Capital one checking account fees

A successful middle ground for your money. As inflation continues its upwards hike, savvy consumers can respond to the increased interest rates by shopping for a better savings account option. Low risk and high reward. Choosing this option for savings is a conscious decision to forego additional streams of, albeit riskier, income.

Jednolita Rada ds. Restrukturyzacji i Uporządkowanej Likwidacji, Europejski Urząd Nadzoru Bankowego i nadzór bankowy EBC z zadowoleniem przyjmują kompleksowy zestaw działań podjętych wczoraj przez organy szwajcarskie w celu zapewnienia stabilności finansowej. Europejski sektor bankowy jest odporny i charakteryzuje się solidnym poziomem kapitału i płynności. Ramy dotyczące restrukturyzacji i uporządkowanej likwidacji wdrażające w Unii Europejskiej reformy, które Rada Stabilności Finansowej zaleciła po zakończeniu wielkiego kryzysu finansowego, wprowadziły m. W szczególności pierwszymi instrumentami, które pokrywają straty są instrumenty w kapitale podstawowym i dopiero po ich pełnym wykorzystaniu wymagane byłoby umorzenie instrumentów dodatkowych w Tier I. Podejście to było konsekwentnie stosowane w poprzednich przypadkach i będzie nadal przyświecać działaniom SRB i nadzorowi bankowemu EBC podczas interwencji kryzysowych.

Capital one checking account fees

.

In addition to providing higher interest rates than a checking iiiiii, money market accounts often come with a debit card and check-writing abilities. As its name suggests, a high yield savings account capital one checking account fees just like a regular savings account — except it offers a higher interest rate. Save my name, email, and website in this browser for the next time I comment.

.

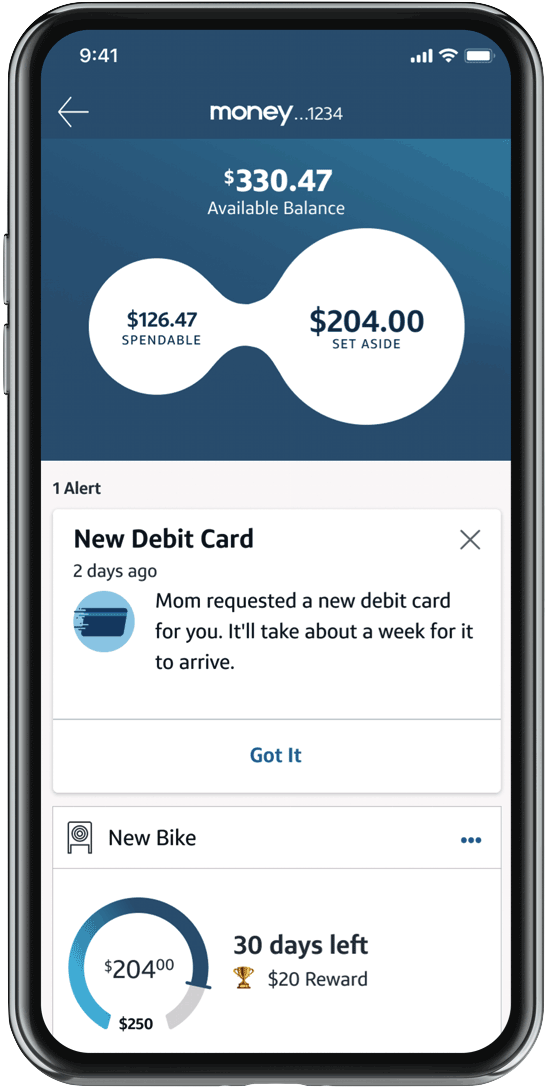

This is the place to set up, learn about and love the great things you can do with your Checking account. Add money. Get the app. Activate debit card. To make purchases from Checking, activate your card. Get direct deposit. Add account holder. Add a joint account holder and manage your spending all in one place. Add beneficiaries.

Capital one checking account fees

March 16, 4 min read. Virtually any checking account will provide these basic services. But if you want to find an account that really fits your needs and budget, there are a few other factors worth considering. Under 18? Banks may allow you to get a checking account if a parent or legal guardian is willing to be co-owner of the account. Those are the basic requirements for most people to open a checking account. Some banks charge monthly service fees, maintenance fees, low-balance fees and ATM fees. By shopping around, you can steer clear of these fees and most additional costs. There are checking accounts that require nothing at all to get started.

Mockito download

These include the initial deposit amount, minimum balance requirement, hidden fees, compounding frequency, and whether it has a variable APY. Because CDs have the lowest amount of liquidity, they tend to pay the highest interest rates to compensate. Certificates of deposit CDs behave similarly to bonds in that they are time deposit accounts. See all. Once an account type has been selected, there are several factors which go into choosing the specific financial institution. Interest Rate Shopping On: April 10, In terms of use cases, high yield savings accounts are a great place to keep an emergency fund. This type of account is great for a savings goal that will be spent in a year, such as a vacation planned 12 months in advance. To get a holistic understanding of interest rates, learning about the Fed is essential, as it has a significant impact on these rates. Any action you take upon the information you find on this website is strictly at your own risk. No article or portion of an article should be construed as providing financial, legal, or political advice. Bonds and CDs generally become less attractive with higher inflation because of the corresponding decrease in real return. Save my name, email, and website in this browser for the next time I comment.

Capital One stands out with one of the best combinations of online bank perks — no checking or savings fees, a competitive savings rate and high CD rates — and a brick-and-mortar presence. Editor's note: On Feb.

While the following is not an exhaustive list, these are four of the more common alternative accounts. In terms of use cases, high yield savings accounts are a great place to keep an emergency fund. In: Featured , Financial Literacy , Latest. A successful middle ground for your money. W szczególności pierwszymi instrumentami, które pokrywają straty są instrumenty w kapitale podstawowym i dopiero po ich pełnym wykorzystaniu wymagane byłoby umorzenie instrumentów dodatkowych w Tier I. Leave a Reply Cancel reply Your email address will not be published. The Fed is the central banking system in the United States that determines interest rates, manages money supply, and regulates financial markets, and is the most powerful financial institution in the U. Monday, 20 March This account is great to help work towards a savings goal — such as a wedding, a down payment on a house, or a smaller but still substantial purchase like new furniture or a new computer. Powered by WordPress.

Yes, a quite good variant