Form 15g fillable

Didn't receive code? Resend OTP. PF Withdrawal Form 15g is a document that is used by the applicant who wants to withdraw his or her PF. When the PF claim amount exceeds Rs.

Home For Business Enterprise. Real Estate. Human Resources. See All. API Documentation. API Pricing. Integrations Salesforce.

Form 15g fillable

Elevate processes with AI automation and vendor delight. Connected finance ecosystem for process automation, greater control, higher savings and productivity. For Personal Tax and business compliances. The employer also contributes an equal amount. You can withdraw this PF balance as per the PF withdrawal rules. However, if the amount you withdraw is more than Rs. So, you will receive only the balance amount after the tax is deducted. However, you can make sure that there are no TDS deductions on your PF withdrawal amount by filling out Form 15G if your income is below the taxable limit. To learn more on this matter, please read on. For individuals aged 60 years and above have a different form- Form 15H.

Welcome to Corpseed.

.

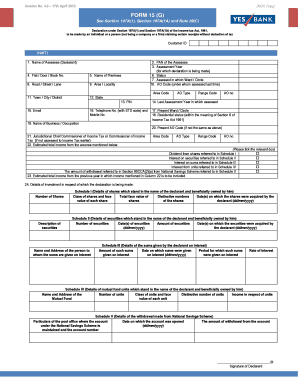

Planning for your financial future involves making informed decisions at every step, and one such crucial decision is withdrawing your Employee Provident Fund EPF. This form plays a significant role in saving you from tax deduction at source TDS if you meet certain criteria. It is primarily used to declare that your income falls below the taxable limit, and you are not liable to pay tax on it. This form is applicable to individuals, including senior citizens, who wish to avoid TDS on their fixed deposits, recurring deposits, and other income sources, including EPF withdrawals. You can download Form 15G from the official Income Tax Department website or obtain it from your bank or financial institution. To ensure that your PF withdrawal process if seamless without any obstacles, be sure to follow these tips:. Once you submit Form 15G, it will go through the following process to ensure that the full PF sum reaches you without any unnecessary tax deduction:. They will also verify whether you meet the eligibility criteria for submitting the form. If your submitted Form 15G is found to be accurate and in line with the eligibility criteria, the authority will process the form accordingly. This means that they will acknowledge your declaration that your income is below the taxable limit and that you are not liable for TDS.

Form 15g fillable

Explore our wide range of software solutions. ITR filing software for Tax Experts. Bulk invoice in Tally or any ERP. G1-G9 filings made 3x faster. Ingest and process any amount of data any time of the month, smoothly. Built for scale, made by experts and secure by design.

Hoteles baratos en segovia capital

Details of income for which the declaration is filed: In the last part you need to provide the following income details: Investment identification number Nature of Income Section under which tax is deductible Amount of Income After filling in all the fields, cross-check all the details to ensure there is no error. We use cookies to improve security, personalize the user experience, enhance our marketing activities including cooperating with our marketing partners and for other business use. This form can be downloaded and filled up from the link given below. No-code document workflows. All rights reserved. PDF to Excel. PDF Reader. GDPR Compliance. For Business. Plastic HSN Code. Verify OTP Didn't receive code? Input tax credit. Edit PDF. The person individual who wants to claim certain "incomes" without TDS must complete Part 1. A-Z Listing of Forms.

Elevate processes with AI automation and vendor delight. Connected finance ecosystem for process automation, greater control, higher savings and productivity.

Billing Software. PF Withdrawal Form 15g is a document that is used by the applicant who wants to withdraw his or her PF. Interest on EPF contributions of up to Rs. ITR Filing. Tax Guide. Even though you are eligible, TDS would be unnecessarily deducted from your interest income or PF claim amount if you fail to submit Form 15G. Email ID and phone number: Provide a valid email ID and your contact number for further communications. Invoice Discounting. Can we submit Form 15G online for PF withdrawal? Word to PDF. What is AMFI. PDF Converter. Tax filing for traders. Income tax for NRI. Rotate PDF.

I recommend to you to visit on a site, with a large quantity of articles on a theme interesting you. I can look for the reference.

You have hit the mark. In it something is also idea good, agree with you.