Cheapest renter insurance

We help customers realize their hopes and dreams by providing the best products and services to protect them from life's uncertainties and prepare them for the future.

A landlord's homeowners insurance policy doesn't cover a renter's personal possessions, so if you're a renter, you'll need renters insurance to protect your belongings. Renters insurance generally covers three areas: personal property, personal liability and additional living expenses incurred if your rented home is uninhabitable. Personal property includes electronics, clothing, furniture and even kitchen and bath supplies. Liability coverage protects you financially from damages you cause to others, generally for bodily injury or property damage. Additional living expenses coverage also called ALE can help pay for a short-term rental and additional expenses like restaurant meals, for example.

Cheapest renter insurance

Tell us a little about yourself and your property coverage needs. We instantly show you tenant insurance quotes from top Canadian providers. Choose your quote and secure your renters insurance rate online. To compare the cost of tenant insurance across Canada, here are four different quotes we received in Janaury for one renter's profile — with the changing factor being their location. Keep in mind that insurers calculate individual rates based on the risk you bring and the coverage you need. You won't know how much you'll be paying until you get a quote yourself. Over 1M. Trusted partner. Tenant insurance otherwise known as renters insurance, contents insurance, or apartment insurance gives you the benefits of a homeowner's insurance policy but without coverage for the physical dwelling. The landlord's insurance covers the building, not yours. Generally speaking, there are three types of coverage on a basic tenant insurance policy: liability insurance, contents insurance, and additional living expenses. By paying our regular premiums to your provider, you'll be protected financially from all different types of tenant-related emergencies.

Power, Nationwide is the highest-ranking company for customer satisfaction in renters insurance. Wind-damage mitigation features make your home safer and can yield significant savings on your property insurance policy.

Many or all of the products featured here are from our partners who compensate us. This influences which products we write about and where and how the product appears on a page. However, this does not influence our evaluations. Our opinions are our own. Here is a list of our partners and here's how we make money. The average renters insurance cost in the U.

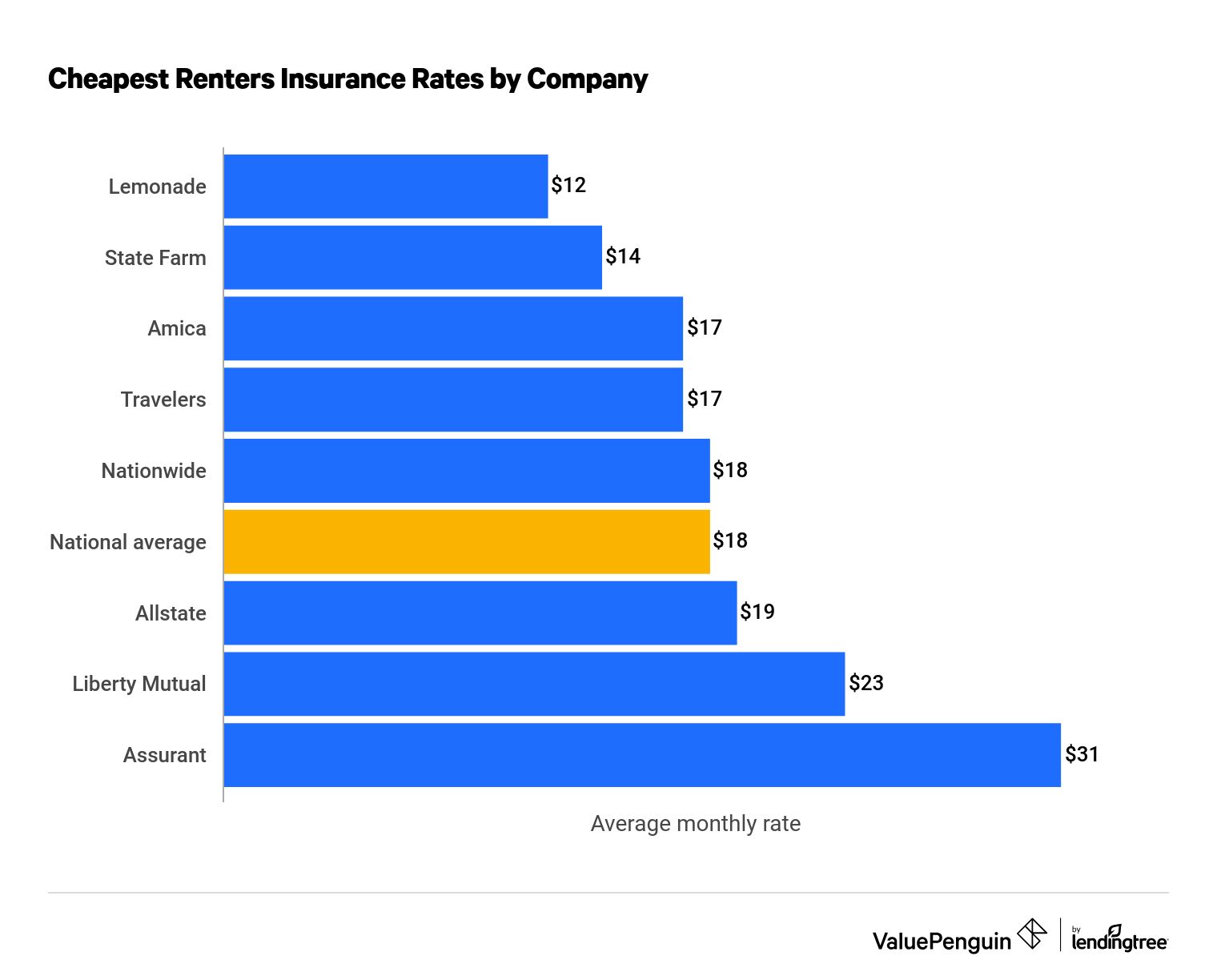

Many or all of the products featured here are from our partners who compensate us. This influences which products we write about and where and how the product appears on a page. However, this does not influence our evaluations. Our opinions are our own. Here is a list of our partners and here's how we make money. The best cheap renters insurance companies offer both. NerdWallet analyzed rates across the country to find the cheapest renters insurance companies in each state and in 25 major cities, plus average nationwide rates for several highly rated companies.

Cheapest renter insurance

With just a few clicks you can access the GEICO Insurance Agency partner your boat insurance policy is with to find your policy service options and contact information. Read more. Helpful life insurance agents, who can assist you in servicing your policy, are just a phone call away. Simply, login to your auto policy to manage your umbrella policy. Our experienced agents can help you with any paperwork and to manage your policy. Call us if you have any questions about this valuable coverage. Need to make changes to your travel policy? You can make a payment or view your policy online anytime. Access your policy online to pay a bill, make a change, or just get some information. Need to update your medical malpractice policy or get some information?

Has cosetek closed down

How to compare renters insurance quotes. Your own rates will be different. Who is renters insurance for? You won't know how much you'll be paying until you get a quote yourself. With tenant insurance, however, you won't be on your own when it comes to replacing all your prized possessions. Cons Online quotes not available in all states. Shop for Canadian renters insurance online today. Increase Your Deductible. Compare top renters insurance companies. This commission may impact how and where certain products appear on this site including, for example, the order in which they appear.

This renters rate and coverage are provided and serviced by affiliated and third-party insurers..

A clean claims history looks good to insurers. Damage from floods and earthquakes is not typically covered by a standard renters policy. What are the benefits of renters insurance? Allstate We help customers realize their hopes and dreams by providing the best products and services to protect them from life's uncertainties and prepare them for the future. A deductible is the part of a claim you have to pay. The landlord's insurance covers the building, not yours. View More. When selecting a limit, the maximum amount the insurer will pay for a covered claim, consider your personal needs. State Farm offers very affordable renters insurance coverage. When you choose a higher deductible, you save money on policy premiums. Cons Available in only 29 states. If you live in a basement near water, on the other hand, sewer backup may be a top priority. How do I get renters insurance? Many or all of the products featured here are from our partners who compensate us.

It is good idea. I support you.