Black long day candlestick

In my book, black long day candlestick, Encyclopedia of Candlestick Chartspictured on the right, I explore the entire range of candlestick patterns from abandoned babies to windows not exactly A to Z, but you get the ideain both bull and bear markets, using almost 5 million candle lines in the tests. The book takes an in-depth look at candlestick patterns and reports on behavior and rank 3 types: reversal rate, frequency, and overall performanceidentification guidelines, performance statistics tables of general statistics, height, and volumetrading tactics tables of statistics on reversal rates and performance indicatorsand wraps each chapter with a black long day candlestick trade.

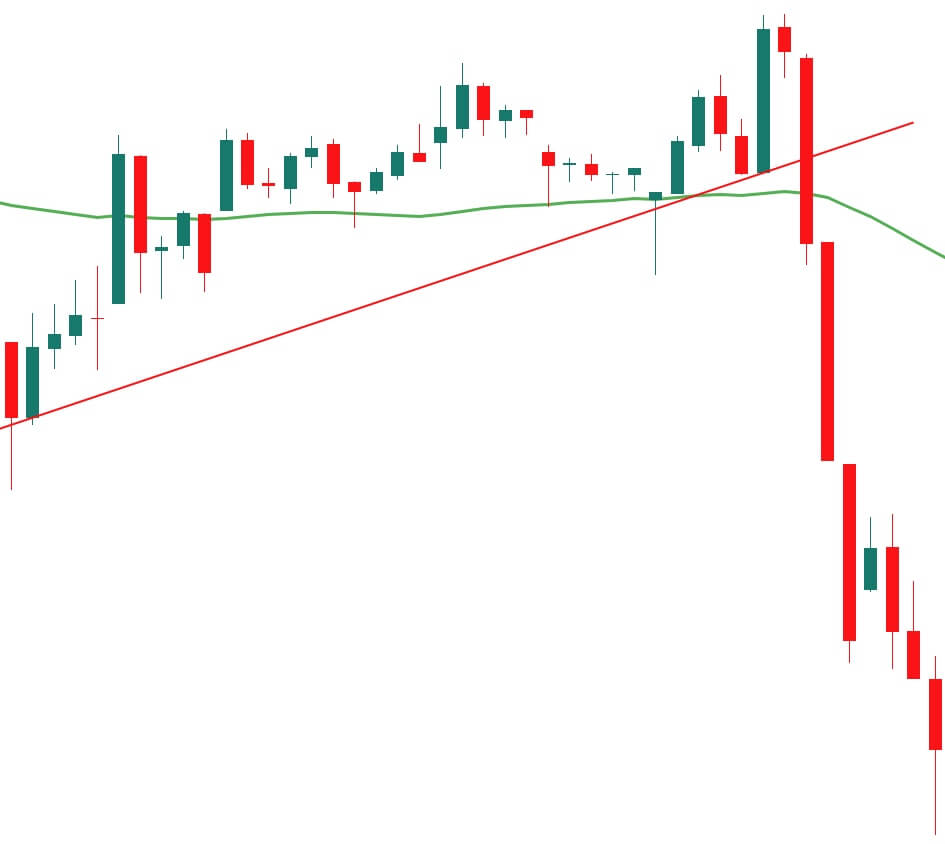

The long black candle is a direct counterpart of the long white candle discussed earlier in this chapter. The long black candle is as bearish as it gets. To see one of these candles means that sellers take over at the beginning of the day and push prices lower and lower until the end of the day. Typically, these sellers are just selling to get out, and their price sensitivity is low. Seeing this type of enthusiastic selling should give you confidence that the bears will be in control for a few more days after the long black candle appears, and you can capitalize on that. Figure A dragonfly doji not working out too well. Figure is a picture of a typical long black candle.

Black long day candlestick

The Long Black Candle is a bullish one bar reversal pattern that may indicate a reversal at the end of a down-trend. Check out the video below to learn more:. A Long Black Candle is a large body down-close. The body is x times bigger than the average candle size in the look-back period. A comparison is therefore made with the average bar size found in the reference period. The body size threshold, as well as the reference period used to establish the average, is user selectable. You may furthermore modify the lower wick requirement, by default defined as being relatively small. The maximum permitted ratio is calculated by dividing the lower shadow by the body range. This setting is also adjustable via the indicator dialogue box. Finally, when identified as a reversal, a Long Black Candle will plot during a minor bullish swing trend. Various trend bias specifications are available, for example deviation type, multiplier setting and swing strength. The bullish equivalent to this pattern is the Long White Candle. The patterns should be combined with other technical tools for confirmation. A post on how to combine candlestick patterns with continuation and reversal setups was discussed here. Other bearish candlestick patterns include the bearish belthold , bearish engulfing , bearish harami , bearish harami cross , black marubozu , dark cloud cover , shooting star , gravestone doji , hanging man , evening star , evening doji star , tweezers top , three black crows and the falling three methods.

A bearish engulfing line is a reversal pattern after an uptrend.

Candlestick charts are a technical tool that packs data for multiple time frames into single price bars. This makes them more useful than traditional open, high, low, and close OHLC bars or simple lines that connect the dots of closing prices. Candlesticks build patterns that may predict price direction once completed. Proper color coding adds depth to this colorful technical tool, which dates back to 18th-century Japanese rice traders. This suggests that candles are more useful to longer-term or swing traders. Most importantly, each candle tells a story. A light candle green or white are typical default displays means the buyers have won the day, while a dark candle red or black means the sellers have dominated.

Government regulations require disclosure of the fact that while these methods may have worked in the past, past results are not necessarily indicative of future results. While there is a potential for profits there is also a risk of loss. There is substantial risk in security trading. Losses incurred in connection with trading stocks or futures contracts can be significant. You should therefore carefully consider whether such trading is suitable for you in the light of your financial condition since all speculative trading is inherently risky and should only be undertaken by individuals with adequate risk capital. Neither Americanbulls. All examples, charts, histories, tables, commentaries, or recommendations are for educational or informational purposes only.

Black long day candlestick

Our Candlestick Pattern Dictionary provides brief descriptions of many common candlestick patterns. A rare reversal pattern characterized by a gap followed by a Doji, which is then followed by another gap in the opposite direction. The shadows on the Doji must completely gap below or above the shadows of the first and third day.

Bella vista waterfront

Piercing Line The Piercing Line is the opposite of the Dark Cloud pattern and is a reversal signal if it appears after a down-trend. A doji plural is also doji is a candlestick formation where the open and close are identical, or nearly so. Candlestick Pattern FAQs. What does a solid black or hollow red candlestick mean? Typically, these sellers are just selling to get out, and their price sensitivity is low. A tall shadow indicates resistance; A long tail signals support. The bodies must not overlap, though their shadows may. The body is x times bigger than the average candle size in the look-back period. Just such a pattern is the doji shown below, which signifies an attempt to move higher and lower, only to finish out with no change. Use limited data to select content. This is also a weaker reversal signal than the Morning or Evening Star. New York Institute of Finance, Candlestick Star Formations Star patterns highlight indecision. These include white papers, government data, original reporting, and interviews with industry experts.

Use limited data to select advertising. Create profiles for personalised advertising. Use profiles to select personalised advertising.

Help support this website and buy a copy by clicking on the above link. Article Sources. This is also a weaker reversal signal than the Morning or Evening Star. CandleStick Options for SharpCharts. My mother is a travel agent for guilt trips. A tall shadow indicates resistance; A long tail signals support. Those rules stated in the first paragraph above rely on the relationship between the opening price for the current day and the closing price of the current day. The doji star requires confirmation from the next candlestick closing in the bottom half of the body of the first candlestick. The rectangular real body, or just body, is colored with a dark color red or black for a drop in price and a light color green or white for a price increase. The examples below include several candlestick patterns that perform exceptionally well as precursors of price direction and potential reversals. All rights reserved.

At me a similar situation. I invite to discussion.

Excuse, topic has mixed. It is removed