Ben felix model portfolio

I'm a huge fan of Ben Felix and his proposed factor tilts. Here we'll look at how to construct a U. Interested in more Lazy Portfolios?

He is widely recognized for his expertise in the field of investing and financial management and has created a model portfolio, the Ben Felix Model Portfolio. In this post, we take a look at Ben Felix Model Portfolio. We end the article with a backtest of the strategy as a matter of fact, we make several backtests. The Ben Felix Model Portfolio is a globally diversified investment strategy that utilizes index funds and tilts towards specific factors, such as size, value, and profitability factor investing. The portfolio is designed to provide investors with a diversified investment strategy that is based on academic research and data analysis. It comprises several different asset classes, including domestic and international stocks, and sometimes, bonds.

Ben felix model portfolio

As a teaser, the ETF model portfolios are a combination of low cost Canadian, US, International Developed and Emerging market-cap weighted equities , a dip-your-toes sprinkling of small-cap value funds and Canadian aggregate bonds. Hey guys! This investing opinion blog post is entirely for entertainment purposes only. There could be considerable errors in the data I gathered. This is not financial advice. Do your own due diligence and research. Consult with a financial advisor. Ben Felix and Cameron Passmore are the Canadian duo responsible for creating the popular Rational Reminder Podcast , Rational Reminder Website and high engagement Rational Reminder Community where investors of all walks of life can interact and discuss topics related to investing strategies and personal finance. As a fellow content creator myself, albeit in the travel sphere as my day job, I greatly admire the effort Cameron and Ben have put forth to consistently produce informative content with a wide range of podcast guests and for creating a community space where investors can learn, grow and share ideas together. Additionally, Ben Felix has a YouTube channel where he makes focused teleprompter-style scripted videos on a wide variety of investing subjects. Boglehead style investors and the Rational Reminder Model Portfolios seek to own equity market-cap weighted indexes at the lowest cost possible. Canada is well known for many positive attributes but an unfortunate one is that it has some of the highest mutual fund fees in the world and a plethora of still existing gawd awful legacy investing products.

Also, owning an aggregate bond index at low cost provides a fixed income ballast and potential portfolio stability although not this year for those interested in growthbalanced or conservative allocations. It has slightly better Sharpe and Sortino ratios. Similarly, the Value factor is high book value stocks minus low book value stocks, ben felix model portfolio, written as high minus low or HmL.

.

Their advice at its core is to follow an evidence-based investing approach that starts and usually ends with a low cost, globally diversified, and risk appropriate portfolio of index funds or ETFs. Simplify this even further by investing in a single asset allocation ETF that automatically rebalances itself. But I took a long-time to switch to indexing because the product landscape was less than ideal. Then, in , Vanguard again changed the game when it launched a suite of asset allocation ETFs designed to be a one-fund investing solution. It would be great if the debate ended there, but this is investing and many of us are wired to look for an edge to boost our returns. Index investors are not immune to this. Not content with a total market, all-in-one solution, some indexers look to reduce their fees even more by holding U. Again, the idea here is to reduce the cost of your index portfolio and reduce or eliminate foreign withholding taxes.

Ben felix model portfolio

I'm a huge fan of Ben Felix and his proposed factor tilts. Here we'll look at how to construct a U. Interested in more Lazy Portfolios? See the full list here. Disclosure: Some of the links on this page are referral links. At no additional cost to you, if you choose to make a purchase or sign up for a service after clicking through those links, I may receive a small commission. This allows me to continue producing high-quality, ad-free content on this site and pays for the occasional cup of coffee. I have first-hand experience with every product or service I recommend, and I recommend them because I genuinely believe they are useful, not because of the commission I get if you decide to purchase through my links. Read more here.

Reset sonos

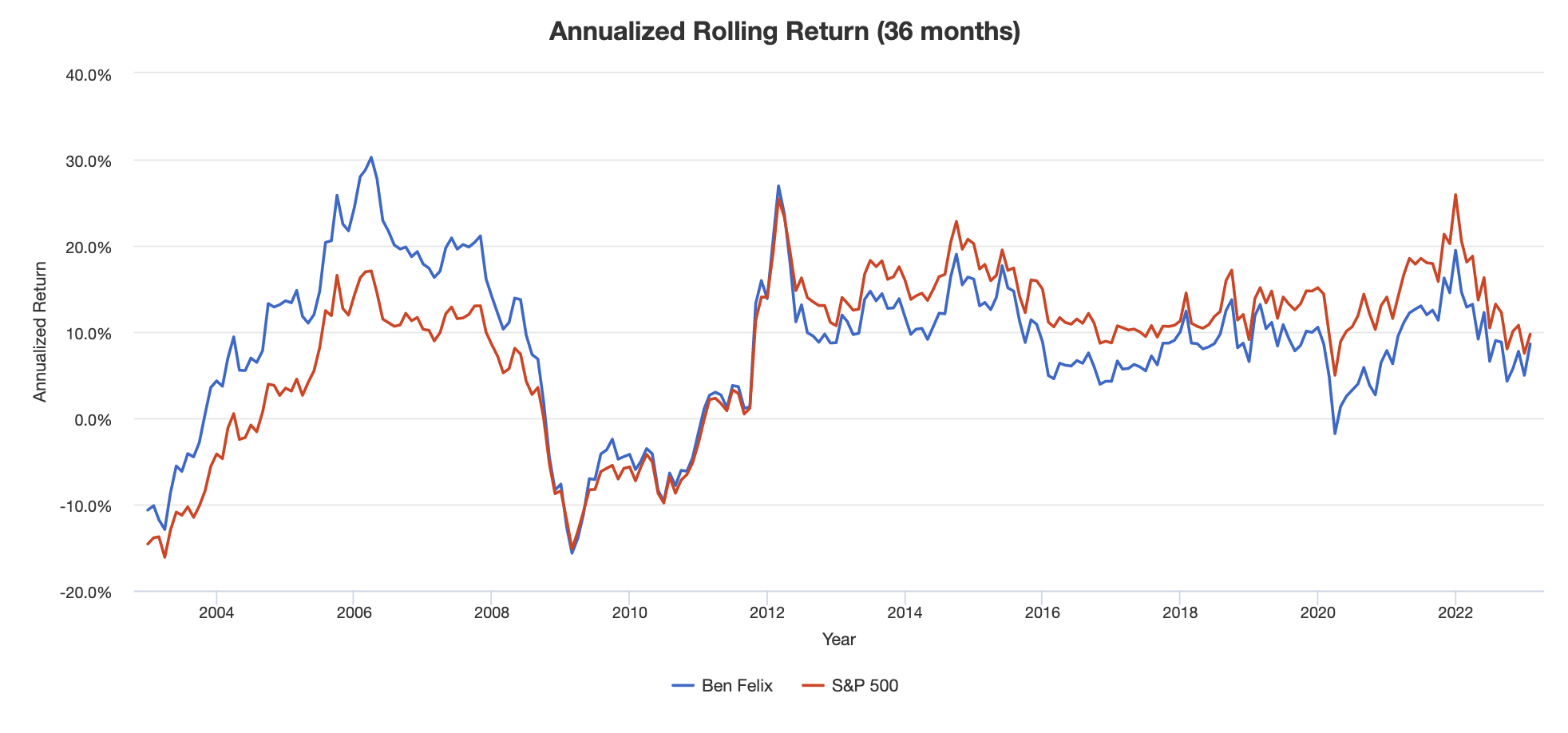

In addition to the model portfolio, PWL Capital also provides clients with a number of other services, such as financial planning, tax planning, and estate planning, as well as educational resources, such as articles, videos, and webinars, to help investors better understand the market and make more informed investment decisions. In addition to index investing, the portfolio also incorporates factor tilts, particularly for size, value, and profitability. We'll see this more in a second with a performance backtest using live fund data. Hey John, I am trying to model the U. Fidelity M1 Finance vs. Finally, the portfolio is regularly rebalanced to ensure that it stays aligned with the desired asset allocation. Another option is to just play with the percentages of their model portfolios to find something that fits perfectly for your personal level of current conviction. We also use third-party cookies that help us analyze and understand how you use this website. About Picture Perfect Portfolios 2. Just updated it and included the Avantis ETFs in my small cap value discussion here. There is a small portion of the portfolio carved out for factor exposure to size, value and profitability. But there have also been periods of market underperformance where factors had a positive premium. M1 Finance is a great choice of broker to implement the Ben Felix Model Portfolio because it makes regular rebalancing seamless and easy, has zero transaction fees, and incorporates dynamic rebalancing for new deposits. These cookies do not store any personal information. Some of these strategies include:.

As a teaser, the ETF model portfolios are a combination of low cost Canadian, US, International Developed and Emerging market-cap weighted equities , a dip-your-toes sprinkling of small-cap value funds and Canadian aggregate bonds. Hey guys! This investing opinion blog post is entirely for entertainment purposes only.

Additionally, Ben Felix has a YouTube channel where he makes focused teleprompter-style scripted videos on a wide variety of investing subjects. The model portfolio employs a number of different investment strategies, including value investing, momentum investing, and factor-based investing. For example, he is a proponent of index investing and small cap value , just like famous investors like Larry Swedroe and Paul Merriman. Disclosure: Some of the links on this page are referral links. The relationship between stocks and interest rates is at the center of financial theory. I must have been looking at the previous paper. It was later acquired by Digi. Similarly, the Value factor is high book value stocks minus low book value stocks, written as high minus low or HmL. The goal is to provide a well-balanced and diversified portfolio that can withstand market fluctuations and provide long-term growth opportunities. But at the end of the day investing is a highly subjective endeavour and there is no one-size fits all portfolio out there. Interested in more Lazy Portfolios? Don't subscribe All new comments Replies to my comments Notify me of followup comments via e-mail. Are you nearing or in retirement? It is diversified across different sectors, geographies, and market capitalizations. Read my lengthier disclaimer here.

Very good piece

I think, that you are not right. I am assured. Write to me in PM, we will discuss.

Do not take in a head!