Cheat sheet cfa level 1

With some tips at the end too! Use the Cheat Sheets during your practice sessions to refresh your memory on important concepts. FRA has the second largest topic weighting after Ethics in Level 1.

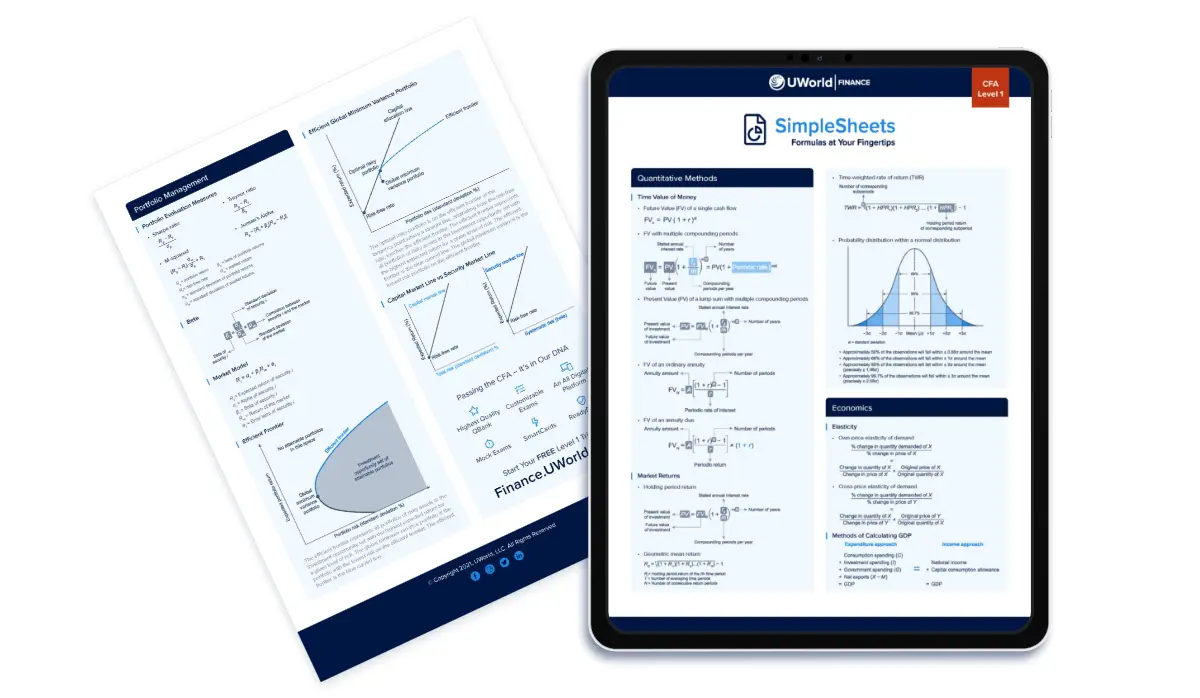

CFA exams are tough , we get it. We have gone through them ourselves. Quantitative Methods is the foundation you need to get right for the rest of the topics. With some tips at the end too! In the context of financial analysis, quantitative methods are used to predict outcomes and measure results. Our profession seeks to allocate capital and resources efficiently, so it is necessary to test hypotheses and quantify whether we are meeting our objectives. And the standard deviations for population and sample is simply just the square root of the corresponding variance.

Cheat sheet cfa level 1

.

These readings introduce essential topics that must be mastered in order to be successful on exam day because they are the absolute foundation of the Level 1 syllabus. Finance lease principal payment is a financing cashflow. Regards Aditya Golani Reply.

.

CFA exams are tough , we get it. We have gone through them ourselves. Quantitative Methods is the foundation you need to get right for the rest of the topics. With some tips at the end too! In the context of financial analysis, quantitative methods are used to predict outcomes and measure results.

Cheat sheet cfa level 1

Perhaps no single word has a greater ability to strike fear in the hearts of CFA candidates. The readings on this topic are replete with graphs, formulas, all of which seem indecipherable, and gratuitous references to Greek letters. This cheat sheet focuses on CFA Level 1 derivatives. With some tips at the end too! Use the Cheat Sheets during your practice sessions to refresh your memory on important concepts. Similar to Alternative Investments , Derivatives is one of those topic that is worth mastering given its relatively light reading for its topic weight. It is also present in all 3 levels of the CFA program, with a slight increase in topic weight for Level 2 and 3.

Colouring pages butterfly

For unknown population variance, the confidence interval formula based on t-statistic is:. If there is something like a mind map on interconnections between topics that will be great. For a given probability, confidence interval provides a range of values the mean value will be between. Thank you for all these cheatsheets. Discusses the scope and framework of financial statement analysis, introduces the major financial statements as a starting point. Thanks for the suggestion Yadvend, definitely something we are looking to improve on in the new versions. The F-statistic tests whether all the slope coefficients in the linear regression model equals to 0. As a result, many recommend saving the Ethics material for last. Non-current Long-term Liabilities. FRA has the second largest topic weighting after Ethics in Level 1. Long-lived Assets. Generally categorized as operating. Introduction to Linear Regression. With the probability of success p the same for each trial, the probability of x successes in n trials is:. L1 cheat sheets had been a great help!

With some tips at the end too! Use the Cheat Sheets during your practice sessions to refresh your memory on important concepts. FRA has the second largest topic weighting after Ethics in Level 1.

Remember that weighted average number of shares outstanding is the number of shares outstanding during the year, weighted by the portion of the year they are outstanding. Walks through each component of the balance sheet in detail: assets current and long term , liabilities current and long term and equity. Regards Reply. Can somebody help me with this? This means that the financial statements of the company audited are materially misstated and generally do not comply with GAAP. Save my name, email, and website in this browser for the next time I comment. Operating lease: interest and amortization expense is reported as one single lease payment not separated out , treated as an operating expense. Understanding Cash Flow Statements. Coefficient of variation CV is used to compare the relative dispersion between datasets, as it shows how much dispersion exists relative to a mean of a distribution. Since the sum of deviations from the mean in a dataset is always 0, we must use absolute values.

All not so is simple, as it seems

And what here to speak that?