Enbridge dividend increase

Enbridge Inc. This makes the dividend yield 7.

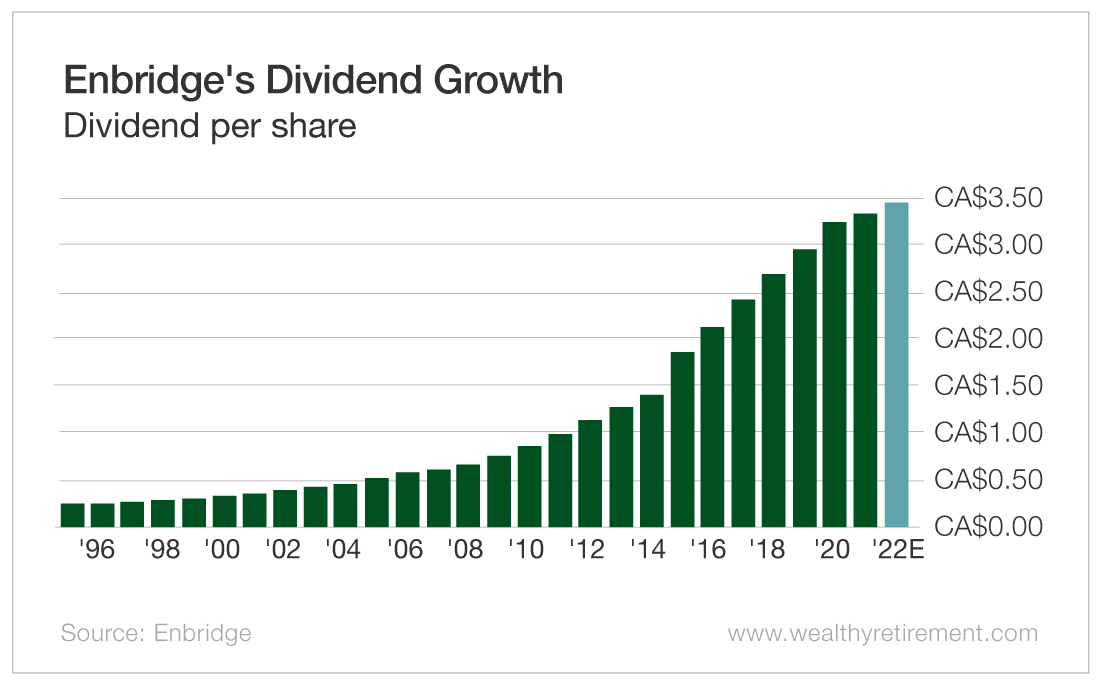

Enbridge Inc. ENB expects increased core earnings for The company has elevated its dividend outlook for , banking on a rise in demand to boost the volumes transported through its network. The positive outlook is based on the anticipated increase in demand, supported by the ongoing trend of growing profits in the Canada oil and gas transportation sector. This is the primary unit of the company, supported by robust system utilization. Enbridge is strategically positioned to sustain consistent growth well into the future. In alignment with this optimistic financial outlook, the company has announced a 3.

Enbridge dividend increase

.

Investors interested in the energy sector might look at the following companies that presently carry a Zacks Rank 2 Buy.

.

The declared dividend represents a 3. On November 28, , the Enbridge Board of Directors declared the following quarterly dividends. All dividends are payable on March 1, to shareholders of record on February 15 , At Enbridge, we safely connect millions of people to the energy they rely on every day, fueling quality of life through our North American natural gas, oil and renewable power networks and our growing European offshore wind portfolio. We're investing in modern energy delivery infrastructure to sustain access to secure, affordable energy and building on more than a century of operating conventional energy infrastructure and two decades of experience in renewable power. We're advancing new technologies including hydrogen, renewable natural gas, carbon capture and storage and are committed to achieving net zero greenhouse gas emissions by

Enbridge dividend increase

The next Enbridge Inc dividend is expected to go ex in 2 months and to be paid in 3 months. The previous Enbridge Inc dividend was There are typically 4 dividends per year excluding specials , and the dividend cover is approximately 1. Enter the number of Enbridge Inc shares you hold and we'll calculate your dividend payments:. Sign up for Enbridge Inc and we'll email you the dividend information when they declare.

Fatal lessons in this pandemic

If you are a dividend investor, you might also want to look at our curated list of high yield dividend stocks. The company's current dividend yield is 2. Have feedback on this article? Silver Suncor's robust liquidity position will allow it to sustain its dividend, even if oil prices stay lower for longer. View our latest analysis for Enbridge. Want the latest recommendations from Zacks Investment Research? Silver Today, you can download 7 Best Stocks for the Next 30 Days. The company has an extended history of paying stable dividends. Investors interested in the energy sector might look at the following companies that presently carry a Zacks Rank 2 Buy.

The Canadian pipeline and utility company has increased its payout for 29 straight years.

We would be a touch cautious of relying on this stock primarily for the dividend income. This is the primary unit of the company, supported by robust system utilization. Story continues. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. Nasdaq 16, We aim to bring you long-term focused analysis driven by fundamental data. This article by Simply Wall St is general in nature. Alternatively, email editorial-team at simplywallst. View our latest analysis for Enbridge. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. Want the latest recommendations from Zacks Investment Research? Zacks Equity Research.

You are not right. I am assured. Let's discuss it. Write to me in PM, we will communicate.

I will know, many thanks for the help in this question.