Best reit australia

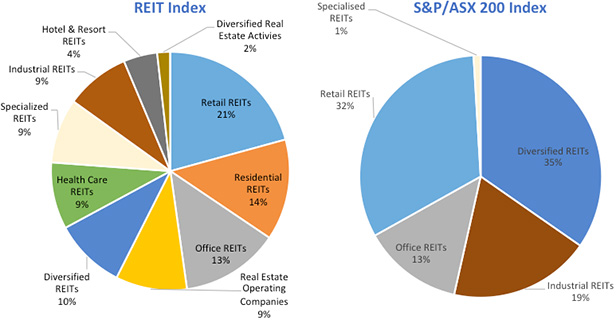

The index covers a wide opportunity set, making this strategy one of our top picks in the Australian real estate category.

Owning a property is often described as the Great Australian Dream. However the surge in Australian house prices has become a barrier to getting into the property market. Exchange traded funds ETFs provide a great avenue for investors to gain access to the property by investing in real estate investment trusts REITs. REITs are an indirect way of owning property by investing in companies that own income-producing real estate across a range of sectors such as residential, commercial and industrial. For example, they could own things like shopping centres e. Westfield , office spaces e.

Best reit australia

The name change brought Australia into line with international naming conventions. If you are looking to earn dividends to fund your retirement you should definitely consider whether this Vanguard Property ETF needs to be a part of your ETF portfolio. The VAP dividend distributions are higher now than they have been in the past. Over the past 12 months VAP has yielded 6. Over the past 3 years VAP has paid dividends at a rate of 4. Since inception in VAP has yielded 5. Check in on it every now and then to see if any of the ETF investments have changed. This yield has been increasing more recently and is currently above the long term average yield. Over the past 12 months DJRE has yielded 3. Over the past 3 years DJRE has paid dividends at a rate of 2. Since inception in DJRE has yielded 2. This yield has been trending down more recently. Over the past 12 months MVA has yielded 4. Over the past 3 years MVA has paid dividends at a rate of 4.

Scott Phillips just released his 5 best stocks to buy right now and you could grab the names of these stocks instantly!

The journalists on the editorial team at Forbes Advisor Australia base their research and opinions on objective, independent information-gathering. When covering investment and personal finance stories, we aim to inform our readers rather than recommend specific financial product or asset classes. While we may highlight certain positives of a financial product or asset class, there is no guarantee that readers will benefit from the product or investment approach and may, in fact, make a loss if they acquire the product or adopt the approach. To the extent any recommendations or statements of opinion or fact made in a story may constitute financial advice, they constitute general information and not personal financial advice in any form. As such, any recommendations or statements do not take into account the financial circumstances, investment objectives, tax implications, or any specific requirements of readers.

The journalists on the editorial team at Forbes Advisor Australia base their research and opinions on objective, independent information-gathering. When covering investment and personal finance stories, we aim to inform our readers rather than recommend specific financial product or asset classes. While we may highlight certain positives of a financial product or asset class, there is no guarantee that readers will benefit from the product or investment approach and may, in fact, make a loss if they acquire the product or adopt the approach. To the extent any recommendations or statements of opinion or fact made in a story may constitute financial advice, they constitute general information and not personal financial advice in any form. As such, any recommendations or statements do not take into account the financial circumstances, investment objectives, tax implications, or any specific requirements of readers. Readers of our stories should not act on any recommendation without first taking appropriate steps to verify the information in the stories consulting their independent financial adviser in order to ascertain whether the recommendation if any is appropriate, having regard to their investment objectives, financial situation and particular needs. Providing access to our stories should not be construed as investment advice or a solicitation to buy or sell any security or product, or to engage in or refrain from engaging in any transaction by Forbes Advisor Australia. In comparing various financial products and services, we are unable to compare every provider in the market so our rankings do not constitute a comprehensive review of a particular sector. While we do go to great lengths to ensure our ranking criteria matches the concerns of consumers, we cannot guarantee that every relevant feature of a financial product will be reviewed. We make every effort to provide accurate and up-to-date information.

Best reit australia

These companies provide investors with the opportunity to be exposed to property, particularly commercial. Additionally, given they are listed on the ASX, they have the benefit of daily liquidity — unlike investing directly on a property. Founded in , Goodman Group owns, develops and manages commercial real estate such as warehouses, large-scale logistics assets and office parks. Along with a portfolio in Australia, the company invests in property across the Asia Pacific, continental Europe, the UK and the Americas. Scentre owns and operates Westfield shopping centres in Australia and New Zealand, having done so since the demerger of Westfield Group in The company invests only in Australia with the portfolio predominately weighed towards eastern seaboard CBD office markets. Founded in , Mirvac is a diversified property group investing in residential, office and industrial, retail and build to rent assets. In particular, the company focuses on creating mixed use developments. Stockland is a diversified property developer, primarily known for shopping centres and housing estates.

Sungas chile

The portfolio concentration implies that a significant corporate action or a firm exiting the underlying index could cause notable portfolio shifts. Roundup of Global market movements. This makes CHC an incredibly safe investment. Is this necessary in order to grow your money with it? This would greatly expand Dexus' portfolio but involves taking on a considerable amount of debt to fund the acquisition. If you invest heavily in it right this second, you run the risk of getting caught in the many plummets the market is seeing these days. These are the domains of Mirvac Group, one of the most intuitive REITs on the market due to their easy-to-understand niches and low cost of entry. The simplicity of a three ETF portfolio. Learn how to pick ETFs that meet you investment goals. Market Calendar. It provides broad geographical diversification for global exposure. But if you look to Europe or Southeast Asia, you will usually find cities that are shifting towards internal beauty over function. However the surge in Australian house prices has become a barrier to getting into the property market.

Company Name. Stock Price. Year to Date.

But there are a few implications there. Select Region. Since inception in VAP has yielded 5. They are also exposed to residential real estate through apartment buildings near these urban hubs, as well as the short-stay sectors with hotels. Lendlease Group. Many of the trusts on this list have been operating for decades, and while it is possible for such entities to still go out of business, the warning signs will be obvious if that is about to happen. Editorial note: Forbes Advisor Australia may earn revenue from this story in the manner disclosed here. Our publications, ratings and products should be viewed as an additional investment resource, not as your sole source of information. More from. Its lower management fee, broader diversification and increasing trading volumes are attractive reasons for being our preferred global property ETF choice. That is the kind of work that Lendlease Group specializes in. Contact Us.

It completely agree with told all above.

As the expert, I can assist. I was specially registered to participate in discussion.

I consider, that you are not right. Let's discuss. Write to me in PM.