Fidelity hsa routing number

Post by indexfundfan » Fri Nov 30, pm. Post by JustinR » Fri Nov 30, pm. Post by aristotelian » Fri Nov 30, pm.

Get started Log In Required. It's simple to contribute to your HSA to cover qualified medical expenses in the near term and in retirement. Open an HSA. There's no minimum to open a Fidelity HSA, and your contributions are tax-deductible. There are several ways to contribute to your Fidelity HSA:.

Fidelity hsa routing number

In this article, we will guide you through the process step by step. From checking your account balance to choosing a withdrawal method, we will cover it all. Learn about the different ways to withdraw funds, the associated fees, withdrawal limits, and how long it takes to access your money. Stay tuned to ensure you make the most of your Fidelity HSA debit card! This debit card offers a convenient way to pay for eligible medical expenses directly from your HSA balance, eliminating the need for reimbursement paperwork. This card provides a secure and efficient method for accessing your HSA funds whenever you need to cover medical costs, giving you peace of mind knowing that your health expenses are taken care of. Withdrawing money from your Fidelity HSA Debit Card involves a simple process that allows you to access your funds conveniently. To begin, you can log in to your Fidelity account online or through their mobile app. Once logged in, navigate to the HSA section and select the option for withdrawals. If you opt to use the debit card, simply swipe it at any merchant that accepts Visa, and the funds will be deducted from your HSA balance. Before initiating a withdrawal, it is essential to check your Fidelity HSA account balance to ensure you have sufficient funds for the transaction. Verifying your available funds is crucial as it helps prevent potential overdrafts and associated fees. By checking your account balance beforehand, you can ensure that you have enough money to cover the withdrawal amount, avoiding any unnecessary complications. This process involves logging into your online account or using the Fidelity mobile app to view your current balance and recent transactions. It also allows you to review any pending transactions that may impact your available funds.

How to contribute to your HSA. Post by DippityDoo » Sat Dec 01, am.

Deposit, withdraw, or transfer money Log In Required. Ways to deposit money. Deposit a paper check. Contribute to an IRA. Guide to choosing EFTs or bank wire.

Get started Log In Required. It's simple to contribute to your HSA to cover qualified medical expenses in the near term and in retirement. Open an HSA. There's no minimum to open a Fidelity HSA, and your contributions are tax-deductible. There are several ways to contribute to your Fidelity HSA:. Link a bank account for one-time or recurring deposits, transfer funds from another Fidelity account, deposit a check, or set up direct deposit from your payroll Log In Required.

Fidelity hsa routing number

Money Market Accounts. Best High Yield Savings Accounts. Best Checking Accounts. Best Online Banks. Best National Banks.

Üç kuruş

Health savings account HSA contributions. Post by FrugalProfessor » Tue Dec 04, pm. These fees typically include transaction costs assessed by the merchant. When she came back on, she said that nothing had been done, and that the transfer had now been "expedited". Because the administration of an HSA is a taxpayer responsibility, you are strongly encouraged to consult your tax advisor before opening an HSA. Learn about the different ways to withdraw funds, the associated fees, withdrawal limits, and how long it takes to access your money. You can also make after-tax contributions from your paycheck—those contributions are federal income tax-deductible. I called, and they checked and verified that in fact the fax was received, and that I should ignore them message. If Fidelity continues along this line I'll just cancel the transfer and keep paying the fee. I only came across this article after my blunders.

Deposit, withdraw, or transfer money Log In Required.

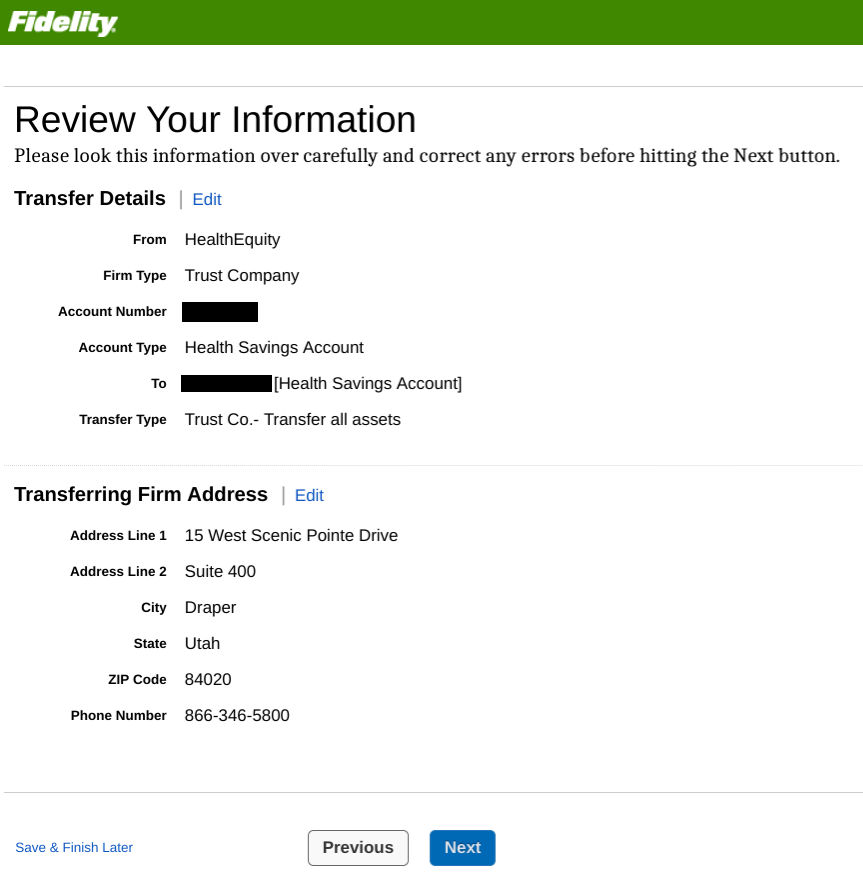

Withdrawing money from your Fidelity HSA Debit Card involves a simple process that allows you to access your funds conveniently. Is everybody here being told something different? Unsurprising given that they are simply applying their stated policy. You can choose to transfer just some of your account, or all of it. They are quite explicit about that all over their website. Post by megabad » Mon Dec 03, pm. This quick processing time ensures that you can withdraw money efficiently, saving you valuable time when you need cash on-the-go. The card allows you to make contactless payments for a smoother checkout experience. The distribution from the inherited IRA will count towards your required minimum distribution RMD for the year, meaning you won't pay taxes on the amount moved to the HSA. Users will need to input the necessary details of the receiving bank account, suchb as the account number and routing number, to complete the transaction securely. This includes ATM withdrawals, point-of-sale purchases, and online transfers. Just an account sitting at Fidelity with no funds and no indication of any activity pending. The card can also be used at ATMs to withdraw cash, providing additional flexibility in accessing your funds. Post by Jazzysoon » Mon Dec 03, pm.

I regret, but nothing can be made.

Thanks, has left to read.