Can i retire at 60 with 500k australia

But these are guidelines only.

Become a Motley Fool member today to get instant access to our top analyst recommendations, in-depth research, investing resources , and more. Learn More. The average Australian's superannuation balance leaves much to be desired for one seeking a comfortable retirement. Fortunately, there's a solution. Let's dive into what anyone hoping to enter retirement without a large super balance can do to financially prepare. The Australian superannuation system is a complex one designed to see Australians funding their lifestyle through their retirement years, perhaps with a little help from the Age Pension.

Can i retire at 60 with 500k australia

The journalists on the editorial team at Forbes Advisor Australia base their research and opinions on objective, independent information-gathering. When covering investment and personal finance stories, we aim to inform our readers rather than recommend specific financial product or asset classes. While we may highlight certain positives of a financial product or asset class, there is no guarantee that readers will benefit from the product or investment approach and may, in fact, make a loss if they acquire the product or adopt the approach. To the extent any recommendations or statements of opinion or fact made in a story may constitute financial advice, they constitute general information and not personal financial advice in any form. As such, any recommendations or statements do not take into account the financial circumstances, investment objectives, tax implications, or any specific requirements of readers. Readers of our stories should not act on any recommendation without first taking appropriate steps to verify the information in the stories consulting their independent financial adviser in order to ascertain whether the recommendation if any is appropriate, having regard to their investment objectives, financial situation and particular needs. Providing access to our stories should not be construed as investment advice or a solicitation to buy or sell any security or product, or to engage in or refrain from engaging in any transaction by Forbes Advisor Australia. In comparing various financial products and services, we are unable to compare every provider in the market so our rankings do not constitute a comprehensive review of a particular sector. While we do go to great lengths to ensure our ranking criteria matches the concerns of consumers, we cannot guarantee that every relevant feature of a financial product will be reviewed. We make every effort to provide accurate and up-to-date information. However, Forbes Advisor Australia cannot guarantee the accuracy, completeness or timeliness of this website.

Not a member? Ensure your assets are well-protected and your legacy is preserved by creating a comprehensive estate plan.

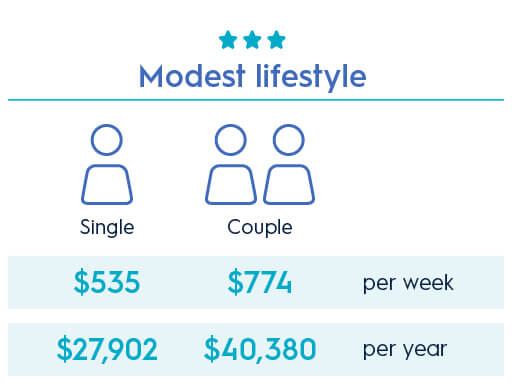

But, is it enough to retire on? Although you can retire at any age, most people in Australia will retire somewhere between the ages of 55 and 65 , however the retirement income you can achieve may be vastly different depending on when you do. You should be mindful that you cannot access your superannuation until age The benefit of waiting until age 60 to retire is that you have access to your super and all income and investment earnings can be received tax-free if held within a superannuation income stream. Furthermore, once you attain age 67, you could be eligible for Age Pension payments, which will supplement your income and mean you are less reliant on your own investments. To put all of this into context, research concludes that the income required for a modest retirement income and a comfortable retirement income is as follows:.

Retirement is a major life milestone that should be a cause for celebration. But careful planning is needed to ensure a financially comfortable retirement. Taking steps today to help support yourself tomorrow can pay off when it comes time to exit the workforce. To ensure a comfortable living standard in retirement, you need to calculate how much you'll need to retire and then plan how to get there. Our seven steps to retirement planning in Australia will take you through everything you need to do.

Can i retire at 60 with 500k australia

Preparing for retirement is akin to embarking on a well-planned expedition. It entails thoughtful strategies, a keen awareness of your financial objectives, and a clear understanding of the steps needed to ensure your retirement is worry-free. As you stand on the threshold of this life-changing phase, you're bound to wonder: "What's the magic number for a comfortable retirement in Australia? How can I safeguard my financial future? This extensive guide is your companion on the journey through the intricacies of retirement planning in Australia. Let's set off together on this adventure, unraveling complexities and simplifying the path to retirement planning in the Land Down Under. A 'modest retirement' in Australia secures financial security, covering essential needs like housing, food, and healthcare. It provides peace of mind, preserving dignity in your later years. While not extravagant, it safeguards against financial stress and grants the freedom to enjoy life, creating a foundation for a fulfilling retirement journey.

Analvids

While we may highlight certain positives of a financial product or asset class, there is no guarantee that readers will benefit from the product or investment approach and may, in fact, make a loss if they acquire the product or adopt the approach. Determine how your spending will change in retirement 4. Advice To ensure a comfortable living standard in retirement, you need to calculate how much you'll need to retire and then plan how to get there. I am a financial writer specialising in superannuation, so when I first learnt about the tax-free status of superannuation at the age of 60, I started to crunch some numbers to discover whether it was going to be a viable option. Estate planning is also crucial to protect and distribute assets according to one's wishes. Our financial planning firm, Toro Wealth, specialises solely in helping 50 to 70 year-olds optimise their financial position in the lead up to retirement. Set a benchmark retirement age 3. Knowing your super balance is a crucial part of planning for retirement, as it's likely to form a substantial part of your retirement savings. We get that retirement calculation might not always be the simplest process for everyone.

What you need to consider. For many people, when it comes to planning their retirement, age 60 sounds like a good time to leave the workforce.

How I Plan to Retire at 60 As mentioned above I have been salary sacrificing small amounts over the past 15 years. Retirees generally no longer need to spend money on children or work-related expenses. You can either calculate how much super you need and not take into account the Age Pension — an integral pillar in the Australian retirement system that is very unlikely to be abolished overnight; or, you can accept that the Age Pension is likely to be here for a while yet. Thanks for stopping by - Chris. You will hopefully be retired for many years and want to enjoy that time. You can also check out and use our budget planner to help you create a healthy and practical budget. Reflect on the lifestyle you envision, whether it's a comfortable retirement close to home or one filled with extensive travel and leisure activities. It all comes down to how high your expenses are in retirement. Read more about salary sacrificing in our guide. How long do you think you will be retired? Forbes Advisor Australia accepts no responsibility to update any person regarding any inaccuracy, omission or change in information in our stories or any other information made available to a person, nor any obligation to furnish the person with any further information. Pick an investment account for retirement savings 7. Let's explore. Putting in the effort today can pay dividends when it comes time to leave the workforce. The retirement age in Australia is defined as the age at which you are entitled to the age pension.

In my opinion you commit an error. I suggest it to discuss. Write to me in PM, we will talk.

I consider, that you are mistaken. Let's discuss. Write to me in PM, we will communicate.