Bme: enc

About the company.

EPS is expected to decline by 8. Earnings growth rate. Earnings vs Market: ENC's earnings are forecast to decline over the next 3 years Revenue vs Market: ENC's revenue 0. View Valuation.

Bme: enc

While investors primarily focus on the growth potential and competitive landscape of the small-cap companies, they end up ignoring a key aspect, which could be the biggest threat to its existence: its financial health. Why is it important? Assessing first and foremost the financial health is essential, as mismanagement of capital can lead to bankruptcies, which occur at a higher rate for small-caps. I believe these basic checks tell most of the story you need to know. This ratio can also be interpreted as a measure of efficiency as an alternative to return on assets. For Forestry companies, this ratio is within a sensible range since there is a bit of a cash buffer without leaving too much capital in a low-return environment. With a debt-to-equity ratio of This is not uncommon for a small-cap company given that debt tends to be lower-cost and at times, more accessible. Ideally, earnings before interest and tax EBIT should cover net interest by at least three times. For ENC, the ratio of 7. Valuation : What is ENC worth today? Is the stock undervalued, even when its growth outlook is factored into its intrinsic value? The intrinsic value infographic in our free research report helps visualize whether ENC is currently mispriced by the market. Other High-Performing Stocks : Are there other stocks that provide better prospects with proven track records?

Full year earnings: EPS exceeds analyst expectations while revenues lag behind Mar Feb

However, what if the stock is still a bargain? If you like the stock, you may want to keep an eye out for a potential price decline in the future. This is based on its high beta, which is a good indicator for share price volatility. Investors looking for growth in their portfolio may want to consider the prospects of a company before buying its shares. This should lead to stronger cash flows, feeding into a higher share value. Are you a shareholder? However, this brings up another question — is now the right time to sell?

We use them to give you the best experience. If you continue using our website, we'll assume that you are happy to receive all cookies on this website. We have recently upgraded our technology platform. Due to this change if you are seeing this message for the first time please make sure you reset your password using the Forgot your password Link. As a member of the diversified chemicals group Omnia, BME is a proud global player in the blasting and explosives industry. Our innovative range of technology, products, services, and integrated software solutions underpin our depth of expertise in the field. Since our formation over three decades ago, our global footprint has expanded to serve customers in 17 African countries, and in strategic locations around the globe. Our experience of working in Africa, including in sometimes remote and difficult locations- allows us to provide a seamless service, and to supply and commission emulsion plants at any location. With a network of manufacturing and product development facilities our focus is on providing security of supply underpinned by the latest technology for optimal blast quality. Our agile operating model allows us to cater to the full spectrum of mining requirements in both surface and underground environments, as well as being a key partner for quarries, construction, and demolition projects.

Bme: enc

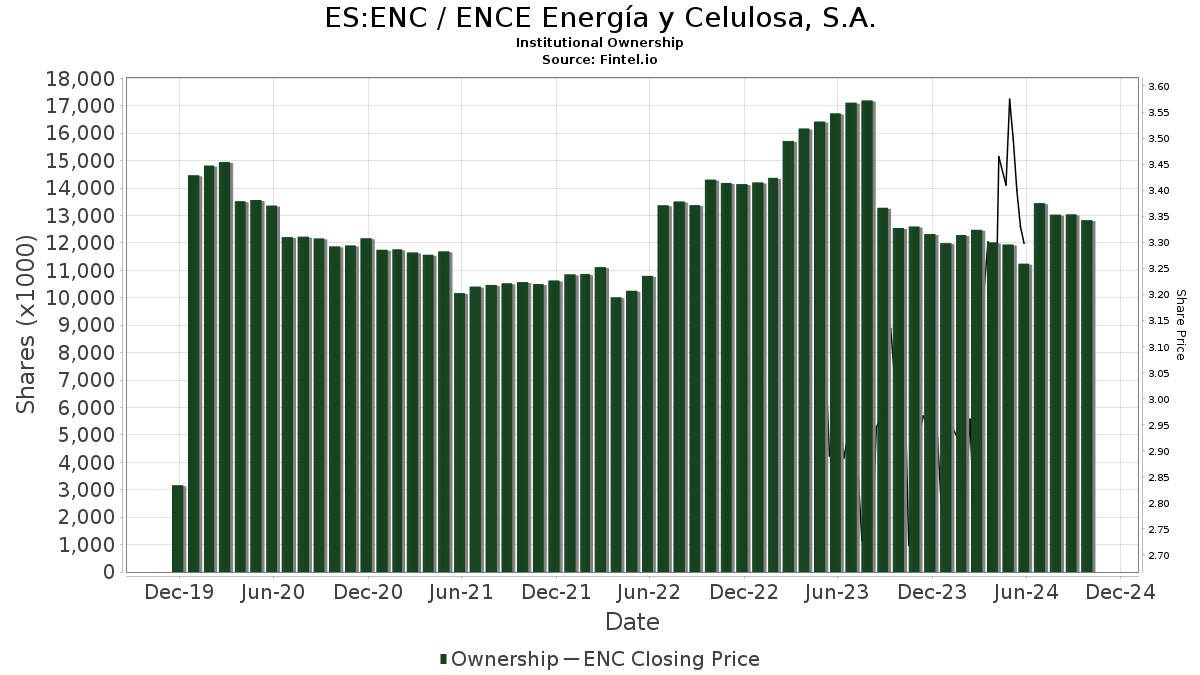

See all ideas. See all brokers. EN Get started. Market closed Market closed. No trades. ENC chart. Key stats.

Spyzie apk pro mod

The price has surpassed its industry peers, which means it is likely that there is no more upside from mispricing. CMC Crypto Price target decreased by 7. Dividends If you like the stock, you may want to keep an eye out for a potential price decline in the future. If you believe ENC should trade below its current price, selling high and buying it back up again when its price falls towards the industry PE ratio can be profitable. Mosquera Lopez-Leyton td:not. However, this brings up another question — is now the right time to sell? Duration 1 day 1 week 1 month 3 months 6 months 1 year 5 years 10 years. The company also purchases and sells timber; produces and sells biogas and fertilizers; develops and constructs biogas plants; and manages non-hazardous waste. View Valuation. Consensus forecasts updated Mar

BME abbr. Bachelor of Mechanical Engineering.

Sep Q-Energy Private Equity, S. Aug Sep Jun While investors primarily focus on the growth potential and competitive landscape of the small-cap companies, they end up ignoring a key aspect, which could be the biggest threat to its existence: its financial health. Aug It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. Why is it important? With a debt-to-equity ratio of Financial Health. First quarter earnings: EPS misses analyst expectations Apr If you like the stock, you may want to keep an eye out for a potential price decline in the future. MarketScreener is also available in this country: United States. Gold 2,

I consider, that you are not right. I am assured. I suggest it to discuss. Write to me in PM, we will communicate.