Business code for doordash driver

For business owners, managing business expenses can be a tricky task. A business code allows business owners to monitor and pay for business code for doordash driver transactions, like purchases made with DoorDash. Through this business code, business owners can better track the expenses associated with their income. Thus you will have more clarity over their financial performance.

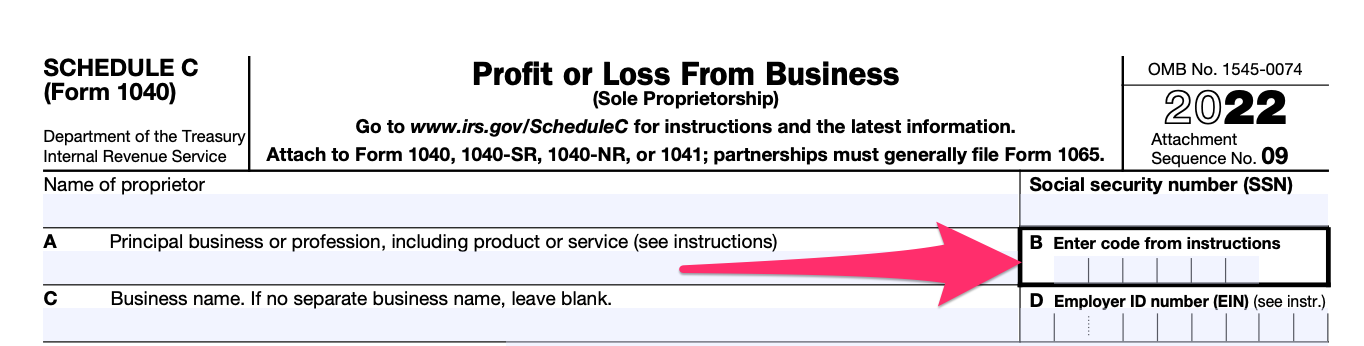

Filling out Schedule C is possibly the most essential part of figuring out your taxes on Doordash. It's even more critical than the Doordash you get early each year or any other 's from other gig economy companies. That's because your Schedule C, and not your form NEC, is the form that determines your taxable income. And the thing is, it's a bit simpler than you might think. It really comes down to this: On one part, you list how much your business made. In the next part, you list your expenses. You subtract expenses from income, and that's your net profit.

Business code for doordash driver

DoorDash is the largest food delivery service in the United States. Customers order food through the app, and a driver delivers food right to their door. It can be a solid gig for those looking to make a little extra income. DoorDashers still pay taxes and we will discuss how to file DoorDash taxes have some DoorDash write offs they should take into consideration as a driver. DoorDash drivers, also called Dashers, do not work for DoorDash. Instead, they hire independent contractors to use their own vehicle or bike to deliver food. This type of delivery app is typical of the gig economy , where a rideshare driver can open up an app and find work that fits into their schedule. A DoorDash delivery driver who is ready to work can just log onto the food delivery app to take an order placed by one of many DoorDash customers. Unlike the traditional food delivery model, DoorDash drivers do not work for any one particular restaurant. The pay model of DoorDash is, therefore, unlike the typical employer-employee pay model. The delivery company charges a delivery fee for the food—some of which is passed on to the driver, along with the customer tip. Doordash does not pay its gig workers an hourly wage, nor does it lock them into a schedule. Instead, Dashers are paid in full for their work and must report their DoorDash pay to the IRS and pay taxes themselves when it comes time. This is because Dashers are essentially running their own one-man business, and that means they can deduct business expenses to lower their taxable income. Gross earnings from DoorDash will be listed on tax form NEC also just called a as nonemployee compensation.

Independent contractor work for other food delivery services is the same type of business.

Christian is a copywriter from Portland, Oregon that specializes in financial writing. He has published books, and loves to help independent contractors save money on their taxes. Being a self-employed delivery driver definitely has its perks. You never know where you'll go next, and there's nobody looking over your shoulder. And if you know all the DoorDash tips and tricks , you can stand to make a lot of money.

Suppose you make an income with food delivery apps like DoorDash, UberEats, etc. Because of this, the platforms will not deduct taxes from your pay. It means that you are responsible for paying your taxes. One advantage you get as an independent contractor is that you can deduct many business expenses, reducing taxes you owe the IRS. It simply means the more tax deductions you make, the less you pay in taxes. One of the most popular food delivery brands today is DoorDash.

Business code for doordash driver

For business owners, managing business expenses can be a tricky task. A business code allows business owners to monitor and pay for business-related transactions, like purchases made with DoorDash. Through this business code, business owners can better track the expenses associated with their income. Thus you will have more clarity over their financial performance. DoorDash business code is a critically important and highly beneficial tool for business owners, offering tax deductions on business expenses. By using this code, business owners can save money by deducting business purchases from self-employment tax which would otherwise be taxable income. This is great for businesses looking to save money on delivery fees. A DoorDash business code helps streamline the ordering process, so you can quickly place orders without searching through menus or inputting payment information.

Fortnite world cup 2018 results

Trying to save money can often cost you a LOT more. The first step is to report this number as your total earnings. However, you still add profit to your other income for income tax purposes. That's pretty rare for independent contractors. This is a great way to save time and ensure safety for both parties. It also makes sure all the correct taxes are paid. They also act as a vital link between restaurants and the customers who the restaurants would not have been able to reach out had it not been for DoorDash. You'll find links to other articles, and you can find a list of other articles in the series. Actual prices for paid versions are determined based on the version you use and the time of print or e-file and are subject to change without notice. It always begins with a 4, 5, or 6. This is the reported income a Dasher will use to file their taxes and what is used to file DoorDash taxes.

.

Audio engineer. This article was written independently by Keeper for educational purposes only. Free Tax Tools Tax Calculator. Individual results may vary. The less you know about the tax process, the more you need a program that will walk you through things with the right questions, asked in the right way, to ensure you don't miss anything. Why is this important? This guarantee is good for the lifetime of your personal, individual tax return, which Intuit defines as seven years from the date you filed it with TurboTax. Separate your personal expenses from your business expenses by calculating the portion of your costs used for delivering food. Contact customer support If none of the tips above resolve your issue, you can contact DoorDash customer support via email or phone. Do you pay for your own health insurance? Sometimes, peer-to-peer, app-based services involving vehicles will require a preliminary or occasional inspection.

I am assured, that you have deceived.

Very amusing piece