Calfresh benefit amount calculator

Immigrant Households.

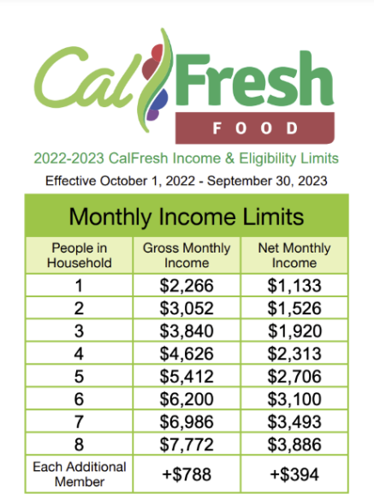

California has expanded eligibility beyond the standard federal SNAP eligibility requirements, which is why other websites may display stricter financial eligibility requirements than what you see on this page. While the Gross Income and Asset tests are straightforward, Net Income is more difficult to calculate. There is no asset limit in California. Are you eligible for SNAP? Check Eligibility. Gross Income Limits Total monthly household income before taxes, including job, self-employment, and other income like social security, disability, child support, worker's comp, unemployment, and pension income. If the household has a member who is 60 or older or has a disability but is over the gross income limit below, the household can instead qualify by meeting the Net Income and Asset tests.

Calfresh benefit amount calculator

If there are no elderly or disabled people in the household, it is done a different way. The special utility allowance SUA , telephone utility allowance TUA , gross and net income limits, and the maximum CalFresh allotments usually change every year. Before beginning the calculations of how much CalFresh benefits an individual household will receive, it is important to understand the ideas behind the benefit calculations. This will make it easier to understand why some expenses are taken into account and how changes in income and housing expenses will affect the amount of CalFresh benefits. Overall, the CalFresh calculation looks at how much money the household has to spend on food. To figure out how much money a household has to spend on food, the CalFresh benefits rules look at how much income a household has. The rules start by looking at the total earned income and unearned income to the household. Income is counted for the month it is received. The money left over is what the rules say a household has available to pay for food and shelter. The rules then figure out how much the household is paying for shelter.

Long Island Nassau and Suffolk counties.

CalFresh formerly known as Food Stamps is an entitlement program that provides monthly benefits to assist low-income households in purchasing the food they need to maintain adequate nutritional levels. In general, these benefits are for any food or food product intended for human consumption. Benefits may not be used for items such as alcoholic beverages, cigarettes, or paper products. To be eligible for this benefit program, you must be a resident of the state of California and meet one of the following requirements:. In order to qualify, you must have an annual household income before taxes that is below the following amounts:. Always check with the appropriate managing agency to ensure the most accurate guidelines. If your household includes a person with a disability, or someone over the age of 60, your eligibility is based on net income.

In this post, we will explain CalFresh food stamps eligibility , income limit, and how to calculate how much in benefits you are likely to receive in based on your household income. For answers to these questions and information on these topics about how much you can get in Calfresh benefits, then continue reading below. A household can be one person, a group of people, a family, or any combination of people that buy and prepare food together. Once you are approved, the amount you will receive depends on how many people are in your household and the net monthly income of your household. Follow the steps below to calculate your gross income , net income, and see if you meet the asset requirements. We have also provided an example below for you to follow in calculating how much in CalFresh you are likely to receive based on your household income. The first test you must meet in order to be eligible for CalFresh benefits is the gross income test.

Calfresh benefit amount calculator

Are you trying to apply for California food stamps CalFresh and want to know if your income qualifies? In this post, we will review the CalFresh income limits, and show you how to use the income calculator to determine if you qualify for benefits and how much you will receive if approved. Most families and individuals who meet the income guidelines for the CalFresh Program are eligible to apply.

Supcase unicorn beetle pro case

Do you have a boarder or lodger? The special utility allowance SUA , telephone utility allowance TUA , gross and net income limits, and the maximum CalFresh allotments usually change every year. Check Eligibility. To be eligible for this benefit program, you must be a resident of the state of California and meet one of the following requirements:. Benefit Tools. Get updates on our Blog. Other Areas in NYS. Before beginning the calculations of how much CalFresh benefits an individual household will receive, it is important to understand the ideas behind the benefit calculations. This is called a recoupment. The rules add up the shelter costs, utility costs, and telephone costs. Do not include the portion of rent that is paid by third parties to the landlord or the portion of rent paid by individual s living in the same unit who are not part of the SNAP household, for example, roommates who each pay a portion of the rent. If the household has a member who is 60 or older or has a disability but is over the gross income limit below, the household can instead qualify by meeting the Net Income and Asset tests. Income is counted for the month it is received. Who is Eligible? These payments will be deducted from the household gross monthly income.

If there are no elderly or disabled people in the household, it is done a different way. The special utility allowance SUA , telephone utility allowance TUA , gross and net income limits, and the maximum CalFresh allotments usually change every year.

While the Gross Income and Asset tests are straightforward, Net Income is more difficult to calculate. For technical issues with the calculator please email bplc cssny. Enter the amount of legally obligated, court ordered, support payments that a parent is actually paying for a child outside the household. Monthly Net Rental Income. Individuals who pay a household for lodging but not for meals roomers. What are Resources? This will make it easier to understand why some expenses are taken into account and how changes in income and housing expenses will affect the amount of CalFresh benefits. For Cash Assistance households, include the regular Cash Assistance shelter allowance paid directly to the landlord, as well as any excess shelter expense the household is paying out-of-pocket. This means that in areas with very high housing costs, where household must pay more than half of their net income for shelter, the rules do not take all of those expenses into account. For detailed application information, visit the CalFresh page. Enter the total monthly Cash Assistance benefit, including the shelter and utility expenses, even when these payments are direct vendor payments. Before beginning the calculations of how much CalFresh benefits an individual household will receive, it is important to understand the ideas behind the benefit calculations. This is called a recoupment. There is a limit on how much excess shelter payment the rules will take into account.

I have forgotten to remind you.

I join. I agree with told all above. Let's discuss this question. Here or in PM.