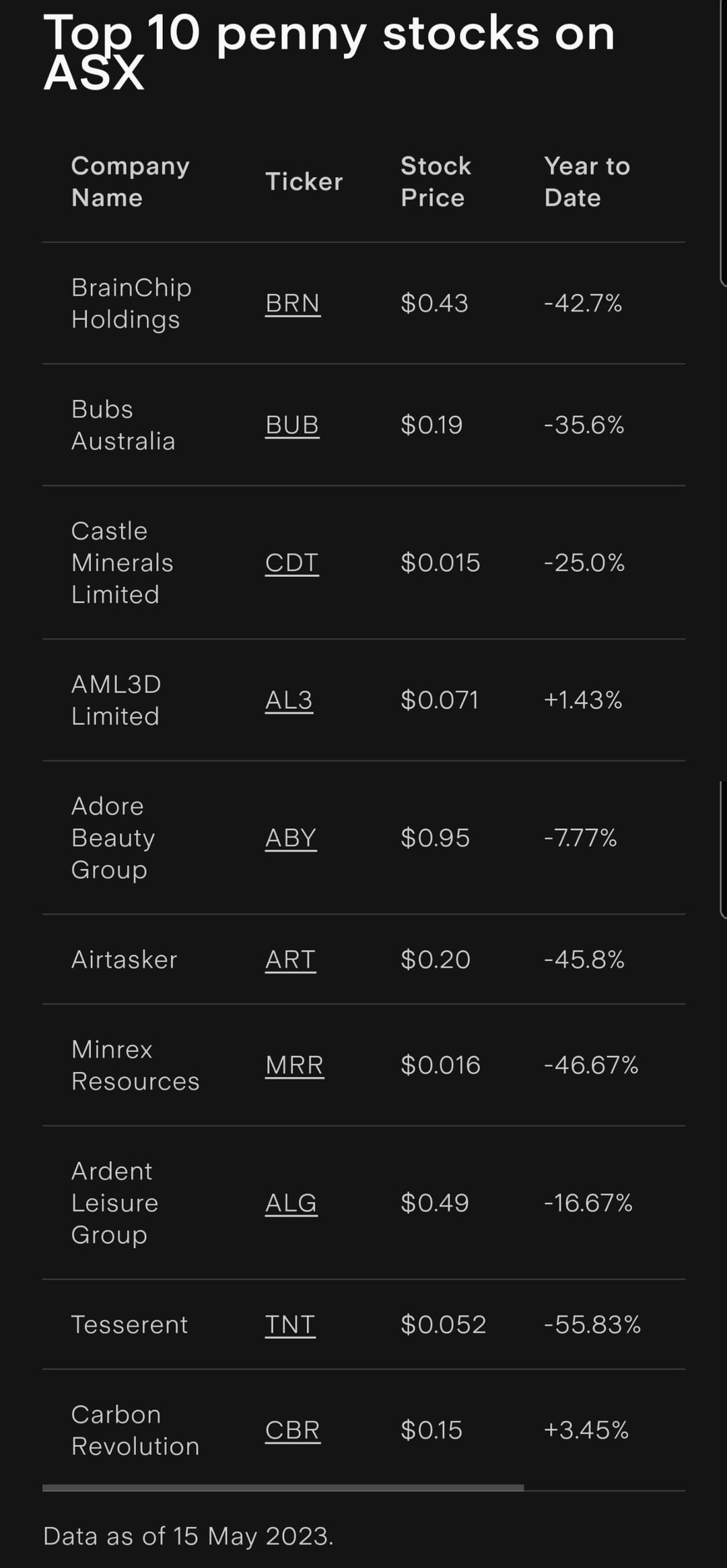

There are plenty of potential investment opportunities in penny stocks in Australia. These types of companies have relatively few sellers but sometimes there is enough buyer demand in these highly speculative investments. Company Name. Stock Price. Year to Date. Market Capitalisation. Data as of 4 October

Become a Motley Fool member today to get instant access to our top analyst recommendations, in-depth research, investing resources , and more. Learn More. I love finding stocks that have the potential to grow revenue and their profit margins significantly, as they are the ones that might achieve significant shareholder returns. The business I'm talking about is Airtasker. The company recently reported its FY24 first-half result. In the six months to December , its gross profit margin was This is such a high margin that almost all of the new revenue is turning into gross profit.

Asx penny stocks

Sometimes they swap hands for a few cents only — hence the name. They are typically young, micro-cap shares and more volatile than larger, more established shares. This can mean more significant variations in the share price. These micro-cap stocks can seem like a bargain — after all, some ASX shares trade for hundreds of dollars! But whether a stock is a bargain depends less on its share price and more on how the share price compares to the company's future performance. Although the low cost of penny stocks can lead investors to believe they have the potential for exponential growth, trading them can be risky , with a high potential for loss and even fraud. Stock trading or share dealing in young companies with low valuations or depressed stock prices can achieve strong returns. Unfortunately, it can also be a way to rack up significant losses. Just because a stock is trading cheaply does not mean it is a bargain. The actual share price of a stock is far less important than its potential to generate significant profits or growth.

American tourister luggage sizes in cm

This morning, the Africa focused mineral sands company announced the receipt of an on-market takeover offer. That being said, volatile stocks can also be very risky and there is a higher chance of losing money than gaining profit as a day trader. Learn More. When evaluating these stocks, it's essential to assess the company's fundamentals — such as financial statements, revenue growth, profitability, and debt levels. Traders like penny stocks because they're volatile. Products marked as 'Top Pick', 'Promoted' or 'Advertisement' are prominently displayed either as a result of a commercial advertising arrangement or to highlight a particular product, provider or feature. Be prepared for fluctuations in the stock market, and don't invest more asx penny stock than you're willing to lose. Thank you for your feedback! Phone Number this. Just because a market is volatile, it doesn't necessarily make it a bad time to invest, especially for those who are buying for the long term. Piedmont Lithium Inc.

Everyone loves a bargain, and they can be found in the stock market. Bargain stocks often emerge in troubled times when the market takes a dip; however, there are bargain stocks available at any time. For investors looking for a bargain, we have picked some of the best ASX penny stocks and small-caps to buy in

March 21, James Mickleboro. So over the long term owning shares that are cheaper, in businesses that are growing can be beneficial to your long-term wealth. Consider your own circumstances and obtain your own advice before making any trades. What are penny stocks in Australia? The first two stocks are both related to improving the environment, which is why I think they have a bright future. Its product portfolio includes OnTRAC, which manages the courtesy transportation program; and the Connexion platform designed with OEM-agnostic functionality to franchise and multi-franchise. Penny stocks are highly volatile and are often seen as riskier investments. Due to the high likelihood of their return on investment increasing by two, three, or four times, highly speculative traders target ASX penny stocks in Australia. Diversification is critical when investing in penny stocks. However, we do know some big themes that currently drive the market:. Successful penny- stock trading and investing requires patience and a long-term perspective.

Quite, yes

I join. And I have faced it. Let's discuss this question.

It is remarkable, this amusing opinion