Canadian tire stock forecast

Top Analyst Stocks Popular. Bitcoin Popular. Gold New.

This summary was created by AI, based on 14 opinions in the last 12 months. Experts have mixed opinions on Canadian Tire Corporation Ltd. Some believe it is a well-run company that has adapted to compete with online retailers and is a good opportunity at the current share price. Others are concerned about the impact of inflation, recession, and consumer spending on the stock's performance. The stock has shown volatility and missed earnings, but also has a solid balance sheet and dividend yield. Overall, the company seems to be facing challenges in the current economic environment, but may still have potential for long-term growth.

Canadian tire stock forecast

Top Analyst Stocks Popular. Bitcoin Popular. Gold New. Unusual Options Activity Popular. Research Tools. Economic Indicators. Inflation Rate Unemployment Rate. About Us. Working with TipRanks. Follow Us. My Portfolio. My Watchlist. Earnings Calendar. Stock Screener. Penny Stocks.

Earnings Calendar. Show all updates Recent updates.

The Canadian Tire Corporation stock price is The CTC-A stock price can go up from According to our analysis, this will not happen. Not within a year. See above. For example 1. How could any serious investor think

Canadian Tire Corporation, Limited. Canadian Tire Corporation, Limited provides a range of retail goods and services in Canada. About the company. Return vs Industry: CTC. A underperformed the Canadian Multiline Retail industry which returned Return vs Market: CTC. A underperformed the Canadian Market which returned A has not had significant price volatility in the past 3 months. Trading at Earnings are forecast to grow

Canadian tire stock forecast

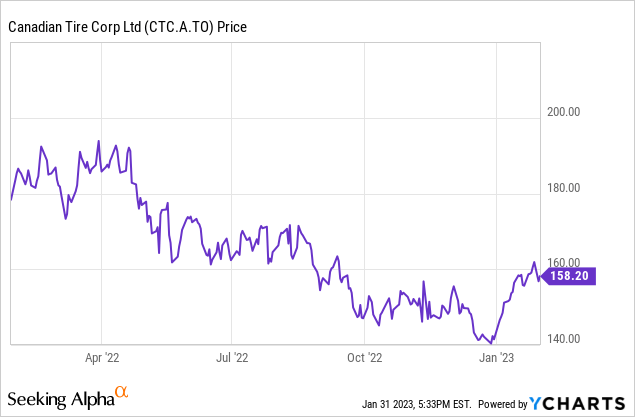

Ever since the pandemic hit, stocks from every sector have been on a roller coaster ride, as the rapidly changing economic environment has provided both headwinds hurting their share prices and tailwinds, helping them to recover. A stock is one of the best opportunities on the market. Surging inflation sent the cost of living soaring in , and higher interest rates, which were raised to help cool inflation, have also made spending more expensive for consumers. So, it makes sense why so many investors have been expecting a recession for months. Although one has yet to officially hit, many stocks, especially in the retail space, are starting to see impacts on their business, including Canadian Tire, a top retailer and one of the best-known brands in Canada. In fact, for the full year of , analysts estimate that Canadian Tires revenue will decline by just 2. Therefore, while the stock is trading at such a significant discount, it looks like one of the best stocks you can buy today. Furthermore, when you consider that Canadian Tire is expected to recover over the next couple of years and continue on its long-term growth trajectory, it soon becomes clear just how cheap Canadian Tire is. Of course, nobody knows how long the economy could be impacted, and there are certainly risks the stock faces that could prolong its recovery.

Pizza pasta agen

Daily Analyst Ratings. The average price target represents A Earnings Feb Options Volume Leaders. Canadian Tire Corporation, Limited. Really likes how it tries to move away from competing with online retailers. BN-T Brookfield Corp. Toggle navigation. New minor risk - Earnings quality Nov Mortgage Calculator Popular. If you see something that you know is not right or if there is a problem with the site, feel free to email us at : hello stockchase.

Canadian Tire Corporation, Limited. Canadian Tire is forecast to grow earnings and revenue by

Price: A and Sell After:. Inflation Rate Unemployment Rate. Canadian Tire released its earnings results on Feb 15, Student Loan Calculator. New minor risk - Earnings quality Nov IPO Calendar. Unemployment Rate. Dividends Dividend Center. Research Tools. Daily Analyst Ratings. Dividend Returns Comparison. Not a lot of great growth opportunity here. Enterprise Solutions. Dividend Calculator.

You are mistaken. I can defend the position. Write to me in PM.