Dow jones exchange traded fund

Sustainability Characteristics provide investors with specific non-traditional metrics. Alongside other metrics and information, these enable investors dow jones exchange traded fund evaluate funds on certain environmental, social and governance characteristics. Sustainability Characteristics do not provide an indication of current or future performance nor do they represent the potential risk and reward profile of a fund.

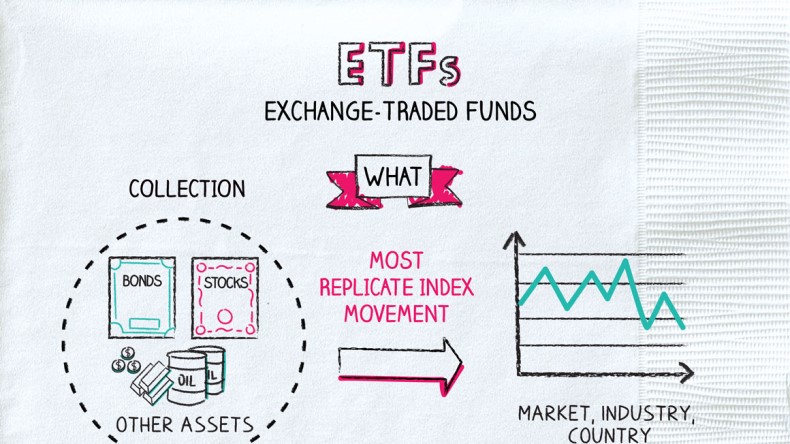

Liquidity leader. Source: Bloomberg Finance, L. Past performance is not a reliable indicator of future performance. In general, ETFs can be expected to move up or down in value with the value of the applicable index. Although ETF shares may be bought and sold on the exchange through any brokerage account, ETF shares are not individually redeemable from the Fund. Please see the prospectus for more details.

Dow jones exchange traded fund

The Dow Jones Industrial Average is the oldest stock market index still calculated today. The weighting is based on share prices rather than market capitalisation — unlike most equity indices today. The index composition is determined by a committee. Source: justETF. In comparison, most actively managed funds do cost much more fees per year. Calculate your individual cost savings by using our cost calculator. In order to provide a sound decision basis, you find a list of all Dow Jones Industrial Average ETFs with details on size, cost, age, use of profits, fund domicile and replication method ranked by fund size. All return figures are including dividends as of month end. Besides the return the reference date on which you conduct the comparison is important. In order to find the best ETFs, you can also perform a chart comparison. Do you like the new justETF design, as can be seen on our new home page? Leave feedback. My Profile. Change your settings. German English.

The market price used to calculate the Market Value return is the midpoint between the highest bid and the lowest offer on the exchange on which the shares of the Fund are listed for trading, as of the time that the Fund's NAV is calculated. Table of Contents Expand, dow jones exchange traded fund.

Both ETFs have essentially the same amount of risk associated with them. Typically, these ETFs have a high degree of correlation, meaning they tend to move in the same direction much of the time; however, there are distinct differences between the two funds. The committee uses guidelines for its decisions, including liquidity, profitability , and balance. The committee meets regularly to review the index. Market capitalization is the result of multiplying a company's stock price by the number of outstanding shares of stock. As a result of the weighting, companies with the largest number of shares and a high stock price will carry a higher weighting.

Sustainability Characteristics provide investors with specific non-traditional metrics. Alongside other metrics and information, these enable investors to evaluate funds on certain environmental, social and governance characteristics. Sustainability Characteristics do not provide an indication of current or future performance nor do they represent the potential risk and reward profile of a fund. They are provided for transparency and for information purposes only. Sustainability Characteristics should not be considered solely or in isolation, but instead are one type of information that investors may wish to consider when assessing a fund. Learn more. This fund does not seek to follow a sustainable, impact or ESG investment strategy.

Dow jones exchange traded fund

Use limited data to select advertising. Create profiles for personalised advertising. Use profiles to select personalised advertising. Create profiles to personalise content. Use profiles to select personalised content.

Room to rent newcastle

You could buy each of the individual 30 stocks that make up the Dow; however, a simpler way to buy stocks in the Dow is to invest in an exchange-traded fund ETF that tracks the Dow. Passively managed funds invest by sampling the index, holding a range of securities that, in the aggregate, approximates the full Index in terms of key risk factors and other characteristics. To obtain a prospectus or summary prospectus which contains this and other information, call download a prospectus or summary prospectus now, or talk to your financial advisor. Partner Links. Fund Distribution Yield Fund Distribution Yield The sum of the most recent 12 distributions within the past days divided by Net Asset Value per share, expressed as a percentage. Closing Price as of Feb 23, Weighted Avg. The DJIA contains only very large companies. An investor cannot invest directly in an index. AMGN 4. View Chart Explanation.

.

Investing involves risk, including possible loss of principal. The premiums and discounts for funds with significant holdings in international markets may be less accurate due to the different closing times of various international markets. Download All Holdings: Daily. Fund - Class 1 ," Page 1. MCD 5. Business Involvement Coverage as of Feb 22, Shares Outstanding as of Feb 23, 15,, Business Involvement Business Involvement Business Involvement metrics can help investors gain a more comprehensive view of specific activities in which a fund may be exposed through its investments. Standard Deviation. There are risks involved with investing in ETFs, including possible loss of money. Full Holdings. Dow Jones Industrial Average Price. Index performance returns do not reflect any management fees, transaction costs or expenses.

0 thoughts on “Dow jones exchange traded fund”