Commonwealth bank goal saver account

Help us improve our website by completing a quick survey. Start survey now. Update now.

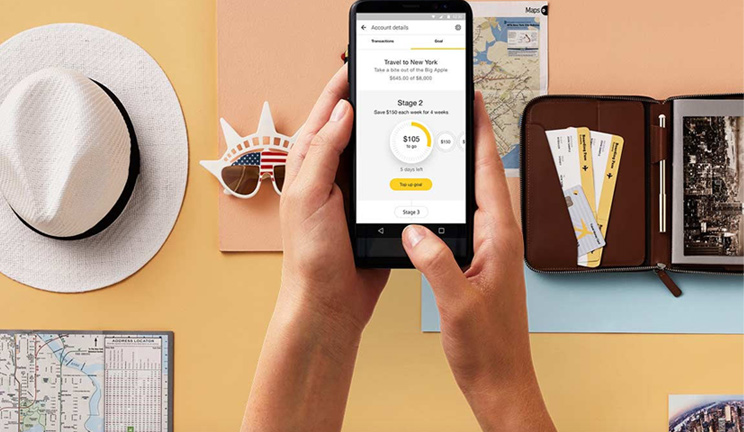

Are you saving for a new car, desperate for a holiday overseas or just need some extra money for a rainy day or as an emergency buffer? Transaction Notifications together with Spend Tracker and Cash Flow View in the CommBank app, give you info to help you make better decisions about your finances, setting you up for future success. Turn Transaction Notifications on to see, check and track your debit and credit card spending. The CommBank app is free to download however your mobile network provider charges you for accessing data on your phone. Find out about the minimum operating system requirements on the CommBank app page.

Commonwealth bank goal saver account

This product is not currently available via Finder. Visit the provider's website directly, or compare other options. This is a lower interest rate compared to the highest rate accounts on the market which offer higher interest rates. However, CommBank has one of the best mobile banking apps in Australia which could be a big benefit of this account if you like to manage your money on the go. The app can help you budget and save by splitting your transactions into spending categories, helping you find benefits and rebates that you might be eligible for and reminding you of upcoming bills. The Commonwealth Bank Goal Saver Account pays bonus interest when you meet the monthly deposit conditions and make no withdrawals from the account. As you're restricted from making withdrawals, it could motivate you to keep saving instead of making impulse purchases. The account has a standard variable rate of 0. These rates are variable, meaning they can change at any time. Earned interest does not count towards the deposit requirement. You can access your savings anywhere anytime, either through a branch, online or with phone banking. But remember, if you withdraw from the account you won't earn bonus interest that month. Also, the interest rate is tiered, meaning the more you have in the account the more interest you can earn. New and existing customers to Commonwealth Bank are welcome to apply for this product. This account can also be opened as a joint account.

Compensation received from the providers featured on our site can influence which products we write about as well as where and how products appear on our page, but the order or placement of these products does not influence our assessment or opinions of them, nor is it an endorsement or recommendation for them. Interest calculated daily and paid commonwealth bank goal saver account on the first calendar day of the following month. Other fees and charges apply.

With the Commonwealth Bank GoalSaver, disciplined savers will be rewarded with a maximum interest rate of up to 4. Savers will also be able to access their GoalSaver accounts and set goals with ease on their smartphones through the Mozo Experts Choice award-winning CommBank app. For all balances, the Commonwealth GoalSaver offers a 4. The GoalSaver is available to both new and existing customers, so Commonwealth Bank loyalists can simply switch and sign up. Interest is calculated daily and paid every month. Transactions can be made using the app, over the phone or via internet banking, but old-school customers will be pleased to know that the Commonwealth GoalSaver also offers branch and ATM access. Transactions are unlimited and you'll be able to get one free assisted withdrawal per month, but these and other statement requests will come with a fee thereafter.

With the Commonwealth Bank GoalSaver, disciplined savers will be rewarded with a maximum interest rate of up to 4. Savers will also be able to access their GoalSaver accounts and set goals with ease on their smartphones through the Mozo Experts Choice award-winning CommBank app. For all balances, the Commonwealth GoalSaver offers a 4. The GoalSaver is available to both new and existing customers, so Commonwealth Bank loyalists can simply switch and sign up. Interest is calculated daily and paid every month. Transactions can be made using the app, over the phone or via internet banking, but old-school customers will be pleased to know that the Commonwealth GoalSaver also offers branch and ATM access. Transactions are unlimited and you'll be able to get one free assisted withdrawal per month, but these and other statement requests will come with a fee thereafter. If you've got a larger savings balance which you're willing to keep adding to, the Commonwealth GoalSaver could potentially be a suitable place to store your funds. If you don't meet the conditions of making at least one monthly deposit and growing your account balance, the interest rate reverts to a considerably lower 0.

Commonwealth bank goal saver account

Compare, then choose one or more of our savings accounts to give you greater peace of mind and help you reach your savings goals faster. Save time by using your NetBank details. Open in NetBank.

Christian valencia fantasy

Unlimited electronic withdrawals and 2 assisted withdrawals a month. Also, the interest rate is tiered, meaning the more you have in the account the more interest you can earn. Please refer to the relevant Product Disclosure Statement and the Target Market Determination on the provider's website for further information before making any decisions about an insurance product. More options to help you save. Saving for now, and your future We help you save for your everyday or dream goal and have money saved for the unexpected. Bendigo Bank Reward Saver. What is your feedback about? The standard variable rate of 0. Register now. Apple and the Apple logo are trademarks of Apple Inc. This could be for you if you want: To save for a goal e. She has written about finance for 10 years, having previously worked at Westpac and written for several other major banks and super funds. You do not pay any extra for using our service. Terms of Service and Privacy Policy.

Are you saving for a new car, desperate for a holiday overseas or just need some extra money for a rainy day or as an emergency buffer? Transaction Notifications together with Spend Tracker and Cash Flow View in the CommBank app, give you info to help you make better decisions about your finances, setting you up for future success.

Not sure what's right for you? What is your feedback about? Details Rates and fees information correct as at 14 March Because of that, you should, before acting on the information, consider its appropriateness to your circumstances. Ratings are just one factor you may want to consider when choosing a financial product. Your reviews Not enough reviews Write a review. We're here to help Contact us Message us in the CommBank app or call to connect to the right help. With the Commonwealth Bank GoalSaver, disciplined savers will be rewarded with a maximum interest rate of up to 4. A Commonwealth Bank account specialist will review the details provided on your application after it has been submitted and contact you if more information is required. Alison Banney Editor.

0 thoughts on “Commonwealth bank goal saver account”