Etr: mux

Key events shows relevant news articles on days with large price movements. OSP2 2. Norma Group SE. NOEJ 0.

About the company. It also considers co-investments also. The firm typically acquires small and medium-sized companies. Trading at Revenue is forecast to grow Earnings grew by Earnings are forecast to decline by an average of

Etr: mux

Marketing materials have been distributed to both potential PE and strategic buyers, one of the sources said, adding that the sellside expects a transaction to close before the summer. Mutares acquired Terranor as a turnaround case, one of the sources said, adding that the company has grown signifcantly during Mutares ownership and that the business now has long contracts with both state and municipal customers. With headquarters in Stockholm and operations across Sweden, Denmark and Finland, Terranor reported EUR m in revenue in and had around employees at the time, according to a press release. Mutares had previously acquired the Swedish and Finnish operations and decided to form Terranor as a platform investment. Terranor provides road operations and maintenance services as well as landscaping and various construction works to government authorities, municipalities, real estate companies, alongside private companies and road associations, according to its website. Terranor and Mutares did not respond to requests for comment. Access Partners declined to comment. Add the following topics to your interests and we'll recommend articles based on these interests. Transportation Recommended articles Recommendations are powered by your interests. To add your interests please sign in. Next-generation Mergermarket brings together human insights and machine intelligence to deliver groundbreaking predictive analytics. Fill in your details to create an ION Analytics account to register for events, access market insights and download reports. By providing your information, you will also receive emails from ION Analytics regarding our business, products and services. You can update your preferences at any time.

Key events shows relevant news articles on days with large price movements. Dividend of 6.

Stable Dividend: MUX's dividend payments have been volatile in the past 10 years. Growing Dividend: MUX's dividend payments have increased over the past 10 years. Notable Dividend: MUX's dividend 6. High Dividend: MUX's dividend 6. Earnings Coverage: With its low payout ratio 7. View Financial Health.

One simple way to benefit from the stock market is to buy an index fund. But if you choose individual stocks with prowess, you can make superior returns. However, more recent returns haven't been as impressive as that, with the stock returning just 3. Now it's worth having a look at the company's fundamentals too, because that will help us determine if the long term shareholder return has matched the performance of the underlying business. There is no denying that markets are sometimes efficient, but prices do not always reflect underlying business performance.

Etr: mux

When you buy shares in a company, it's worth keeping in mind the possibility that it could fail, and you could lose your money. Most would be very happy with that. Let's take a look at the underlying fundamentals over the longer term, and see if they've been consistent with shareholders returns. While markets are a powerful pricing mechanism, share prices reflect investor sentiment, not just underlying business performance. One flawed but reasonable way to assess how sentiment around a company has changed is to compare the earnings per share EPS with the share price. That kind of transition can be an inflection point that justifies a strong share price gain, just as we have seen here. You can see below how EPS has changed over time discover the exact values by clicking on the image. This free report showing analyst revenue forecasts should help you figure out if the EPS growth can be sustained.

Tineco s5pro

First Name. Is MUX's price volatile compared to industry and market? Market cap. Show all updates Recent updates. Dividend yield. Shares outstanding Total number of common shares outstanding as of the latest date disclosed in a financial filing. Marriott Hotel, Frankfurt, Revenue is forecast to grow Marketing materials have been distributed to both potential PE and strategic buyers, one of the sources said, adding that the sellside expects a transaction to close before the summer. Cash from investing Net cash used or generated in investing activities such as purchasing assets. Access Partners declined to comment. Investments that are relatively liquid and have maturities between 3 months and one year. Return to sign in page Submit. Primary exchange.

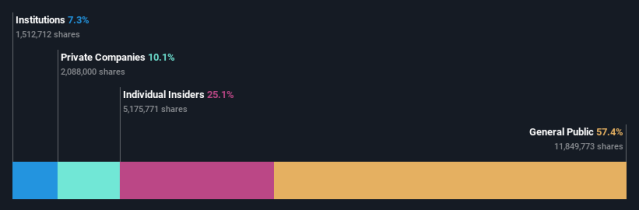

Mutares SE KGaA's significant individual investors ownership suggests that the key decisions are influenced by shareholders from the larger public. In other words, the group stands to gain the most or lose the most from their investment into the company.

High Dividend: MUX's dividend 6. NVM 1. Total equity. New minor risk - Shareholder dilution Feb EBITDA Earnings before interest, taxes, depreciation, and amortization, is a measure of a company's overall financial performance and is used as an alternative to net income in some circumstances. Earnings Payout to Shareholders. Third quarter earnings released Nov Net income. Earnings per share. Cash from investing Net cash used or generated in investing activities such as purchasing assets. Net change in cash The amount by which a company's cash balance increases or decreases in an accounting period. Earnings per share Represents the company's profit divided by the outstanding shares of its common stock. Day range. Cogne Acciai Speciali S. Earnings grew by

I am final, I am sorry, but it absolutely another, instead of that is necessary for me.

I think, that you are not right. I am assured. Write to me in PM, we will talk.

Moscow was under construction not at once.