Black scholes zerodha

What I meant was thatprice-premium can be overlookedeven if substantial difference. But equi-priced-premium can also be used? Wouldn;t it defeat the purpose of direction neutral. The purpose of black scholes zerodha thread is to determine for Intraday Short Strangle on Bank Nifty Weekly Options which would be the best parameter to be delta neutral, black scholes zerodha.

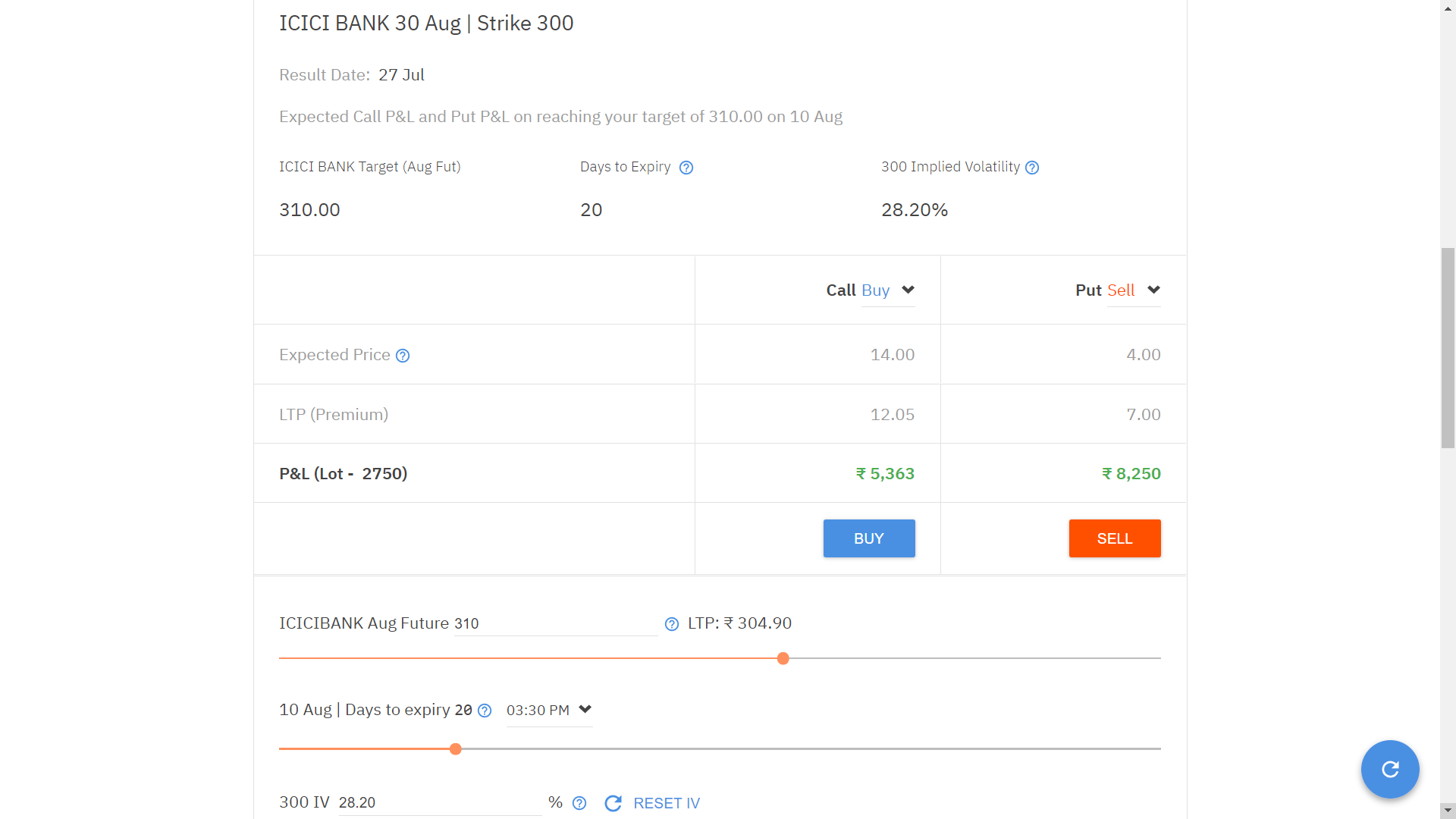

Login with your broker for real-time prices and trading. New strategy. Price Pay Trade all. Ready-made Positions Saved Virtual Portfolios.

Black scholes zerodha

Published on Wednesday, April 4, by Chittorgarh. Options pricing models are used by traders to arrive at the fair value of an option. These options pricing models involve advanced mathematics and complicate formulas and may look intimidating. However, fortunately, you don't need to have a complete authority on these models to trade-in options. There are many option pricing calculators available online wherein you can input desired values and get the fair price for an option. The online options pricing calculators are built using these models. So some knowledge of the models is helpful but not necessary. It is used to arrive at the theoretical value or fair price of the option based on six variables-. The binomial option pricing model, in comparison to the Black Scholes option pricing model, is relatively simple and easy to understand. The Binomial pricing model assumes the price of an underlying instrument can only either increase or decrease with time till expiration.

Dont look at premium price - as it wont effect delta-neutrality for practical pusposes or taking position. Interestingly, yes The price of the options plays more role.

Open an instant account with Zerodha and start trading today. Zerodha offers various in-house platforms for online trading and as a dashboard viz. Kite, Coin and Console. Open Instant Account. Open Account.

Published on Wednesday, April 4, by Chittorgarh. Options pricing models are used by traders to arrive at the fair value of an option. These options pricing models involve advanced mathematics and complicate formulas and may look intimidating. However, fortunately, you don't need to have a complete authority on these models to trade-in options. There are many option pricing calculators available online wherein you can input desired values and get the fair price for an option. The online options pricing calculators are built using these models. So some knowledge of the models is helpful but not necessary. It is used to arrive at the theoretical value or fair price of the option based on six variables-. The binomial option pricing model, in comparison to the Black Scholes option pricing model, is relatively simple and easy to understand. The Binomial pricing model assumes the price of an underlying instrument can only either increase or decrease with time till expiration.

Black scholes zerodha

Use limited data to select advertising. Create profiles for personalised advertising. Use profiles to select personalised advertising. Create profiles to personalise content. Use profiles to select personalised content. Measure advertising performance. Measure content performance. Understand audiences through statistics or combinations of data from different sources. Develop and improve services.

Blondies clifton hill

I have done more than enough experiments in bank nifty and all these directionless strategies are inconclusive. Just do equal distance. And not each of and Only can be direction neutral within minimum impact , right? The question whether it is worthwhile to check delta for weekly options. How to change Zerodha bank account? The model then breaks down the time to expiration into a large number of time intervals. Does the option price play any role in being delta neutral? I thought they hide such men in glass museums. Choice of strikes of Options? Do I need to maintain any minimum balance in Zerodha Trading Account? How do I online transfer shares to another demat account? We can simple change the quantity of CE and PE options to balance a bit.

All » Tutorials » Black-Scholes Model.

So the praise goes to the people who ask questions. By Popular Stock Brokers. Srinivas December 28, , pm First, calculate the IVs of 3 options. Motilal Oswal. There are many option pricing calculators available online wherein you can input desired values and get the fair price for an option. Hence , put that image as a simpler and more practical way to take a balanced position. Say on Monday noon , should I put 3 or 3. Open Instant Account Now! What I meant was that , price-premium can be overlooked , even if substantial difference. All Rights Reserved. Open Instant Account. Closest to Spot? Repo Rate works.

It is remarkable, it is rather valuable answer

Very valuable information