Does doordash provide a 1099

Sound confusing? Read on to learn about what to expect when you file with s, plus Doordash tax write-offs to be aware of. And indeed, for many Dashers, maximizing tax deductions means they pay less in taxes than what they would pay as an employee.

As an independent contractor, the responsibility to pay your taxes falls on your shoulders. Each year, tax season kicks off with tax forms that show all the important information from the previous year. These items can be reported on Schedule C. Note: Form NEC is new. Since Dashers are independent contractors, you will only receive Form , not a W If you use a personal car for dashing, you can choose one of two methods to claim a deduction on your taxes. However, using the standard mileage method you can generally still deduct the following items separately: tolls and parking fees, auto loan interest, and personal property taxes.

Does doordash provide a 1099

DoorDash is a food delivery service that has been gaining popularity over the past few years. For a lot of taxpayers, DoorDash is the 1st place that they worked that they were issued a NEC tax form and have to pay taxes on a Schedule C. This form must be reported on your tax return as self-employment income on a Schedule C. Deductions for delivery drivers — Filing quarterly taxes as a freelance delivery driver for Postmates is a massive task. Instacart delivery drivers are responsible for paying taxes on their income and need the right information about every Instacart tax form. Doordash most likely issues a NEC form to the drivers as the business owner. Then the independent contractor taxpayer has to report this on Schedule C on their tax return to generate their tax bill during the tax season. Some states may require that they pay the drivers with a W2. DoorDash is responsible for filing appropriate forms with each jurisdiction, including NEC forms for subcontractors. The taxpayer can deduct business expenses from this amount to lower their tax during the tax season. As a Driver, you have to keep track of your expenses. It is important to research online and see what DoorDash drivers and Uber drivers have said about their tax obligations when figuring out how to pay taxes on your income works. Neglecting tax duties can otherwise lead to unexpected bills or even penalties. DoorDash provides resources on its website to help you understand DoorDash taxes and your responsibilities to file taxes as a DoorDasher.

Self-Employment Tax: Independent contractors as small business owners are responsible for paying their federal and FICA taxes every quarter. Doordash does not provide drivers with a report of total earnings, tips, raises or bonuses. DoorDash and Uber will also provide you with a tax form.

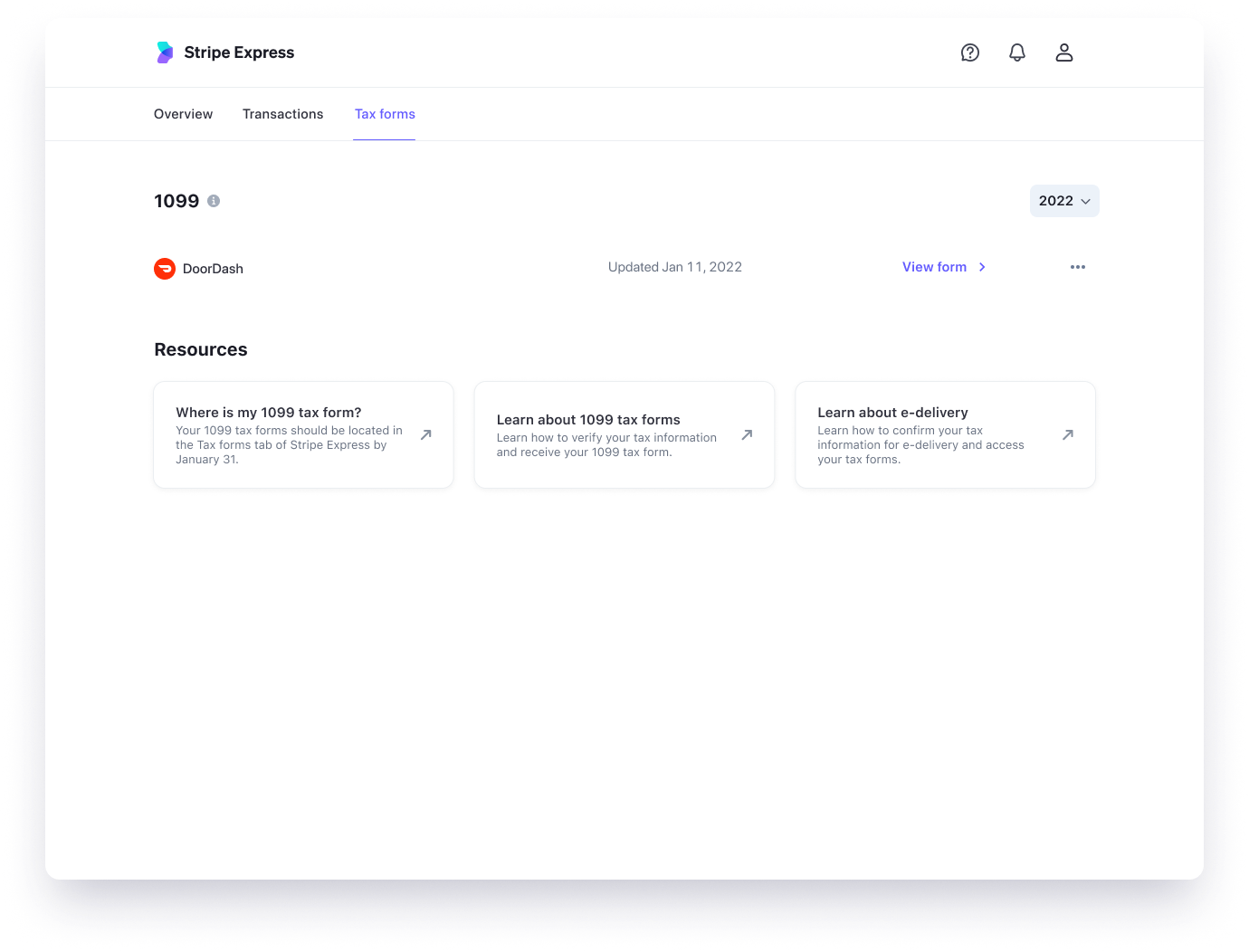

DoorDash partners with Stripe to file tax forms that summarize your earnings or sales activities. If you have already created a Stripe Express account, you can log in to manage your tax information at connect. A K form summarizes your sales activity as a Merchant. Stripe Express allows you to update your tax information, download your tax forms, and track your earnings. You should expect to sent an E-delivery notification for your K if you meet the following criteria in If you are unable to find that email, head to our Support Site where you can request a new link to be sent to your email. If you still are not able to locate your invite email, please reach out to DoorDash support for help updating your email address.

DoorDash partners with Stripe to file tax forms that summarize your earnings or sales activities. If you have already created a Stripe Express account, you can log in to manage your tax information at connect. A K form summarizes your sales activity as a Merchant. Stripe Express allows you to update your tax information, download your tax forms, and track your earnings. You should expect to sent an E-delivery notification for your K if you meet the following criteria in If you are unable to find that email, head to our Support Site where you can request a new link to be sent to your email. If you still are not able to locate your invite email, please reach out to DoorDash support for help updating your email address. I no longer have access to the phone number I signed up with.

Does doordash provide a 1099

Home Delivery. Since , Brett Helling has built expertise in the rideshare and delivery sectors, working with major platforms like Uber, Lyft, and DoorDash. He acquired Ridester. Expanding his reach, Brett founded Gigworker. More about Brett How we publish content. DoorDash recognizes its dashers as independent contractors responsible for keeping track of their total earnings and filing their taxes. These DoorDash tax deductions apply to employees and self-employed workers. They cover social security 6.

Change icloud address

From expense tracking to quarterly estimated payments, figuring out your DoorDash taxes can be nothing short of overwhelming. Whether you're a full-time dasher or a side hustler, it's important to keep track of your write-offs. Both DoorDash and Uber provides annual tax summaries of your earnings that you can use in preparing your income taxes. Before mid-January, you will need to confirm your tax information e. Over 1M freelancers trust Keeper with their taxes Keeper is the top-rated all-in-one business expense tracker, tax filing service, and personal accountant. FlyFin caters to the tax needs of self-employed individuals, including freelancers, gig workers, independent contractors and sole proprietors. Part of the money withheld for tax purposes goes toward Social Security and Medicare taxes. When everything is ready and reviewed, the CPA will efile the income tax federal return, and your taxes are complete for the year. Take control of your taxes and get every credit and deduction you deserve. Ultimately, independent driver taxes can sometimes be confusing and intimidating, but having the right information and resources on hand can make the process much simpler. HVAC technician. But rest assured, with the right information about Doordash taxes, you can avoid any tax penalties and save the most possible on your taxes. Each year, tax season kicks off with tax forms that show all the important information from the previous year. You can claim the uniform and any background check fees as Doordash tax write-offs on your tax return.

Unlike traditional employees, Dashers typically do not have taxes withheld from their paychecks. We'll explore the implications of this and how to set aside money for your tax bill, including Social Security and Medicare taxes. Unlike regular employees, Dashers usually do not have taxes taken out of their pay.

These items can be reported on Schedule C. Form Used to file a normal tax return. Every business, including DoorDash, is responsible for filing appropriate tax forms with each jurisdiction. In addition to federal and state income taxes you may be subject to local income taxes. Accurate records will help you identify opportunities for deductions and credits and make filing your income taxes much easier. Stripe gives you the option to receive your by either e-delivery or snail mail. We know it can be tough to estimate how much of your phone usage is due to work. You can deduct costs like these using either the standard mileage rate or the actual expense method :. Ready to file? There is some good news here: you're allowed to write off the employer portion of your FICA taxes on your income tax return.

0 thoughts on “Does doordash provide a 1099”