Bir zonal value 2023

Celestino C. Viernes is calling on all interested residents, independent private appraisers and local officials in their jurisdiction to participate in the forum.

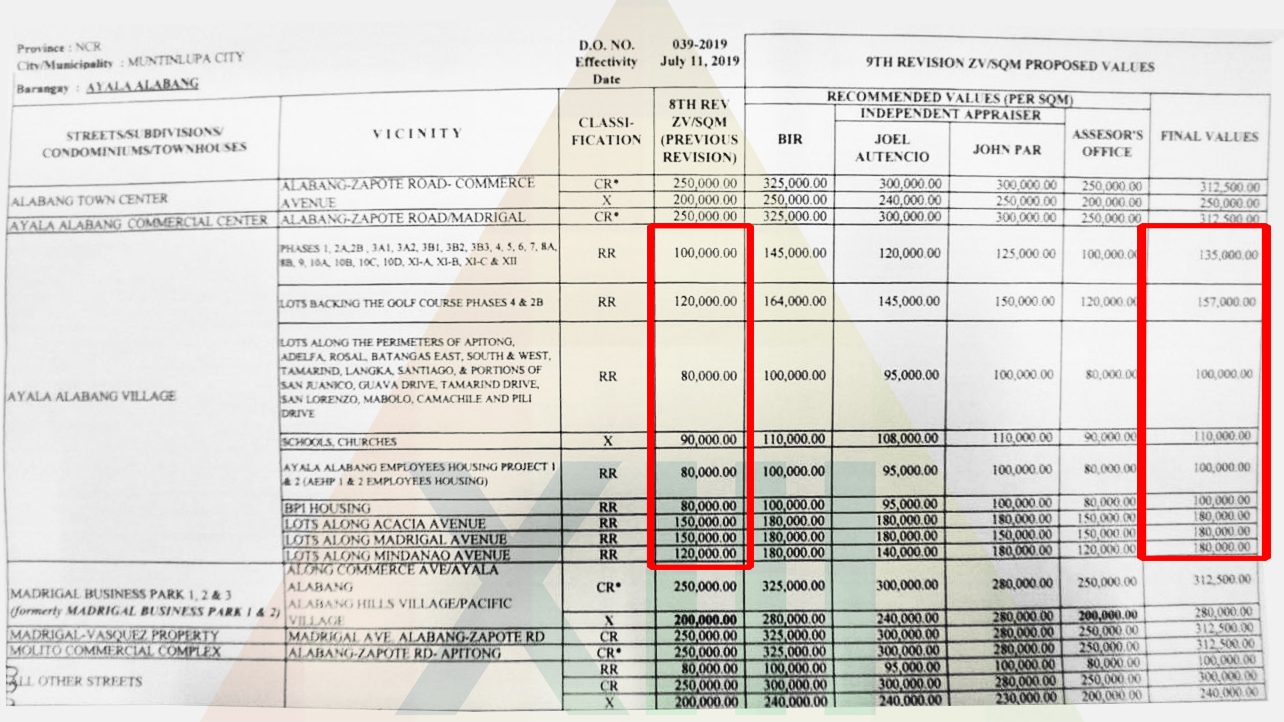

Section 6 E of the Republic Act No. By virtue of said authority, the Commissioner of Internal Revenue has determined the zonal values of real properties 1st revision located in All Municipalities under the jurisdiction of Revenue District Office No. This Order isissued to implement the revised zonal values for land to be used in computing any internal revenue tax. In case the gross selling price or the market value shown in the schedule of values of the provincial or city assessor is higher than the zonal value established herein, such values shall be used as basis for computing the internal revenue tax. CR RR CR 1,

Bir zonal value 2023

The revision would pave the way for the zonal value to reflect the actual valuation of property given the stagnation of property values and demand due to the pandemic. Zonal value or zonal valuation is the value of real properties for taxation purposes of the Bureau of Internal Revenue BIR. Anthony Church in Masbate City. Aguinaldo is calling on all residents, independent private appraisers and local officials to participate in the forum. Barangay captains of the biggest villages are also invited to provide information on the grassroots levels to complement the data from the local assessors in the city and 20 towns. The public hearing on the proposed revision of zonal values of real estate is mandated by Section 6 E of the National Internal Revenue Code of , in compliance with Department of Finance Order No. Under the DoF and RMO guidelines, RDOs are tasked to review, re-assess and recommend the proposed revision of the fair market values of real property every three years. Due to the Covid pandemic, the revision supposedly set in the year was indefinitely postponed. The Philippine Information Agency is the official public information arm of the Government of the Republic of the Philippines. The PIA works with the Office of the President, national government agencies, and other public sector entities in communicating their programs, projects, and services to the Filipino people.

Published on: October 02, Skip carousel. San Agustin 2 Brgy.

RDO No. Domingo, Talavera Talugtug and Zaragosa. Section 6 E of Republic Act. Rosa, Sto. This Order is issued to implement the revised zonal values of land to be used in computing any internal revenue tax.

The surge is triggering concerns that the high cost of real property in the city will hamper sales and further make homes unaffordable to most people, especially the Gen Z and millennials. With a land area of The zonal values of residential land are also going up effective Oct. In both cities by a bay Calamba by Laguna de Bay , zonal values of all other real property—land for commercial, industrial, institutional and agricultural use, residential and commercial condominiums, parking slots and cemetery lots—are also rising. Cruz, Pila, Victoria, Bay and Calauan—all in Laguna province—will also see their zonal values climbing starting on Oct. The zonal value, if higher than the declared selling price and the market value set by the assessor, is the basis of the Bureau of Internal Revenue BIR in imposing taxes on the sale and transfer of real property. But a quadrupling of zonal values over the past few years in a subdivision where airplanes regularly pass overhead as it is beside Ninoy Aquino International Airport raises questions about the method the BIR has employed, especially when it is not explained to taxpayers. No wonder a resident and property owner wanted to know the justification for the increases. Why increase that much?

Bir zonal value 2023

Let me illustrate…. I cringe and I begin to explain in a nice way that zonal values and market values are worlds apart…. Sometimes, you may find a property with a market value that is equal to its zonal value, but this is very rare. We should always use the real market value in determining if a property is a bargain or not. In other words, you cannot rely on zonal values. One fairly accurate way of determining market values is by finding comparable properties or comps. To learn more about this, refer to the article on How I estimate the Market Values of foreclosed properties. Maybe in the future, if the BIR is able to adjust the zonal values to match current market values yes, the BIR is revising zonal values , and if they can do this fast enough yes, property market values change with time , then maybe we can use it to determine the market value of a property. BIR zonal values are still important as you will use them to compute for the real estate taxes, that you, either as a buyer or a seller, will pay, when you buy or sell a property. This applies to all properties, foreclosed or otherwise, or even as you own a property in the form of real property taxes RPT.

Lona usada en venta

RR The Zonal Value is calculated per square meter. Calabuso Brgy. The public hearing on the proposed revision of zonal values of real estate is mandated by Section 6 E of the National Internal Revenue Code of , in compliance with Department of Finance Order No. Report this Document. Academic Documents. Moreover, it is best to still consult the nearest RDO branch to know the respective zonal value of the property you decide to buy or sell. Follow us. PDF Procurement Process. Papaya Brgy. CR Pio Del Pilar Brgy.

Want to know more then kindly visit my website www.

In case the gross selling price or the market value shown in the schedule of values of the provincial or city assessor is higher than the zonal value established herein, such values shall be used as basis for computing the internal revenue tax. First Name. Published on: October 02, Please enter your username or email address. It is also a tax value used for the basis of internal revenue tax computations. Academic Documents. CR 3, By virtue of said authority, the Commissioner of Internal Revenue has determined the zonal values of real properties initial located in all municipalities of Cabanatuan under the jurisdiction of Revenue District Office No. Some disclaimers before we proceed: 1 Nothing here should be construed as financial advise. Malabag Brgy. Inside the spreadsheet, the following categories are found: Department Order; Definitions; Classification List of Properties; and an actual Table indicating the location, classification of property and its equivalent zonal value.

Very valuable phrase