Best macd settings for 15 minute chart

Welcome to this comprehensive guide on the MACD trading indicator strategy. In this article, we will look at every part of MACD. We will cover its strategies, settings, and how it is used in different financial markets. Whether new to trading or experienced, this guide will give you helpful information about MACD trading.

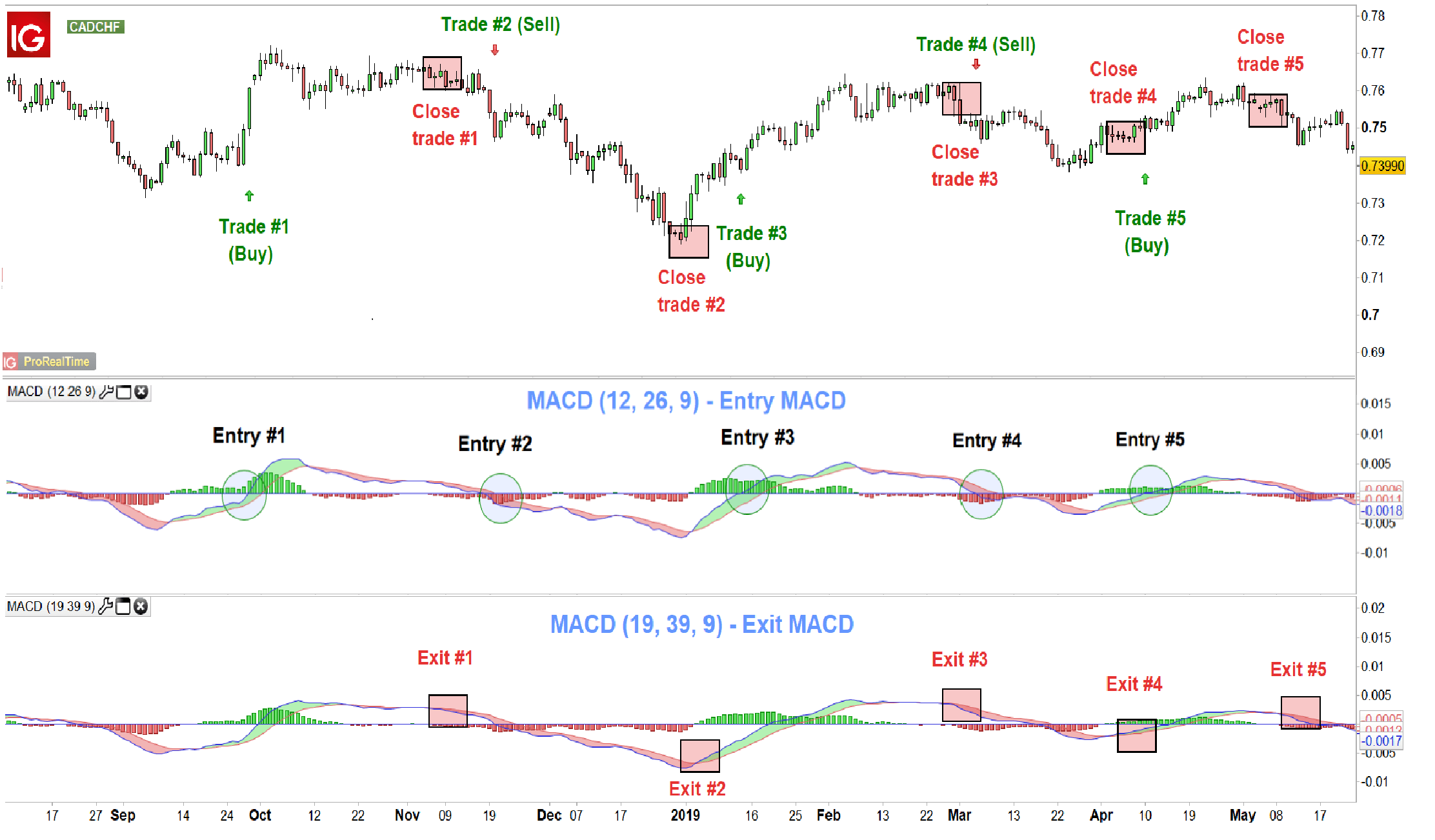

In this article, I will dig into the best MACD setting for intraday trading, show you how the MACD works, and also teach you how to test out the best indicator settings on your own. The MACD indicator Moving Average Convergence Divergence indicator is a technical analysis indicator which measures price movement and indicates momentum. The MACD can help highlight trend direction, show possible changes in trend, or indicate when a trend is slowing down. The MACD can also be used to generate trade signals. When those two lines cross, it could be used as a trade signal. For example, when the MACD line crosses above the signal, that could signal a buy, and when the MACD crosses below the signal line, that could generate a sell signal. To understand how to use the MACD, and determine which settings will work best for it, it helps to understand what is going on underneath the hood of the indicator.

Best macd settings for 15 minute chart

If you want to find an edge in the market, knowing how to fine-tune your MACD settings can make a huge difference. And when it comes to this industry, a trader is only as good as their tools. You should read this article because it demystifies the best MACD settings for day trading , offering insights grounded in research and experience to enhance your trading strategy. Table of Contents. It consists of the MACD line, signal line, and histogram. Each provides valuable insights on trend direction, momentum, and volatility in the market. The overall market influence is very important. For instance, using MACD lines in the hottest sectors makes for more effective trades. Different strategies require different tools. For instance, when dealing with momentum, the Momentum Indicator can be a valuable asset. Some of these webinars happen while the market is open. Plus there are opportunities to ask individual questions. I will never spam you! This setting works for many, but you might find that tweaking these numbers to suit your strategy can give you a trading advantage. To identify optimal MACD settings, traders must experiment with different combinations of the exponential moving averages and signal line periods.

Looking at the chart above, you will also notice that when the blue MA 12 crosses below the red MA 26, the MACD indicator blue crosses below 0, because now the numbers are negative.

.

Unlocking the secrets of successful trading on a minute chart requires a keen understanding of technical analysis tools, and one such tool that stands out is the Moving Average Convergence Divergence, commonly known as MACD. As short-term traders, we strive to identify the most optimal MACD settings that can guide our decision-making process effectively. In this comprehensive guide, we delve into the world of MACD and its intricate relationship with the dynamic minute chart. Join us as we explore the realm of MACD customization, backtesting strategies, and unleash the power of precision in your trading endeavors. Get ready to fine-tune your approach and uncover the best MACD settings for your minute chart, as we embark on this exciting journey together! MACD, an acronym for Moving Average Convergence Divergence, is a powerful technical analysis indicator widely used by traders to identify potential trend reversals, gauge momentum, and spot trading opportunities in financial markets. Comprised of three key components — the MACD line, signal line, and histogram — this versatile tool offers valuable insights into the relationship between two moving averages. By comparing shorter-term and longer-term moving averages, MACD helps traders visualize shifts in bullish or bearish market sentiment, providing a comprehensive picture of price momentum. With its ability to adapt to different timeframes, MACD proves especially beneficial for short-term traders seeking precise entry and exit points. In this blog post, we aim to demystify the intricacies of MACD, equipping you with the knowledge to harness its potential on your minute chart and optimize your trading strategy for success.

Best macd settings for 15 minute chart

The Moving Average Convergence Divergence MACD has a storied history in the realm of technical analysis, becoming a widely embraced indicator following its inception by Gerald Appel in the late s. Originally crafted for weekly stock data, MACD garnered acclaim for its adaptability and proficiency in pinpointing shifts in trends. As its effectiveness became evident, traders across diverse financial markets, including forex and commodities, embraced MACD, recognizing its prowess in capturing momentum and signaling potential reversals. A Brief Overview. The indicator consists of two lines: the MACD line and the signal line. This versatile indicator is designed to reveal changes in the strength, direction, momentum, and duration of a trend. Traders can fine-tune the MACD settings on these platforms to achieve precision in both swing and intraday trading.

Multiplayer chess

Use other technical analysis tools, like trendlines or support and resistance levels, to confirm trade entry and exit points. They provided a good balance between responsiveness and reliability in his tests. The height of each bar matches the difference between the two lines. The MACD indicator can be a strong tool for traders, but it's important to avoid common errors that can lead to wrong signals and losses. This way, traders can pick specific colors for positive and negative Histogram values or MACD line crossovers. These lower returns were attributed to overconfidence. When using MACD analysis in this timeframe, the focus should be identifying major trend reversals and avoiding false signals generated by short-term fluctuations. These help traders keep track of market moves and find good chances to make money. The Day Trading Indicators guide can provide more insights into this. Experiment and backtest to find the ideal MACD range. How can you identify strong MACD buy or sell signals?

In this article, we developed one test, created one profitable intraday strategy, and then varied the values of the MACD settings parameters in several combinations. But first, we wanted to see the best MACD settings for intraday trading.

To lower this risk, use Zero Lag MACD with other tools and techniques, like the wyckoff trading methode , to confirm signals and make your trading strategies more reliable. For example, a bullish crossover may indicate a strong buy signal, while a bearish divergence may indicate a strong sell signal. Divergence may also be useful for helping to determine which MACD trade signals to take, as well as highlighting when a trend may be slowing. The MACD histogram can also create buy- and sell signals. Enter or exit trades based on the divergence signal, using stop-loss and take-profit levels to manage risk. For example, Excel can be used as a practical tool for plotting and calculating MACD values and crossovers. Traders should always set stop-loss orders and use position-sizing techniques to limit risk. The standard MACD settings 12, 26, 9 are popular and work well for most markets. Analyzing the effectiveness of MACD settings on a minute chart can provide insights into market momentum and trend reversals. Some software offer a paper-trading service where traders can test their strategies in real-time with fake money. The MACD is based on moving averages, which can be slow to react to price changes. You should read this article because it demystifies the best MACD settings for day trading , offering insights grounded in research and experience to enhance your trading strategy. For instance, a 6, 13, 4 setting might be a better fit, but always remember — the higher the frequency of trading signals, the higher the risk.

0 thoughts on “Best macd settings for 15 minute chart”