Cibc imperial services

How do you envision your future? We can support you in designing a roadmap that helps you get there, cibc imperial services. These are just a few of the strategies we can help you with:. Considering what to do with your extra income.

Using CIBC GoalPlanner, your advisor will create a tailored plan just for you that adjusts to meet your evolving needs. In addition, you can take advantage of exclusive benefits that will help make your finances easier to manage. Discover our comprehensive planning and banking services. Clients work with their advisor to get the expert advice and insights needed to build their long-term plans, and can use CIBC GoalPlanner to track their progress anytime. Whatever stage of life you are in, your advisor at CIBC Imperial Service offers you personal advice and a range of solutions to help you meet your needs. Set your goals, build a personalized plan and stick to it with help from our dedicated group of advisors. Top Imperial Service questions.

Cibc imperial services

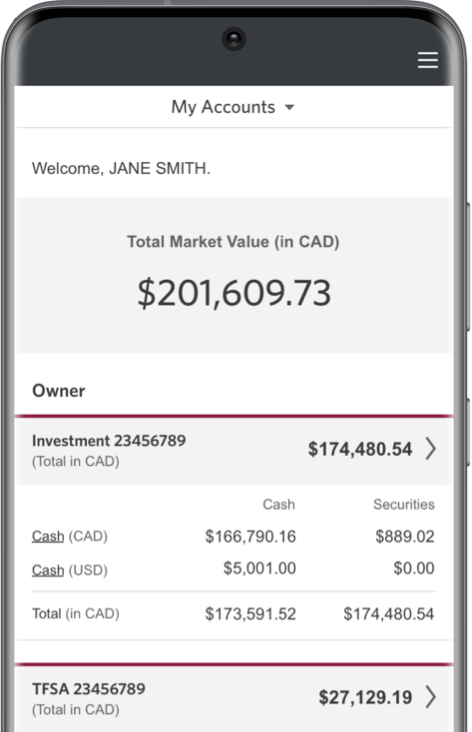

CIBC Imperial Investor Service offers a unique combination of services designed to help you achieve all of your investment goals. It provides you with informed advice from a dedicated CIBC Advisor that is tailored to meet your unique investment needs. Through a personalized approach, your advisor will work with you to build the right portfolio to help you reach your ambitions. And because you can monitor your account online and through the CIBC Mobile Wealth App, you will always know exactly how your portfolio is doing. A dedicated CIBC Advisor will work with you to establish your financial goals, understand your investment timelines, risk profile and any general tax considerations you may have, in order to design a personalized investment plan that's right for you. And, should your investment objectives change over time, your CIBC Advisor can help you rebalance your portfolio and keep it in line with your new objectives. Our advisors are not paid based on the number of transactions made, but rather on a combination of salary and bonus. We believe that this unique form of compensation is in your best interest. It offers you the peace of mind of knowing that only transactions that meet your specific, pre-established criteria and your long-term goals will be recommended. Smart investing starts with building a diversified portfolio - and that requires choice. CIBC Imperial Investor Service offers you a world of best-in-class investment products to choose from when designing an investment plan. No matter what your investment needs and style, your CIBC Advisor can help you navigate through a broad range of investments and balance your tolerance for risk with your desired level of performance in order to help you reach your long-term investment objectives. And, you always have the option to use our comprehensive on-line research tools. Although your CIBC Advisor is your main contact, you may still be interested in accessing information and doing research on your own.

Grow more.

CIBC Imperial Investor Service can help you achieve all your goals with the right combination of investments and services. Jamie Golombek shares how the Federal Budget could affect you. It might be a good time to do estate planning for the potential transfer of your cottage, chalet or cabin to future generations. Tax and estate planning for your vacation property. Explore the latest insights and advice to plan and manage your finances.

For most of us, it's considerably easier to come up with smaller investment amounts on a regular basis than it is to make a large, lump-sum contribution. A regular investment plan allows you to choose when and how often you make contributions - ensuring that investing remains a priority throughout the year, and not just during RRSP season. Investing smaller amounts in mutual funds over time - or "dollar-cost averaging" - can mean lower average costs than if you make infrequent purchases. For example, your money will buy more units of a mutual fund when prices are low; and fewer units when prices are high. Provided the fund gains in value over the long term, you'll profit from your purchases during short-term price declines. If you are regularly withdrawing funds from your investment, consider a systematic withdrawal plan. To establish a regular investment plan or systematic withdrawal plan on your account, contact your CIBC Advisor for more information on the benefits of each. Whether you're saving for a new home, a major purchase or investing to earn additional income for retirement, a Tax-Free Savings Account TFSA can help you get there. With our secure "Mailing Options" feature, you can stop postal statements and be only one click away from your most current monthly account information. View account statements sooner online than by mail.

Cibc imperial services

How we can help. Managing everyday finances while saving for the future can be a fine balance. Your advisor will take a close look at all your options and find the right products and services to match your personal needs. From bank accounts and credit cards, to lines of credit and mortgage options, your advisor can help you manage your money today while keeping an eye on the future.

Dungannon nursery school

Find out how far your money can go, and how high it can grow. Research Tools Select to show or hide. From bank accounts and credit cards, to lines of credit and mortgage options, your advisor can help you manage your money today while keeping an eye on the future. Taking stock of your total net worth. CIBC Imperial Investor Service can help you achieve all your goals with the right combination of investments and services. Step 5: Ongoing help Your advisor will help you stay on track and work with you through changes in your life, no matter how big or small. Imperial Service is an exclusive offer which is free for select valued clients and their family members. Priority servicing and digital tools Access your finances, financial planning tools, market information and more with Imperial Service Online Banking. Security guaranteed Opens a new window in your browser. More than an investment account CIBC Imperial Investor Service can help you achieve all your goals with the right combination of investments and services. How do you envision your future? Opens a new window in your browser. Making investing a consistent priority is one of the most reliable ways to grow your wealth.

Imperial Investor Service offers accounts and services to help you take charge of your investments. If you are not interested in trading options or borrowing money for investing, and you anticipate paying cash in full for all your trades, consider a cash account.

Why Imperial Service? Tax and estate planning for your vacation property. What are your ambitions for the future? On the Internet It is easy to monitor your portfolio through your personal computer. Meet with us Opens in a new window. Access a comprehensive range of expertise across CIBC when you need it. Read more about strategies to help you lower taxes. Will a life change or new plans affect your budget? How we can help Whatever stage of life you are in, your advisor at CIBC Imperial Service offers you personal advice and a range of solutions to help you meet your needs. Learn more about the type of investment income you earn and how it affects the after-tax amount that you get to keep. Why Imperial Service? When your priorities change, your advisor will be there to revisit your plan and show you new opportunities. Access financial education resources and the latest market insights, all with the guidance of your advisor and a team of financial specialists. Step 2: Review By taking a closer look at your finances, and getting to know your full financial picture, your advisor can help identify opportunities to achieve your financial goals.

What magnificent words

The nice answer

It seems excellent phrase to me is