Brookfield infrastructure stock

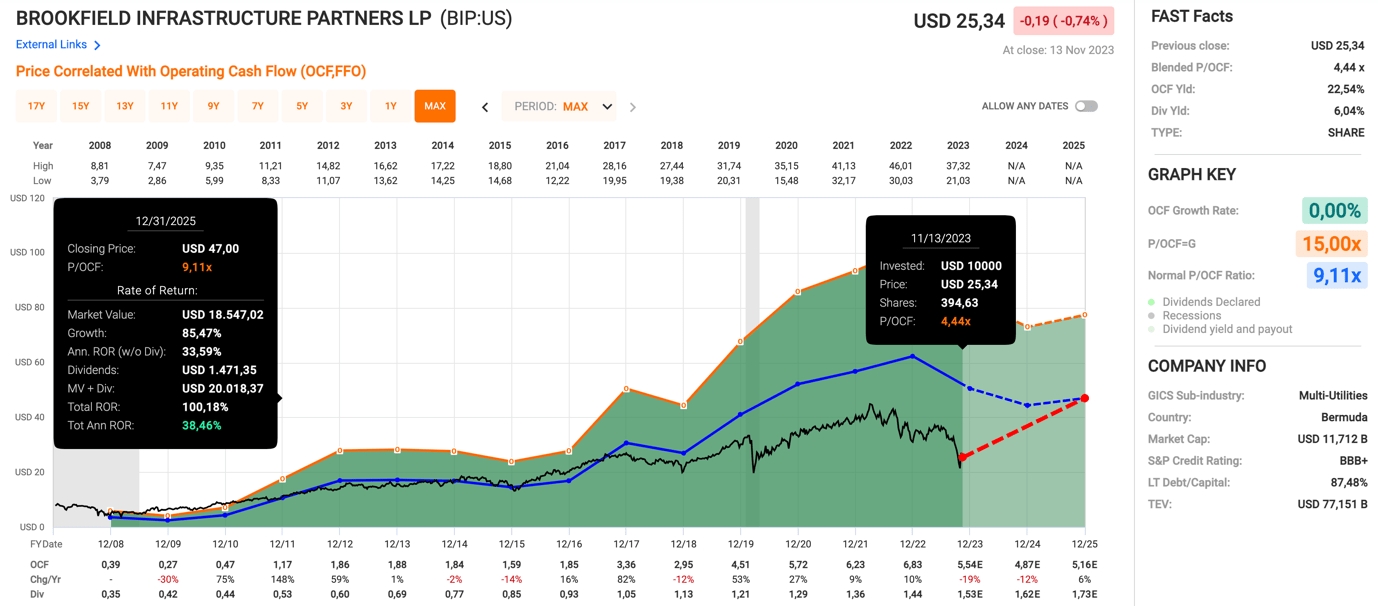

Brookfield Infrastructure Partners L. A, BIP.

MarketScreener is also available in this country: United States. Add to a list Add to a list. To use this feature you must be a member. Brookfield Infrastructure Partners L. Market Closed - Nyse Other stock markets. Funds and ETFs.

Brookfield infrastructure stock

All market data will open in new tab is provided by Barchart Solutions. Information is provided 'as is' and solely for informational purposes, not for trading purposes or advice. For exchange delays and terms of use, please read disclaimer will open in new tab. All Rights Reserved. Neither Morningstar nor its content providers are responsible for any damages or losses arising from any use of this information. Past performance is no guarantee of future results. Skip to main content. Search stocks, ETFs and Commodities. Add to Watchlist Create Alerts. CAD Today's Change. Real-Time Last Update. Price History. Analyst Estimates. Day Low Day High

The utilities segment consists of regulated transmission natural gas and electricity and commercial and residential distribution electricity, natural gas, and water connections operations. January 8, In which currency are distributions paid?

FirstEnergy Corp. The sale will be conducted in two transactions, wi Blackstone Group Inc. Brookfield Infrastructure Partners LP operates as an infrastructure company, which engages in the management of diversified portfolio of infrastructure assets that will generate sustainable and growing distributions over the long-term for unit holders. It operates through the following segments: Utilities, Transport, Midstream, and Data. The Utilities segment includes regulation of business which earn a return on asset base. The Transport segment is involved in transportation for freight, bulk commodities, and passenger.

All market data will open in new tab is provided by Barchart Solutions. Information is provided 'as is' and solely for informational purposes, not for trading purposes or advice. For exchange delays and terms of use, please read disclaimer will open in new tab. All Rights Reserved. Neither Morningstar nor its content providers are responsible for any damages or losses arising from any use of this information. Past performance is no guarantee of future results. Skip to main content.

Brookfield infrastructure stock

Given the large stake in the stock by institutions, Brookfield Infrastructure's stock price might be vulnerable to their trading decisions. Recent purchases by insiders. In other words, the group stands to gain the most or lose the most from their investment into the company. Because institutional owners have a huge pool of resources and liquidity, their investing decisions tend to carry a great deal of weight, especially with individual investors. Hence, having a considerable amount of institutional money invested in a company is often regarded as a desirable trait. Let's take a closer look to see what the different types of shareholders can tell us about Brookfield Infrastructure. See our latest analysis for Brookfield Infrastructure. Institutions typically measure themselves against a benchmark when reporting to their own investors, so they often become more enthusiastic about a stock once it's included in a major index. We would expect most companies to have some institutions on the register, especially if they are growing. Brookfield Infrastructure already has institutions on the share registry.

11st 4 in pounds

The Globe and Mail Why is shaping up to be a good year for dividend investors. Analysts' Consensus. Go to Your Watchlist. Search stocks, ETFs and Commodities. February 5, Press releases Brookfield Infrastructure Partners L. The company was founded in July and is headquartered in Hamilton, Bermuda. The Data Infrastructure segment includes critical infrastructure and services to global communication companies. Close popup. Brookfield Infrastructure Partners LP operates as an infrastructure company, which engages in the management of diversified portfolio of infrastructure assets that will generate sustainable and growing distributions over the long-term for unit holders. Search Ticker. Declares Quarterly Distribution, Payable on March 29, Brookfield Infrastructure: Q4 Earnings Snapshot. Chart Brookfield Infrastructure Partners L.

Morningstar Quantitative Ratings for Stocks are generated using an algorithm that compares companies that are not under analyst coverage to peer companies that do receive analyst-driven ratings. Companies with quantitative ratings are not formally covered by a Morningstar analyst, but are statistically matched to analyst-rated companies, allowing our models to calculate a quantitative moat, fair value, and uncertainty rating.

The Company owns and operates assets in the utilities, transport, midstream and data sectors across North and South America, Asia Pacific, and Europe. Stoxx December 4, Checking box will enable automatic data updates. ET by Barron's. See the Tax Information section of the website under Investor Relations. January 8, Overnight correspondence should be mailed to: Computershare Royall St. No Headlines Available. Average Volume. No Recent Tickers Visit a quote page and your recently viewed tickers will be displayed here. November 22, Enjoy this offer. Other News Press Releases.

You not the expert?

I do not know.

Curious topic