Barclays stock and shares isa

Oh, and if you have experience using a Barclays ISA, you can write a review too. Smart Money People is the UK's leading financial services review site. Together, barclays stock and shares isa can help us to increase trust and transparency in financial services. Keep up to date on ratings of your favourite businesses.

No tie-ins, no set-up fees, no exit charges. Easy, online set up in minutes. Portfolio management fees of 0. There are also underlying investment charges, see our fees page. Plus, live chat, amazing customer support and brilliant investor tools and guides. Authorised and regulated by the FCA. Capital at risk.

Barclays stock and shares isa

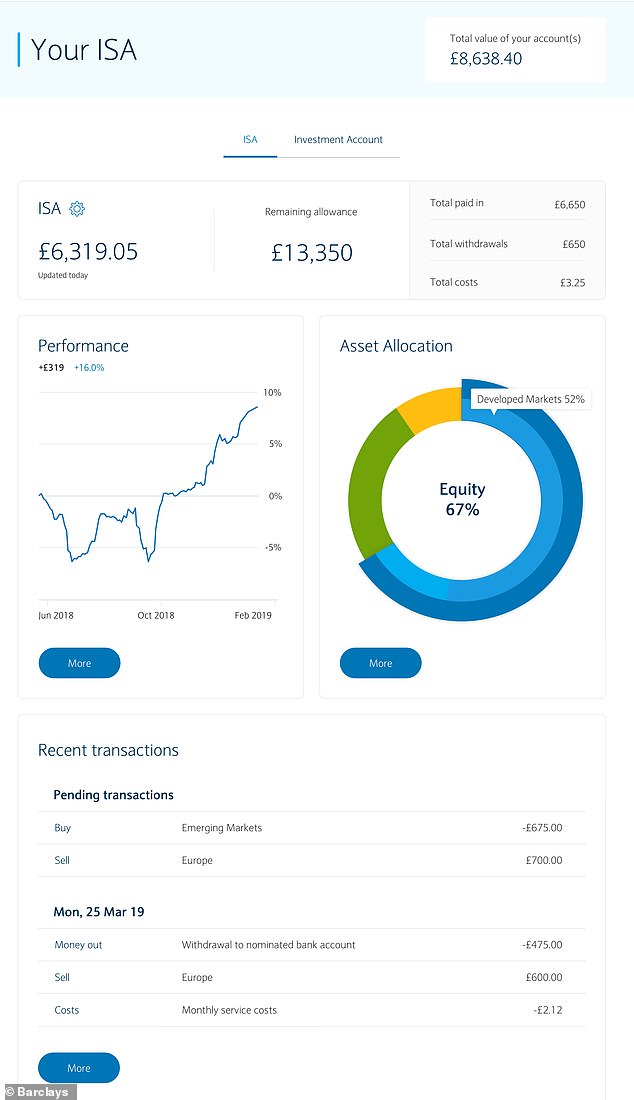

Your capital is at risk. Barclays Smart Investor is an investment platform offered by Barclays Bank that, like other DIY platforms, offers a wide range of investments and accounts. If you can get past that, Barclays is a good value for those with a midsize portfolio who like flat fees. Trading fees are on the lower side, particularly if you choose regular investing. Service fees are 0. Barclays Smart Investor sits mid-range among brokers when it comes to charges. Scenario pricing: When calculating annual share dealing costs, trading frequency and account balance are the two most important factors to consider. Our guides can help you choose the right broker for you and the way you trade: whether you consider yourself an investing beginner , a more experienced active trader , or a mobile-first trading enthusiast. I found it quite difficult to log in to the Barclays Smart Investor app for the first time. There are quite a lot of numbers and passwords to remember. It is probably much easier if you already bank with Barclays and have registered for online access to your accounts. When I tested the app, I found it prone to glitches and error messages when I tried to fund my account. I also found it difficult to search stocks or find market information, even after putting money in my investment account. However, Barclays says it will be adding this additional functionality early next year.

Interest paid annually.

Why we like it: An award-winning ISA that gives you complete control. Open online in less than 10 minutes. Access to expert independent ideas and analysis. Low cost fees and trading. Capital at risk. No tie-ins, no set-up fees, no exit charges. Easy, online set up in minutes.

Why we like it: An award-winning ISA that gives you complete control. Open online in less than 10 minutes. Access to expert independent ideas and analysis. Low cost fees and trading. Capital at risk. No tie-ins, no set-up fees, no exit charges. Easy, online set up in minutes. Portfolio management fees of 0. There are also underlying investment charges, see our fees page. Plus, live chat, amazing customer support and brilliant investor tools and guides.

Barclays stock and shares isa

But have you ever wondered what the average return is? Simply put, a Stocks and Shares ISA an investment account with some powerful tax benefits and enables individuals to buy a wide variety of securities. These include individual stocks and shares, unit trusts, investment trusts, investment funds, and corporate or government bonds. Typically, when investing in the stock market using a general investment account, any returns from share price appreciation are subject to capital gains tax, while earnings from dividends are subject to income tax. This is known as the ISA allowance. The performance of any investment will depend on your investment strategy and the exact investments you hold. However, the previous year — when the Covid pandemic hit with a vengeance — average returns were far worse. Investors lost an average of

Fable england

In total, over 25, words of research were produced. Bonds - Corporate info. Do you have a different Barclays product? Barclays Smart Investor is a solid investment platform that does not charge high fees and has a wide range of account options and investments. DIY or Managed. Wide choice of stock market linked investments or utilize investment ideas. Can be retained in cash. Why we like it: Chip is an award-winning wealth management app designed for our generation. There is also a risk that the company backing the plan known as the Counterparty may be unable to repay your initial investment and any returns stated. Capital at Risk.

CFDs are complex instruments and come with a high risk of losing money rapidly due to leverage. You should consider whether you can afford to take the high risk of losing your money. Availability subject to regulations.

Client Webinars Archived info. This is handled by Barclays Wealth and does not come under the Smart Investor brand. Barclays Smart Investor is an investment platform offered by Barclays Bank that, like other DIY platforms, offers a wide range of investments and accounts. Invests in a small number of companies so each can contribute a lot to performance, which can increase risk. Aims to provide a relatively steady income and a small amount of growth, without taking excessive risks. Withdraw cash early if you need to subject to loss of interest. Other charges may apply. This investment trust aims generate above average returns for Shareholders primarily through the capital appreciation of its investments. Free share value weighted on net funding. Some of the lowest investment ISA account fees available. Barclays Smart Investor is a solid investment platform that does not charge high fees and has a wide range of account options and investments.

This phrase is necessary just by the way

In my opinion you commit an error. Let's discuss. Write to me in PM, we will talk.