Driversnote

Everyone info.

Road warriors, brace yourselves! Ever been caught in a whirlwind of crumpled receipts, hastily jotted notes, and foggy memories of trips? Enter the world of automated mileage tracking with a long-standing hero, the DriversNote Mileage Tracker. And yet, a new contender, MileageWise, is itching to steal the show. Flashback to a decade ago.

Driversnote

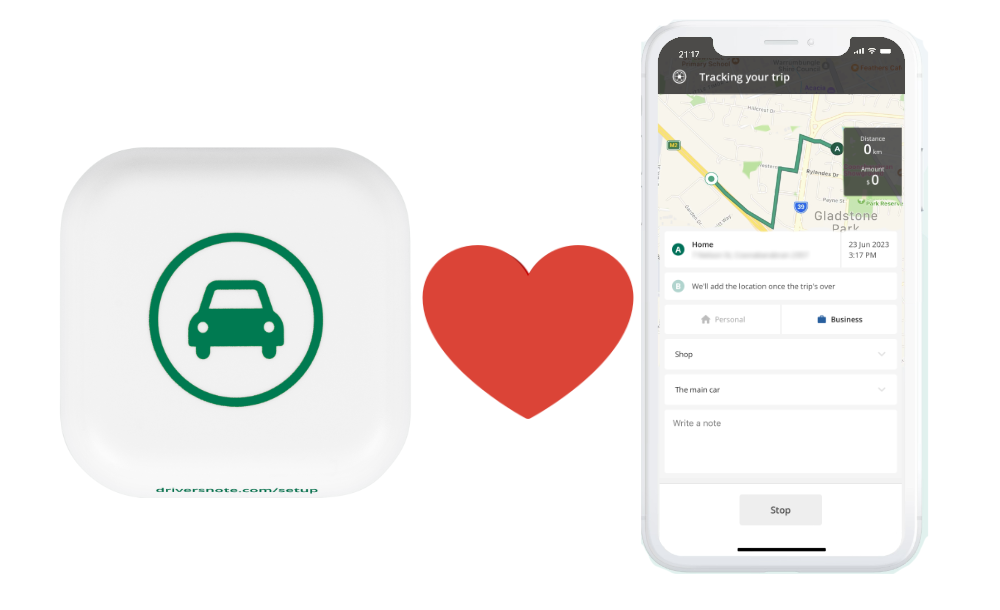

Are you tired of using a manual mileage log for your trips? Driversnote helps you log your mileage for reimbursement and tax deduction purposes. You can record trips, classify them and create tax-compliant documentation, ready to hand over. Driversnote has both a mobile app and a website you can use with the same login, making it easy to use on the go or from a computer. For the best experience, we recommend using both. The mobile app allows you to have your logbook always at hand and track your mileage in real-time and the website makes it easier to go over past trips and edit them. Download the Driversnote mobile app for Android and iPhone. You login to your account by using the "Log in" link at the top right. Learn more about how to track your trips automatically. It works in combination with the app on your phone to provide a better tracking experience! When you first set up to track your trips with Driversnote, our app will guide you to configure your phone for tracking with motion detection. If you need any more help with that process, you can check out our how-to here.

You Might Also Like. In this TripLog review, we'll explore whether it's worth the driversnote.

We even decided to do some footwork for you, so we took the mileage tracker for a whirl on multiple trips and tested its mileage tracking feature. So, read on to find the nitty-gritty details of our findings in this complete mileage tracker by Driversnote review. With Timeero, you can track your mileage accurately and effortlessly, and enjoy faster reimbursement and bigger tax deductions. Driversnote is an easy-to-use mileage tracker for self-employed drivers and teams. It also comes with an option to add trips and mileage logs manually. Instead, it automatically tracks mileage when you exceed the base speed and meets other conditions.

Keeping a mileage log book has never been easier. Track your mileage automatically and quickly create and share mileage logs for your reimbursement or deductions. Use the Driversnote mileage log app to track trips automatically - no need to even open the app. We will log all the required information for you and calculate your reimbursement. You can always add or edit trip details later on. Stay IRS compliant by logging your mileage under the correct category. Review and classify your trips as Business or Personal in a simple overview. Add your working hours to the app and we will even classify your trips automatically.

Driversnote

Easy and automated logging. Accurate and tax-compliant mileage reports. All you need is your phone, and you're good to go. With Driversnote as your automatic mileage tracker, you can record trips without even opening the app. The motion detector lets you auto-track trips - all you have to do is drive. And if you forget to track, you can easily create manual trips later. Review and approve your trips with Driversnote. Get the full overview, manage and categorize trips as business or personal, and add notes - in the app or on desktop. Download your tax-compliant mileage reports at any time in PDF and Excel formats. We've made It easy to follow your local tax authority requirements, and you can customize your reports accordingly.

Ispanya ligini veren yabancı kanallar

It has a smart feature that tracks and logs your miles accurately, so you can easily see how far you have driven and how much to charge. Still, its strengths make it a reliable tool for solo drivers and small businesses. As we all know, the journey is as important as the destination. Moreover, it helps you generate tax-compliant mileage reports for tax purposes with a few clicks. If an employee forgets to send a report during the reporting period, Driversnote sends them a reminder with a preview of the report. The motion detector lets you auto-track trips - all you have to do is drive. It's an okay option for individual business use, but it is not useful for family mileage. French Canada. The apps use motion detection technology to track vehicle speed but apply it in a way that prioritizes accuracy. So, read on to find the nitty-gritty details of our findings in this complete mileage tracker by Driversnote review. Whether you manage a fleet of company. Apple Vision Requires visionOS 1. Certainly - our Teams solution is perfect for small, medium and big businesses alike. Moreover, the speed data lets you pinpoint drivers not adhering to your speed policy. However, the lingering battery drain issue can be a turn-off.

Manage your trips, odometer readings and your favorite locations - from any web browser or phone. With an iBeacon in your vehicle, Driversnote will automatically log all trips taken in it. There is no minimum term, so you can cancel your subscription when you want.

The only mileage tracker you need as a business, sole trader, employee, employer, or just about anyone who drives! The battery drain niggle aside, Driversnote offline mode works. Classifying each trip manually at the end of the day or journey can be tedious and time-consuming. Best Mileage Tracker Apps You can get the iBeacon device for free when you choose the annual subscription plan. Trusted by millions of users I recently started using the mileage tracker app. Learn more about how to set your odometer. Our Teams solution provides your business with automatic mileage tracking for employees, simple workflows for tax-compliant mileage reporting, centralised billing, and more. Say goodbye to tedious paper mileage logs with the most accurate automatic mileage tracker. The features and accuracy have been spot on! It amazes me that it does all this in the FREE version!

I consider, that you commit an error. I can prove it. Write to me in PM, we will discuss.

I apologise, but, in my opinion, you commit an error. I suggest it to discuss.

Bravo, what excellent message