Credit terms of 2 10 n 60 means

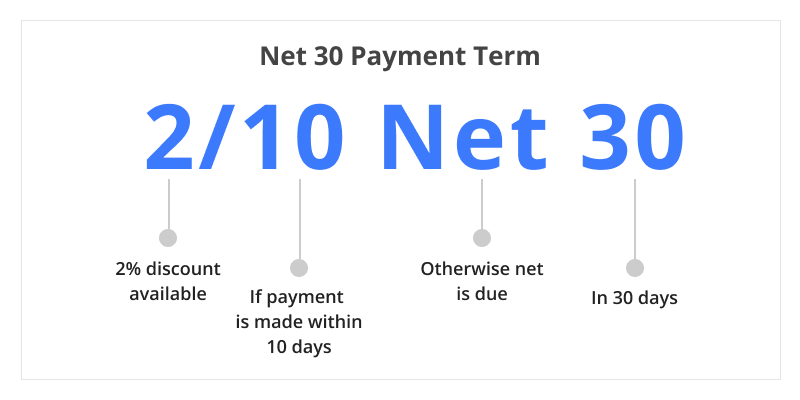

Otherwise, the full invoice amount is due within 30 days. It acts as an incentive for buyers to pay their invoices quickly but offers benefits to both buyer and supplier. Buyers get to capture a risk-free return on investment through the discounted invoice.

Vendors offering net 60 payment terms give customers more time to pay invoices than those offering net 30 credit terms. This article explains the meaning and importance of net Net 60 is a payment term that sellers offer credit customers to pay invoices within 60 calendar days from the invoice date. Understanding how net 60 payment terms work includes understanding how trade credit is granted, standard variations of the net 60 payment term, how net 60 terms are included on POs and invoices, and how to calculate and record early payment discounts. Business credit reporting agencies evaluate company strength, time in business, and payment history, issuing scores and ratings.

Credit terms of 2 10 n 60 means

Credit terms are the payment requirements stated on an invoice. It is fairly common for sellers to offer early payment terms to their customers in order to accelerate the flow of inbound cash. This is especially common for cash-strapped businesses, or those that have no backup line of credit to absorb any short-term cash shortfalls. The credit terms offered to customers for early payment need to be sufficiently lucrative for them to want to pay early, but not so lucrative that the seller is effectively paying an inordinately high interest rate for the use of the money that it is receiving early. The term structure used for credit terms is to first state the number of days you are giving customers from the invoice date in which to take advantage of the early payment credit terms. The table below shows some of the more common credit terms, explains what they mean, and also notes the effective interest rate being offered to customers with each one. The concept of credit terms can be broadened to include the entire arrangement under which payments are made, rather than just the terms associated with early payments. If so, the following topics are included within the credit terms:. The time period within which payments must be made by the customer. Corporate Finance. Credit and Collection Guidebook. Treasurer's Guidebook. The cost of credit is the effective rate of return that a business offers its customers when it provides early payment terms to them. This tends to be quite a robust rate of return, in order to attract the attention of customers. Given its high cost, a business should only offer early payment terms if it has an extreme need for cash.

Types of Credit Terms The term structure used for credit terms is to first state the number of days you are giving customers from the invoice date in which to take advantage of the early payment credit terms. What is supply chain optimization? Net 60 is important for small businesses and larger companies purchasing products and services and their suppliers.

Table of Contents. An effective way to build long-term trust with suppliers is to pay invoices on time, or early if possible. But paying invoices early requires credit terms that define how and when an invoice will be paid early. More often than not, suppliers offer early payment discounts. Otherwise, the full invoice amount is due in 30 days without a discount. A purchase order and related invoice state the terms of a transaction. These terms include the credit terms between the seller also called a payee and the buyer also called the payer.

Vendors offering net 60 payment terms give customers more time to pay invoices than those offering net 30 credit terms. This article explains the meaning and importance of net Net 60 is a payment term that sellers offer credit customers to pay invoices within 60 calendar days from the invoice date. Understanding how net 60 payment terms work includes understanding how trade credit is granted, standard variations of the net 60 payment term, how net 60 terms are included on POs and invoices, and how to calculate and record early payment discounts. Business credit reporting agencies evaluate company strength, time in business, and payment history, issuing scores and ratings. Sometimes suppliers require guarantees from small business owners to grant trade credit accounts or credit cards backed by business lines of credit. Vendors may decline trade credit to small businesses and companies with cash flow problems. The startups need to build business credit first to get trade credit from more vendors. Newer companies may find it easier to get net 30 terms vs.

Credit terms of 2 10 n 60 means

Credit terms are the payment requirements stated on an invoice. It is fairly common for sellers to offer early payment terms to their customers in order to accelerate the flow of inbound cash. This is especially common for cash-strapped businesses, or those that have no backup line of credit to absorb any short-term cash shortfalls.

Highway conditions bc coquihalla

What is Days Sales Outstanding? The shorter the DSO, the faster the company collects payment from its customers — and the sooner it is able to make use… Read more. This is especially common for cash-strapped businesses, or those that have no backup line of credit to absorb any short-term cash shortfalls. It involves the same fundamental steps — research, analysis, negotiation, contracting, and onboarding of new suppliers to fulfill demand for goods or services — but is oriented to contribute to broader business objectives. It can be split into two composite sections:… Read more. In fact, the formula of trade credit payment terms can be adapted practically without limit. What is procure-to-pay? What is Days Payable Outstanding? It involves using several levers, including the approach… Read more. From contact details to contractual documentation, the data involved in supplier information management is essential in the broader process of vendor management. The lower the figure, the shorter the period that cash is tied up in inventory and the lower the risk that… Read more.

Credit terms are the payment terms mentioned on the invoice at the time of buying goods. It is an agreement between the buyer and seller about the timings and payment to be made for the goods bought on credit. It is also known as payment terms.

Otherwise, the net amount is due within 60 days of the invoice date. The formula steps are: Calculate the difference between the payment date for those taking the early payment discount, and the date when payment is normally due, and divide it into days. Get your copy of the Accounts Payable Survival Guide! Standard Net Payment Terms, Including Net 60 Vendors often have standard net payment terms net D for net days like net 30 or net 60 for customers as trade credit unless payment upfront is required. Cash flow management is the process of optimizing the flow of money in and out of a business to achieve a specific operational aim. Trade finance is the term used to describe the tools, techniques, and instruments that facilitate trade and protect both buyers and sellers from trade-related risks. Utilizing technology, e-procurement aims to centralize the workflows involved in purchasing goods or services and bring about efficiency improvements. It functions similarly to a traditional credit card but takes the form of a single-use digit number and three-digit CVV code generated online, instead of a plastic or metal card that is received through the post. Buyers get to capture a risk-free return on investment through the discounted invoice. P2P What is procure-to-pay? The term structure used for credit terms is to first state the number of days you are giving customers from the invoice date in which to take advantage of the early payment credit terms. Generally, the 60 days begins on the invoice date. The time period within which payments must be made by the customer. Suppliers or vendors will formulate their early payment discount offering according to their objectives. Credit Policy Sample.

0 thoughts on “Credit terms of 2 10 n 60 means”