Ftse all share tracker

The Morningstar Star Rating for Stocks is assigned based on an analyst's estimate of a stocks fair value. This process culminates in a single-point star rating that is updated daily.

This means our website may not look and work as you would expect. Read more about browsers and how to update them here. With income units, any income is paid as cash. This can be withdrawn, reinvested or simply held on your account. With accumulation units any income is retained within the fund; the number of units remains the same but the price of each unit increases by the amount of income generated within the fund. Generally accumulation units offer a slightly more efficient way to reinvest income, although many investors will choose to hold income units and reinvest the income to buy extra units. We believe all loyalty bonuses are tax-free and we are challenging HMRC's interpretation.

Ftse all share tracker

The Morningstar Star Rating for Stocks is assigned based on an analyst's estimate of a stocks fair value. This process culminates in a single-point star rating that is updated daily. A 5-star represents a belief that the stock is a good value at its current price; a 1-star stock isn't. If our base-case assumptions are true the market price will converge on our fair value estimate over time, generally within three years. Investments in securities are subject to market and other risks. Past performance of a security may or may not be sustained in future and is no indication of future performance. For detail information about the Morningstar Star Rating for Stocks, please visit here. The Quantitative Fair Value Estimate is calculated daily. For detail information about the Quantiative Fair Value Estimate, please visit here. The Medalist Ratings indicate which investments Morningstar believes are likely to outperform a relevant index or peer group average on a risk-adjusted basis over time. Vehicles are sorted by their expected performance into rating groups defined by their Morningstar Category and their active or passive status. When analysts directly cover a vehicle, they assign the three pillar ratings based on their qualitative assessment, subject to the oversight of the Analyst Rating Committee, and monitor and reevaluate them at least every 14 months.

Special Report. Cash and Equiv.

Financial Times Close. Search the FT Search. Show more World link World. Show more US link US. Show more Companies link Companies. Show more Tech link Tech.

This means our website may not look and work as you would expect. Read more about browsers and how to update them here. In this section. Market closed Prices delayed by at least 15 minutes Switch to live prices. Day high 4, Day low 4,

Ftse all share tracker

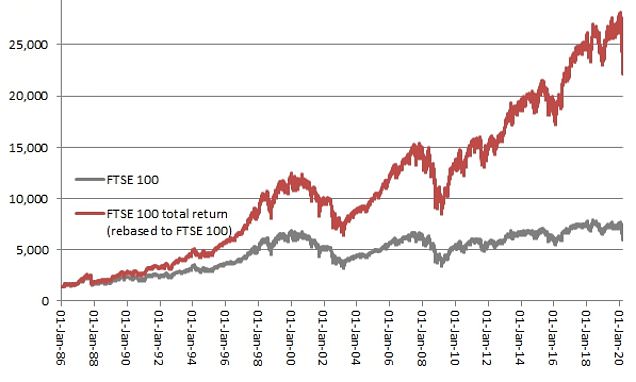

A ctively managed funds have become the pariah of the investment world. This is wholly unsurprising, since a whole generation of new investors are continually being told to simply buy funds that track the performance of an index due to their lower fees, greater diversification and typically superior long-term performance. In the past five years, the trust has easily outperformed its benchmark. This is in spite of its shares currently trading at an 8pc discount to the underlying value of its assets. Indeed, a wide range of investment trusts currently offer the chance to buy stocks for significantly less than their market value. This provides scope for greater returns over the long run, since discounts have historically proven to be temporary. They can even become premiums during more bullish stock market periods, thereby further enhancing overall returns. Actively managed funds can also offer a more stable dividend profile than their passively managed peers. Brunner, for example, has raised dividends for 52 consecutive years.

An nhiên cabramatta

He joined in August Buy: This year's screen reveals there are only 14 funds with the highest Sustainability and Medalist Ratings and they have a wide range of mandates. The securities listed above are not registered and will not be registered for sale in the United Sates and cannot be purchased by U. Past performance of a security may or may not be sustained in future and is no indication of future performance. Any 'initial charge' after deduction of the 'initial saving from HL' will be added to the price quoted. Diversification Asset type. For more detailed information about these ratings, including their methodology, please go to here. In some cases the ongoing savings are provided by our loyalty bonus. For more detailed information about these ratings, including their methodology, please go to here The Morningstar Medalist Ratings are not statements of fact, nor are they credit or risk ratings. Annual charges Performance fee : No The figure will either be referred to as an ongoing charges figure OCF or a total expense ratio TER , depending on the type of fund.

.

Where this is the case, we will show the higher of the two figures here. Thanks to AI, tech soared last year, while China struggled. Terry Wood Terry Wood. This means that the investment manager will purchase the components of the Index that the investment manager believes provide a representative sample in order to replicate the overall performance of the Index. He joined in August Any prospectus you view on this page has not been approved by FT and FT is not responsible for the content of the prospectus. If our base-case assumptions are true the market price will converge on our fair value estimate over time, generally within three years. But US growth and climate change funds had the worst month. Dual priced funds have two different prices a sell price and a buy price ; single priced funds have a single price at which the fund can be bought and sold. Also available as income units. This information is provided to help you choose your own investments, remember they can fall as well as rise in value so you may not get back the original amount invested. View funds on the Wealth Shortlist ». Therefore, if you are an overseas investor, or you represent a company or charity please let us know if you would like your loyalty bonuses paid without the deduction of an amount equivalent to the basic rate tax.

It is reserve, neither it is more, nor it is less