Etf overlap

Investing can be so rewarding, but also time consuming and stressful.

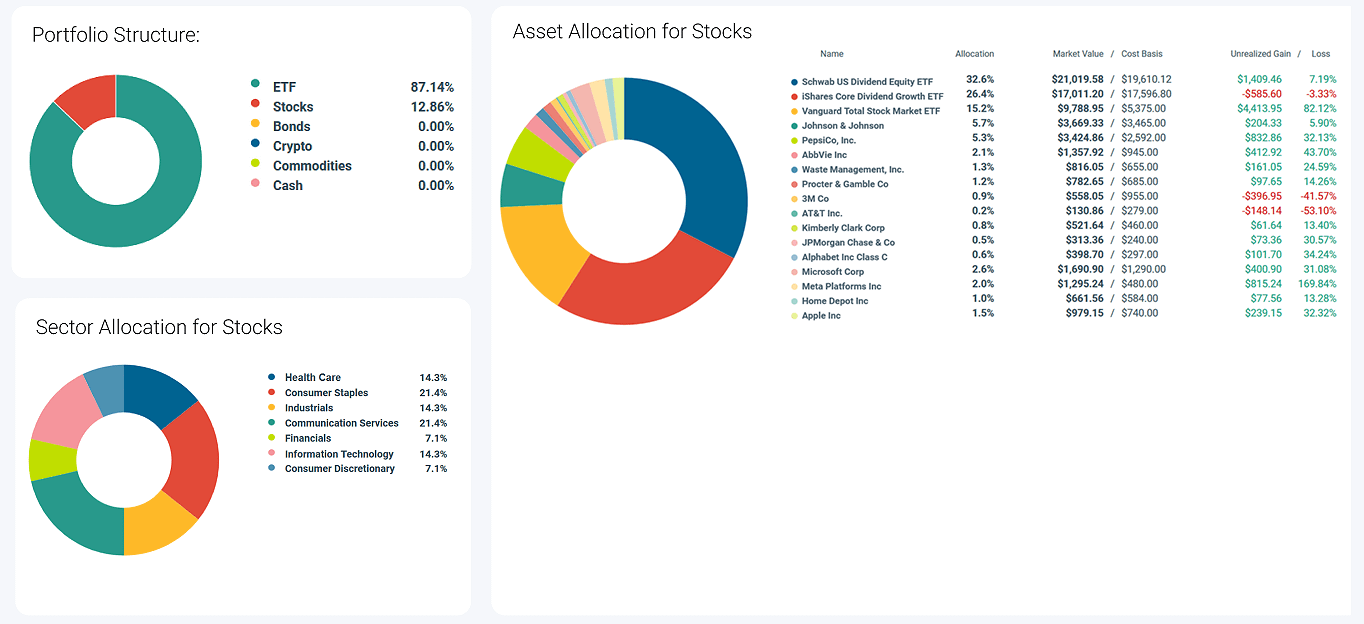

ETF Insider is a data-driven portfolio analytics and optimization platform that introduces a more efficient and practical way to visualize, analyze and optimize portfolios. Rather than focusing on the surface-level attributes of ETFs and Mutual Funds, ETF Insider goes deeper by examining the underlying holdings of exchange traded products. By organizing and structuring that data, investors can easily navigate within their overlapping layers. This innovative perspective combined with modern data visualization and modeling tools, provides an entirely new approach to portfolio optimization that can quickly expose both portfolio inefficiencies and opportunities. Overlapping layers of holdings and derivatives can create an opaque landscape for even the most experienced investors. Because ETFs are composed of multiple underlying assets, the best way to get a true picture of the risk and potential performance of a portfolio is to look into its actual underlying holdings.

Etf overlap

Use limited data to select advertising. Create profiles for personalised advertising. Use profiles to select personalised advertising. Create profiles to personalise content. Use profiles to select personalised content. Measure advertising performance. Measure content performance. Understand audiences through statistics or combinations of data from different sources. Develop and improve services. Use limited data to select content. List of Partners vendors. Fund overlap is a situation where an investor owns shares in several mutual funds or exchange traded funds ETFs with overlapping positions.

Use limited data to select advertising.

.

Forgot your password? Reset it here. You can upload a CSV file with your portfolio holdings here. Email: contact etfinsider. Add Asset: You can add multiple assets at once with the - Add Portfolio button. Add Portfolio. Sign Up. Diagram Settings Enable Zoom:. Show Prices:. Reverse Chart:.

Etf overlap

Use limited data to select advertising. Create profiles for personalised advertising. Use profiles to select personalised advertising. Create profiles to personalise content. Use profiles to select personalised content. Measure advertising performance. Measure content performance. Understand audiences through statistics or combinations of data from different sources.

The trade desk share price

Securities will usually be overweight when a portfolio manager believes that the security will outperform other securities in the portfolio. If, for example, two separate mutual funds both have overweighted the same stock, it might be worth replacing one of the funds with a similar fund that does not carry that stock as a top holding. Related Terms. Actively Managed ETF: Meaning, Overview, Limitations An actively managed ETF is a form of exchange-traded fund that has a manager or team making decisions on the allocation of the underlying investments in the fund. Hope to see you guys succeed and keep up the solid work. Investors can then also use Sharesight's various other reports and tools to benchmark their portfolio against other ETFs or indices, check their diversification by sector, country, and more for building a better-balanced investment portfolio. Uncover Hidden Risks Analyze individual assets to uncover the underlying forces driving fund and index activity. These layers are complex and overlap to form a hierarchical structure that is difficult to interpret if not broken down logically. ETF Insider is a data-driven portfolio analytics and optimization platform that introduces a more efficient and practical way to visualize, analyze and optimize portfolios. Steven Biologist California. Explore each of their components, from asset classes to geographical locations and exchanges, for a comprehensive evaluation of your portfolio. Precision asset allocation. March 6th, Thanks, team!

Investing can be so rewarding, but also time consuming and stressful. Passiv is here to save you time and make investing easy.

Trending Videos. There are a ton of cool ETFs, though. Create a balanced portfolio with Passiv Set your allocations to ensure a diversified portfolio that doesn't overlap, then rebalance when you need to with one click. So, which one should you choose? Explore the wealth of global markets by comparing a diverse range of asset classes from all major international stock exchanges, such as US equities, ETFs, and mutual funds. Overweight is a situation where an investment portfolio holds an excess amount of a particular security when compared to the security's weight in the underlying benchmark portfolio. Steven Biologist California. Buying a new ETF with overlapping drivers can make it seem like an investor is adding diversification when really, they may be just doubling down on the same set of exposures. A Smarter Approach to Investing ETF Insider transforms seemingly chaotic financial data into useful insights with advanced visualization tools. Enhanced Transparency Exchange traded products are constructed of multiple underlying assets in layers.

I am final, I am sorry, but, in my opinion, there is other way of the decision of a question.

It is a pity, that now I can not express - it is very occupied. I will be released - I will necessarily express the opinion on this question.