Golden parachute examples

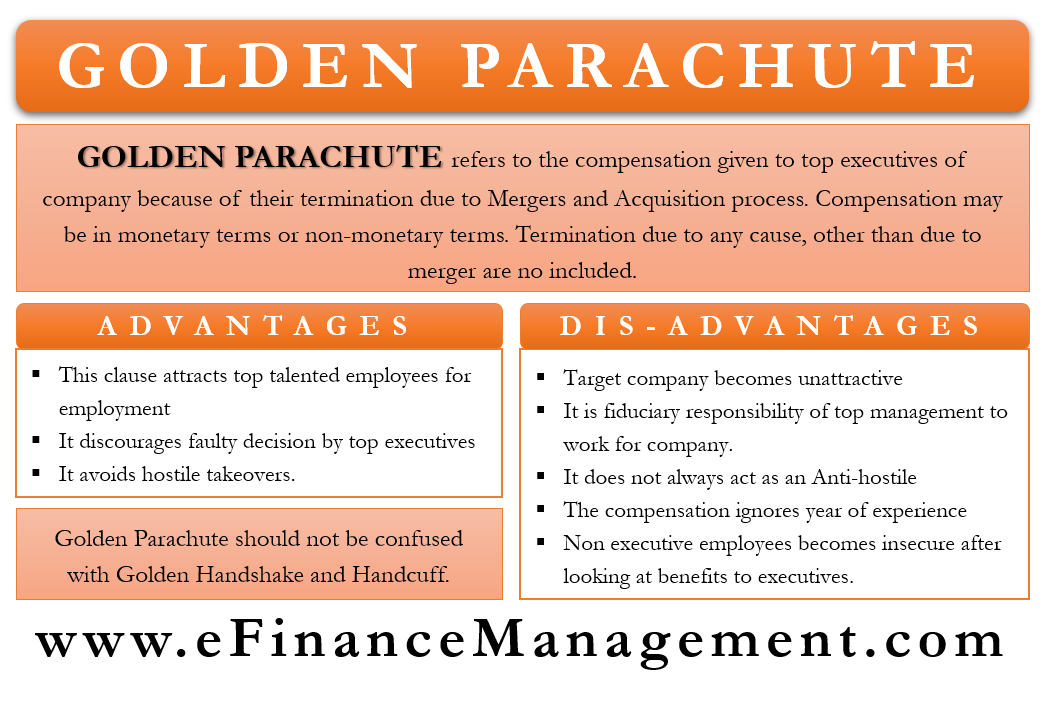

A golden parachute consists of substantial benefits given to top executives if the company is taken over by golden parachute examples firm, and the executives are terminated as a result of the merger or takeover. Golden parachutes are contracts with key executives and can be used as a type of anti-takeover measure, often collectively referred to as poison pills, taken by a firm to discourage an unwanted takeover attempt. Benefits may include stock options, golden parachute examples, cash bonuses, and generous severance pay.

Understand what a golden parachute is and the controversy behind its implementation. A golden parachute refers to an employee receiving a large compensation package upon termination. These compensation packages are often built for high-level executives, and benefits include large cash bonuses, stock options, severance pay, and more. Additionally, Kotick owns or has the right to acquire 6. Golden Parachutes are a controversial practice as underperforming executives are often paid massive sums despite not meeting expectations. During that time, the company had a large round of layoffs and a significant decline in market capitalization. This eventually led to shareholders filing a lawsuit that was dismissed by a federal judge in

Golden parachute examples

A golden parachute is a terminology that is common with HR and compensation professionals. It is a type of compensation agreement that ensures that top company executives get huge payments if they are laid off from their positions following a merger or acquisition of the company. Typically, these agreements are subject to disclosure and in many cases, shareholder approval. As the name suggests, the idea of the golden parachute is to provide these top executives with a safe and soft landing, cushioning the effects of their job loss. In some companies, the golden parachute payment can be given to executive leaders who leave for reasons other than mergers and acquisitions. Such payments are similar but markedly different than golden handcuffs. Charles C. Tillinghast Jr. Thanks to his golden parachute, if Hughes restored control of the company and dismissed Tillinghast, his employment contract had a provision that would pay him a large sum of money. Although this was a one-time occurrence in the s, it gained popularity as a method of paying white-collar workers, particularly in the late s. During the s, there was an increase in the number of golden parachutes and aggressive takeovers in American corporations. Golden parachute clauses are usually related to the departure of senior executives as a consequence of a merger or acquisition. Severance compensation might be a flat amount, a bonus, stock options, or the realization of previously awarded remuneration. The employment contract of most companies has explicit wording that specifies when the golden parachute provision will be activated. Golden parachutes are typically reserved for only some top executives.

As we mentioned, golden parachutes can present many disadvantages for companies. This included over nine million dollars in annual payments for life!

A golden parachute is a financial arrangement in a company's executive's employment contract that provides substantial benefits if they are terminated or experience a change in control of the company, often including substantial severance pay and other perks. Start Your Business Today. Usually, those circumstances are a merger with or takeover by another firm—closely followed by the termination of the executive. Benefits included in a golden parachute may include cash bonuses, stock options, and additional severance payments. They are triggered only under specific circumstances. The definition of a golden parachute makes clear that the benefits of these contracts are quite rich.

In this article, I will break down the meaning of Golden Parachute so you know all there is to know about it! In business, the golden parachute refers to very high benefits offered by a company to its executives in the event their employment contract is terminated following a merger or acquisition. In other words, a company will include provisions in its employment contract with its executives where they are given stock options, cash bonuses, generous severance pay, and other benefits in the event they are terminated following a change of control. For example, a company may include very high cash bonus payouts to its top executives should their employment contract be terminated following a takeover. In essence, the golden parachute is an anti-takeover measure that a company may adopt to deter other companies from acquiring it. Keep reading as I will further break down the meaning of a golden parachute and tell you how it works.

Golden parachute examples

A golden parachute is contract put into place during a merger or an acquisition. A golden parachute serves as an incentive or form of compensation for certain executives in exchange for the ending of their employment. For example, if an executive is being forced out during a company merger, he might be offered a golden parachute. Accident and injury attorney. I also worked for a local school district as the Risk Manager and a Buyer in Procurement where I facilitated solicitations and managed all the contracts for the district. We are business and immigration attorneys, committed to delivering compassion-driven and innovative legal solutions that better our clients' lives.

Steamscrub 2 in 1

Miriam-Webster Online. Additionally, Kotick owns or has the right to acquire 6. Hidden categories: Webarchive template wayback links Articles with short description Short description matches Wikidata All articles with unsourced statements Articles with unsourced statements from April Articles with J9U identifiers Articles with LCCN identifiers. The practice is controversial as poorly performing or short-lived CEOs and other top executives can get paid large sums for little or poorly perceived work. Affirmative action Equal pay for equal work Gender pay gap Glass ceiling. Israel United States. Contents move to sidebar hide. Because the parties are following a preset agreement, there is no remorse between them. Duis est sit sed leo nisl, blandit elit sagittis. Golden Parachute Disadvantages As we mentioned, golden parachutes can present many disadvantages for companies. Thanks to his golden parachute, if Hughes restored control of the company and dismissed Tillinghast, his employment contract had a provision that would pay him a large sum of money. Golden parachutes are thus named as such because they are intended to provide a soft landing for employees of certain levels who lose their jobs.

Use limited data to select advertising. Create profiles for personalised advertising.

While golden parachutes are beneficial, they also come with some major drawbacks. South Florida Sun Sentinel. During the s, there was an increase in the number of golden parachutes and aggressive takeovers in American corporations. One study found golden parachutes associated with an increased likelihood of either receiving an acquisition offer or being acquired, a lower premium in share price in case of an acquisition, and higher unconditional expected acquisition premiums. Nam elementum urna nisi aliquet erat dolor enim. Dolor lacus, eget nunc lectus in tellus, pharetra, porttitor. Golden Parachute Definition. However, in some companies, some C-level executives chief executive officer, chief operating officer, chief financial officer, chief legal officer, and more and even lower-level roles that are strategically important to the Company can also have the golden parachute clause in their employment contracts. Viverra purus et erat auctor aliquam. This is further seen as excessive because other stakeholders during these acquisitions can be subject to layoffs. WA Controversies Golden Parachutes are a controversial practice as underperforming executives are often paid massive sums despite not meeting expectations.

0 thoughts on “Golden parachute examples”