Australian taxation office salary sacrifice

The key to tax-effective australian taxation office salary sacrifice sacrifice is for the employee to take some of their remuneration in the form of concessionally taxed benefits instead of taking it all as fully assessable salary. This procedure is called 'Salary Sacrifice' because the employee sacrifices some part of their salary in return for the desired benefits.

To encourage people to work for charities, such as InLife, the Australian Tax Office ATO allows eligible staff to receive an additional part of their salary tax-free. This amount is on top of your usual tax-free threshold so you pay less tax. Instead, the ATO wants to know you spent the money on goods or services that contributed to the economy. That's where salary packaging comes in. Salary packaging lets you trade part of your pre-tax wages for benefits of a similar value. The whole process is managed by a salary packaging provider to make sure everything is compliant. Jay submits a copy of her lease to Go Salary as proof for the year.

Australian taxation office salary sacrifice

.

Instead, the ATO wants to know you spent the money on goods or services that contributed to the economy.

.

However, when it comes to salary sacrifice and taxes, the opposite is true. Sacrificing a portion of your salary can actually be an excellent way to gain an advantage on your tax bill. But before you make any decisions, you need to understand the ins and outs of this strategy, including the potential benefits and drawbacks. Generally, the ATO states that there is no restriction on the benefits you can receive from a salary sacrifice arrangement as long as your employer agrees. Some common benefits that you can obtain through a salary sacrifice agreement include the following:.

Australian taxation office salary sacrifice

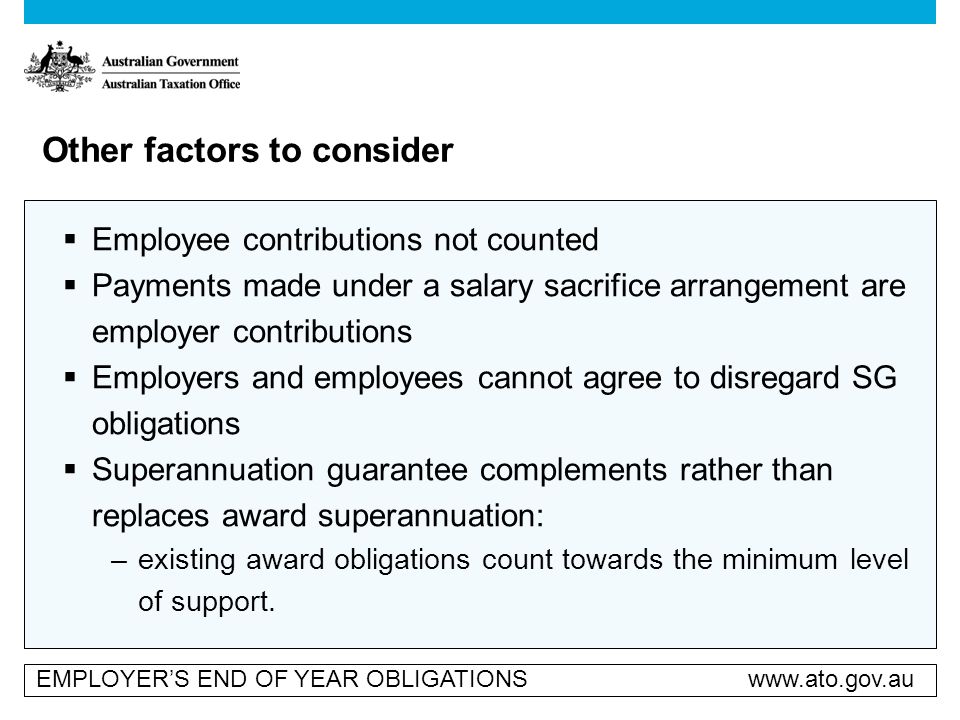

A salary sacrifice arrangement refers to an arrangement between an employer and employee whereby the employee agrees to forego part of their future salary or wage in return for some other form of non-cash benefits of equivalent cost to the employer. The Australian Taxation Office ATO treats 'effective salary sacrificing arrangements' and 'ineffective salary sacrificing arrangements' differently. To be an effective salary sacrifice arrangement, it must:. Under an ineffective salary sacrifice arrangement, the amount sacrificed is treated as salary or wages and payroll tax is payable on the total wage or salary. If the benefit provided is exempt from fringe benefits tax FBT , such as a laptop that is provided primarily for work purposes, no payroll tax is payable in respect of the amount sacrificed for that benefit. Payroll tax is payable only on a reduced salary on which the employee pays income tax. Some employees agree to make regular donations to charitable organisations of their choice under a workplace giving program. Payroll tax is payable on the normal gross salary. He negotiates a salary sacrifice arrangement for a car under a novated lease arrangement.

Wish tv

What are you looking for? What Can I Salary Sacrifice? Find an office Close modal. If the concessional contributions cap is exceeded any excess concessional contributions are included in the assessable income for the corresponding year and taxed at the person's marginal tax rate. Salary packaging is considered a Fringe Benefit, so you need to spend your allowance between 1 April and 31 March, rather than the traditional 1 July to 30 June tax year. Students already registered in participating locations will not be eligible for the special offer retrospectively. There are two types of cards: Salary Packaging card. Once registration is confirmed, we are giving you a non-exclusive, non-transferable license to use the course materials for your personal educational use only. There is a limit of one gift card per referred student. Go Salary manages the documentation the ATO needs for compliance think of it a bit like providing receipts to claim tax deductions. On this page: How does salary packaging work?

The majority of us would have thought about giving something up. Salary sacrificing into super includes reducing your take-home pay to put away an amount of money from your retirement. In this blog, you will get to know what salary sacrifice means, how you can set up an effective arrangement, and the tax implications of this arrangement.

Sign up now at gosalary. From 1 July , certain zero or low emission vehicles are exempt from FBT. That's where salary packaging comes in. Qualifying recipients will receive the gift card electronically, to the same email address used on registration. Go Salary manages the documentation the ATO needs for compliance think of it a bit like providing receipts to claim tax deductions. As superannuation contributions are not subject to FBT and are not reportable benefits, they are attractive to salary package. Registration or participation in the course is not to be deemed an offer of employment. Your course is deemed to have commenced on 10 February Keep reading to learn more about salary packaging and whether it's right for you. Positions are available for Tax Season , which successful applicants will be advised of in June and are subject to availability across our network of over offices. SPL Students who receive any portion of their fee refunded, will be also be deactivated from the Learning Management System immediately. Sign up. For more information. If a person has contributions made to more than one superannuation fund, all contributions are aggregated. Sharing any of your login credentials for our Learning Management System or the student tax software, is a not allowed.

It agree, this remarkable message

Let's be.