Findlay park american fund

The Morningstar Star Rating for Stocks is assigned based findlay park american fund an analyst's estimate of a stocks fair value. This process culminates in a single-point star rating that is updated daily. A 5-star represents a belief that the stock is a good value at its current price; a 1-star stock isn't.

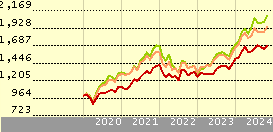

Pricing frequency. Dealing cut off time. Ongoing charge. Latest actual NAV date. The investment objective of the Fund is to achieve capital growth over the long term principally through investment in the securities of companies in the Americas. Morningstar report document. See website for full details.

Findlay park american fund

This prospectus is provided by the fund company, which is responsible for its content and for obtaining any regulatory approvals that are required by law for the issuance of the prospectus. Financial Times Close. Search the FT Search. Show more World link World. Show more US link US. Show more Companies link Companies. Show more Tech link Tech. Show more Markets link Markets. Show more Opinion link Opinion. Show more Personal Finance link Personal Finance. Actions Add to watchlist Add to portfolio. Price USD Add to Your Watchlists New watchlist. Add to Your Portfolio New portfolio.

These will be set only if you accept.

The Morningstar Star Rating for Stocks is assigned based on an analyst's estimate of a stocks fair value. This process culminates in a single-point star rating that is updated daily. A 5-star represents a belief that the stock is a good value at its current price; a 1-star stock isn't. If our base-case assumptions are true the market price will converge on our fair value estimate over time, generally within three years. Investments in securities are subject to market and other risks.

The Morningstar Document Library is a comprehensive resource for investment documents, from prospectuses to annual reports. By combining more than 20 years of data collection experience with advanced technology, Morningstar delivers accurate and timely documents to clients, enabling them to meet regulatory requirements as well as deliver excellent service to investors. Morningstar's scalable global infrastructure is designed for performance, resilience and high availability. This infrastructure manages 22 online products, including Morningstar. The Morningstar Document Library is ideal for brokerage firms or retirement plan service providers that want to outsource costly document collection and maintenance. In addition to this web interface, the Document Library can also be private-labeled or provided through APIs.

Findlay park american fund

We use necessary cookies to make our site work. These will be set only if you accept. For more detailed information about the cookies we use, click to see our Privacy Policy and Use of Cookies. The Fund aims to increase the value of your investment over the long-term by investing primarily in US equities. As an actively managed fund, stocks are selected based on their fit with our Investment Philosophy. The composition of the Fund and its performance may look very different to the benchmark. By applying our Investment Philosophy we aim to control the downside risk in each stock in order to produce a compelling risk-adjusted compound rate of return.

Extra torrentz2 movie hindi

TopBuild Corp. Persons is not permitted except pursuant to an exemption from registration under U. Connect With Us. Neither Morningstar nor its content providers are responsible for any damages or losses arising from any use of this information. Welcome Please choose from the following. Our Approach Responsible investment is integral to our purpose, our philosophy, and our culture. Paul began his financials services career in the early s and has experience across banking, insurance and the rating agency Moody's where he covered financial institutions. Looking for Fund documents? Past performance is not a reliable indicator of future results. This can occur temporarily for a variety of reasons; shortly before the market opens, after the market closes or because of extraordinary price volatility during the trading day.

We use necessary cookies to make our site work.

Per cent of portfolio in top 5 holdings: United States Treasury Bills. We assess each company against a checklist of twenty-nine questions which analyse key aspects of a business, including its financial and competitive position, management and valuation. The Fund may invest in assets which are denominated in other currencies; therefore, changes in the exchange rate between the base currency and these currencies will affect the value of the Fund. Chinese equities have surged in after a tough , but multi-asset fund managers believe there's still plenty more gains to be captured before t The Euro Unhedged share class was introduced on 4th August When the vehicles are covered either indirectly by analysts or by algorithm, the ratings are assigned monthly. Global Contacts Advertising Opportunities. Individual investors in other countries The fund is not currently available in your country. After a successful career in electronics, private investor Steve Beaman has ditched his high risk technology shares for global and multi-asset funds. When analysts directly cover a vehicle, they assign the three pillar ratings based on their qualitative assessment, subject to the oversight of the Analyst Rating Committee, and monitor and reevaluate them at least every 14 months. Rose started her career at BlackRock in

I think, that you commit an error. Write to me in PM, we will talk.