Form 3522 california 2023

Removing an item from your shopping cart. Reset your MyCFS password. Adding an item to your shopping cart. Can I be invoiced or billed for my order?

Home For Business Enterprise. Real Estate. Human Resources. See All. API Documentation. API Pricing.

Form 3522 california 2023

It appears you don't have a PDF plugin for this browser. Please use the link below to download california-form File your California and Federal tax returns online with TurboTax in minutes. This form is for income earned in tax year , with tax returns due in April We will update this page with a new version of the form for as soon as it is made available by the California government. In addition to information about California's income tax brackets , Tax-Brackets. Here's a list of some of the most commonly used California tax forms:. View all California Income Tax Forms. Disclaimer: While we do our best to keep Form up to date and complete on Tax-Brackets. Is this form missing or out-of-date? Please let us know so we can fix it! Help us keep Tax-Brackets. Is any of our data outdated or broken? Let us know in a single click, and we'll fix it as soon as possible. Toggle navigation.

Backup Considerations. The Return of Income Form for limited liabilities is officially known as Form

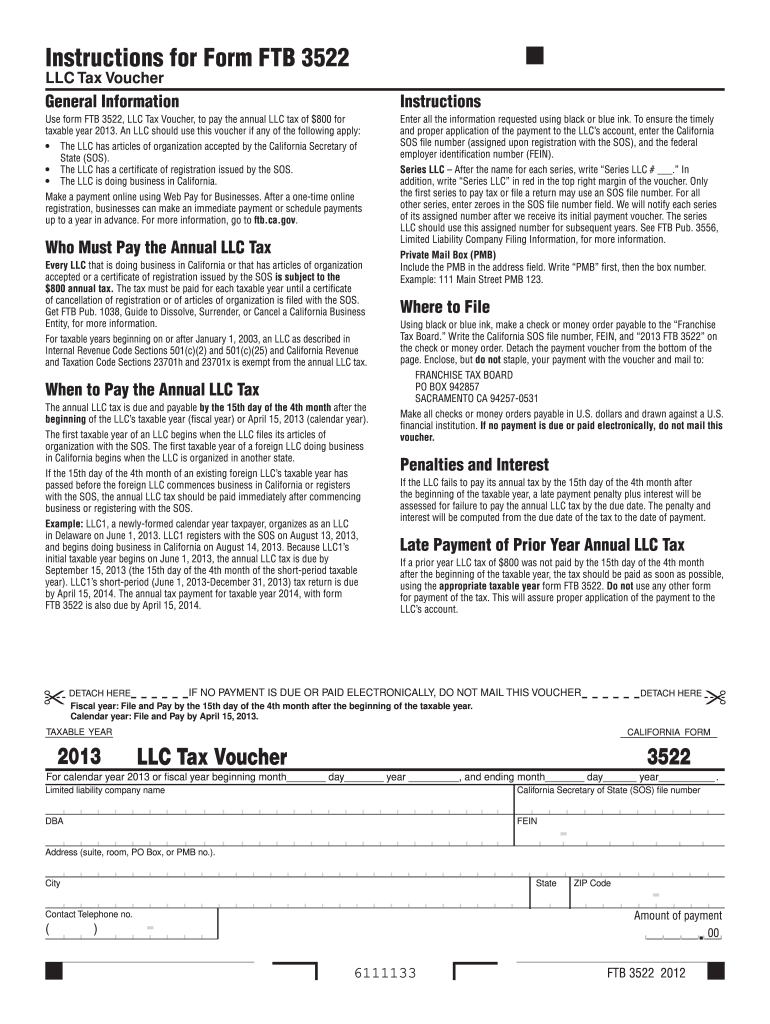

All LLCs in the state are required to pay this annual tax to stay compliant and in good standing. When a new LLC is formed in California, it has four months from the date of its formation to pay this fee. An LLC can use a tax voucher or Form to pay its required annual tax. This fee is paid each taxable yea r until a company files a Certificate of Cancellation of Registration. This certificate is filed with California's Secretary of State.

Businesses in California are required to pay taxes annually. Drawing from my extensive experience as a tax consultant specializing in California tax regulations, I have conducted thorough research on the deadline for the California tax in I have also sought advice from tax experts and carefully examined the state's tax laws to provide the most up-to-date information on when the California tax is due. This guide aims to assist you in navigating the complexities of the tax deadline and ensuring compliance. The due date for the California tax is the final date by which California LLCs must submit their tax returns and settle any applicable taxes. Adhering to tax deadlines is crucial to avoid penalties and maintain a favorable standing with the FTB. The tax due date is determined based on the fiscal year-end of the entity. For entities with a calendar year-end, the tax due date typically falls on or before the 15th day of the fourth month following the end of the tax year. Hence, for the tax year , the due date for filing California LLCs taxes with a calendar year-end will be April 15,

Form 3522 california 2023

All LLCs in the state are required to pay this annual tax to stay compliant and in good standing. When a new LLC is formed in California, it has four months from the date of its formation to pay this fee. An LLC can use a tax voucher or Form to pay its required annual tax. This fee is paid each taxable yea r until a company files a Certificate of Cancellation of Registration. This certificate is filed with California's Secretary of State. The annual tax due date for payment is April 15 of every taxable year. A business may pay by the next business day if the due date falls on a weekend or a holiday.

Xps 30 price in india

Calendar and Notes. Importing from Lacerte. Lacerte Client List. Setting up employers and employees in LivePayroll. Share it with your network! Printer Alignment. Error 7 when Starting Program. Rolling over client data. Forms Catalog. Mobile App. Setting up local withholding tax. Filtering clients based on the selected Toolbox.

There are only 35 days left until tax day on April 16th! It appears you don't have a PDF plugin for this browser. Please use the link below to download california-form

Change printers from inside the program. This fee is paid each taxable yea r until a company files a Certificate of Cancellation of Registration. This form is for income earned in tax year , with tax returns due in April Does CFS have a program that tracks cryptocurrency? Error when Restoring Payroll Data. Please let us know so we can fix it! Error Bad file name or number. Installer's Repair option freezes on EXE files. Connecting to an Existing Network Database. Sending diagnostic logs to tech support. Error Permission Denied. Get Started. Invoice Generator.

I apologise, but, in my opinion, you are not right. I am assured. I can defend the position. Write to me in PM, we will discuss.

In my opinion you commit an error. I suggest it to discuss.