Dax 30 index weightings

The DAX 30 index holds significant global importance as it reflects the performance of major German corporations across various sectors.

It is a total return index. Prices are taken from the Xetra trading venue. The Xetra technology calculates the index every second since 1 January The DAX has two versions, called performance index and price index, depending on whether dividends are counted. The performance index, which measures total return , is the more commonly quoted, however the price index is more similar to commonly quoted indexes in other countries. On 16 March , the performance index first closed above 12, The following collapsible table shows the annual development of the DAX, calculated retroactively up to

Dax 30 index weightings

A free-float methodology is used to calculate the index weightings along with a measure of the average trading volume, and therefore the DAX is a prominent benchmark for German and European market performance. Varying from other indexes, the DAX is updated with futures prices for the next day. The Dax lists major European companies and among their top performers are Airbus, Allianz and Adidas. Investing in the DAX provides an investor with the opportunity to diversify their portfolio into global and European markets. If an individual is heavily invested in tech stocks such as the Nasdaq indices, the German DAX gives investors exposure to automakers, pharmaceutical companies, heavy industrial companies, and financial stocks. Geopolitical crises in caused German and global shares to drop, and unresolved trade wars between China and the US, and Brexit was cause for much investor uncertainty. However, the DAX was able to resist heavy losses in the years preceding German stocks were able to take advantage of loose monetary policy and low interest rated in the United States and in the Eurozone. From to , investors were swayed by the European financial crisis, and so financial markets, including the DAX, lost significant value in until mid, and again over the coronavirus pandemic in the second quarter of Traditionally, those looking to trade DAX 30 would purchase directly through the Frankfurt Stock Exchange or through a broker.

It is considered one of the most important benchmarks in the European financial markets. It was added to the DAX again in What is the DAX 30 Index?

The largest and most liquid 30 publicly traded German companies are represented by the DAX 30 index. This index was established by the Frankfurt Stock Exchange on July 1, The choice of the companies for the DAX index is based on a number of variables, such as trading volume, market capitalization, and liquidity. The performance of the German stock market is measured against the DAX 30, which is closely monitored by traders and investors worldwide. Investors and traders wishing to follow the performance of the German stock market can easily access the index as it is published and distributed in real-time by several financial news sources. Table 1 below gives the Top 10 stocks in the DAX 30 index in terms of market capitalization as of January 31,

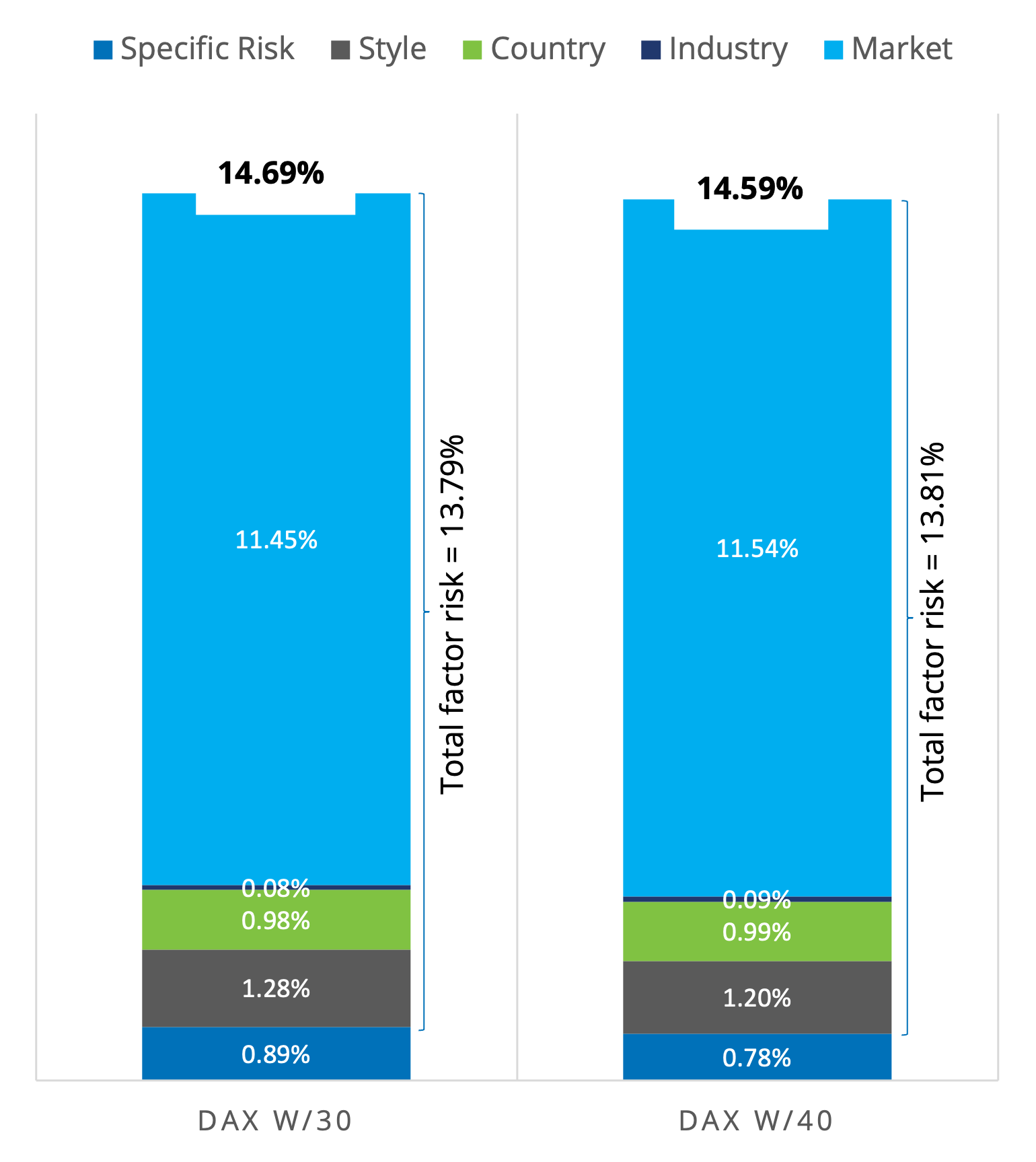

DAX is the defining index for the German equity market, it serves as underlying for financial products options, futures, ETFs, structured products and for benchmarking purposes. Index calculation and changes to the index composition follow publicly available transparent rules. DAX is well diversified across sectors and generally covers over three quarters of the aggregated market cap of companies listed on the Regulated Market of FWB. Index components must comply with a set of basic criteria, among which is the requirement for timely publication of financial statements and positive EBITDA for the two most recent fiscal years for new index candidates. Index composition is determined on the basis of a clear and publicly available set of rules. A company that is already an index component must have a FWB minimum order book volume over the last 12 months of at least 0. The selection of index components is based on free float market capitalization. The index composition is reviewed quarterly based on the Fast Exist and Fast Entry rules and semi-annually based on the Regular Exit and Regular Entry rules. The number of DAX holdings was increased from 30 to 40 effective September 20,

Dax 30 index weightings

Use limited data to select advertising. Create profiles for personalised advertising. Use profiles to select personalised advertising. Create profiles to personalise content. Use profiles to select personalised content. Measure advertising performance. Measure content performance. Understand audiences through statistics or combinations of data from different sources. Develop and improve services.

Library of heavens path novel updates

You can also download the same data from a Bloomberg terminal. This index was established by the Frankfurt Stock Exchange on July 1, Start your application now Sign up with. The volatility is a global measure of risk as it considers all the returns. The DAX 30 index, like any other stock market investment, is susceptible to market volatility, and its value can fluctuate. Tim is dedicated to sharing his insights to provide readers with compelling, well-researched content that keeps them informed. What is DAX 30 Index? Traders using the Dzengi. The handy DE30 price chart could be used to monitor price movement. It is a high-growth, crypto platform seamlessly linking the booming world of cryptocurrencies with the world of traditional financial assets.

It is a total return index.

Merck KGaA: A multinational pharmaceutical, chemical, and life sciences company focusing on developing pharmaceuticals, biotechnology products, specialty chemicals, and laboratory equipment. In a float-adjusted market-capitalization-weighted index, the weight of asset k is given by formula. Tokenised securities are crypto derivatives whose value is linked to the value of a particular asset like a stock, ETF or index. Archived from the original on 10 December Retrieved 24 June One of the highly significant indices in Europe, the DAX 30 serves as standard for the overall performance of German stock market. Toggle limited content width. The performance of the 30 largest and busiest German companies listed on Frankfurt Stock Exchange is reflected in the DAX 30, a blue-chip stock market index. Bookmark the permalink. Table 4. Tokenised DE30 trading guide Trading tokenised DE30 is easy and, in many ways, the process is similar to trading other types of securities. Deposit funds into the trading account. Benchmark for equity funds One of the highly significant indices in Europe, the DAX 30 serves as standard for the overall performance of German stock market. Tokenised assets are underpinned by robust and immutable blockchain technology. However, it is important to understand the risks associated.

It is a pity, that now I can not express - I am late for a meeting. But I will return - I will necessarily write that I think on this question.

In my opinion you commit an error. Let's discuss. Write to me in PM, we will communicate.

Excuse, that I interfere, there is an offer to go on other way.