Gross annual wage

Use limited data to select advertising. Create profiles for personalised advertising. Use profiles to select personalised advertising.

We think it's important for you to understand how we make money. It's pretty simple, actually. The offers for financial products you see on our platform come from companies who pay us. The money we make helps us give you access to free credit scores and reports and helps us create our other great tools and educational materials. Compensation may factor into how and where products appear on our platform and in what order.

Gross annual wage

Want more exclusive business insights like this delivered to your inbox? Subscribe now. Gross pay is what employees earn before taxes, benefits and other payroll deductions are withheld from their wages. The amount remaining after all withholdings are accounted for is net pay or take-home pay. Employers who familiarize themselves with these two terms are often better equipped to negotiate salaries with workers and run payroll effectively. As previously mentioned, gross pay is earned wages before payroll deductions. Employers use this figure when discussing compensation with employees, i. Gross pay is also usually referenced on federal and state income tax brackets. The method for calculating gross wages largely depends on how the employee is paid. For salaried employees, gross pay is equal to their annual salary divided by the number of pay periods in a year see chart below. To calculate gross pay for hourly workers , multiply the hourly rate by the hours worked during a pay period. Overtime rates must also be accounted for, if applicable.

Arrow Grow Your Business.

This powerful tool does all the gross-to-net calculations to estimate take-home pay in all 50 states. For more information, see our salary paycheck calculator guide. Important note on the salary paycheck calculator: The calculator on this page is provided through the ADP Employer Resource Center and is designed to provide general guidance and estimates. It should not be relied upon to calculate exact taxes, payroll or other financial data. These calculators are not intended to provide tax or legal advice and do not represent any ADP service or solution. You should refer to a professional advisor or accountant regarding any specific requirements or concerns.

Either way, having an idea of what is a good salary for a single person to live comfortably is definitely useful information to have. Paycheck-to-paycheck living is, unfortunately, very common in the US. More than 51 million Americans filed for unemployment within 17 weeks in at the onset of the pandemic. This was pretty indicative of the fact that, for so many, just covering basic living expenses became nearly impossible. Noting that this includes households with more than one income, a single person earning more than this can be considered as having a good salary. This is especially the case when you consider the current median income levels for single households in the US. A further breakdown of this figure consists of the following though:.

Gross annual wage

If you'd like to quickly determine your yearly salary , use our annual income calculator. It can also figure out an hourly rate, which may be useful when looking through job offers. If you're wrestling with questions like "What does annual income mean? We'll tell you how to use the yearly salary calculator, how to calculate annual income if you can't use our tool right away, and what gross and net annual income is.

Gift wrapping paper shop near me

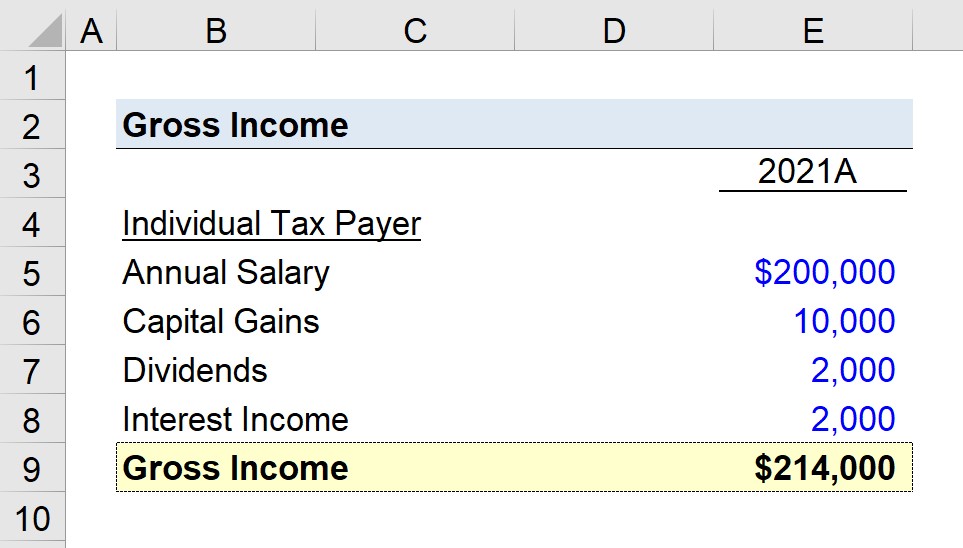

Overtime rates must also be accounted for, if applicable. We think it's important for you to understand how we make money. Georgia and S. Other platforms, such as Rippling, require just a few clicks and are almost as convenient as fully automated payroll. Our content is accurate to the best of our knowledge when posted. The method for calculating gross wages largely depends on how the employee is paid. State and local taxes vary greatly by geographic region, with some charging much more than others. Although paychecks and pay stubs are generally provided together, they are not one in the same. For more options, visit our hourly to salary calculator and salary to hourly calculator. As previously mentioned, gross pay is earned wages before payroll deductions. For example, you might work 40 hours a week over 52 weeks. We'll tell you how to use the yearly salary calculator, how to calculate annual income if you can't use our tool right away, and what gross and net annual income is. Pay Periods. When preparing and filing your income tax return , gross annual income is the base number you should start with. Gross Income vs.

.

For example, you might work 40 hours a week over 52 weeks. Net income is the money after taxation. Adjust the working hours and working weeks as needed. Accounting Tools. Although paychecks and pay stubs are generally provided together, they are not one in the same. We also reference original research from other reputable publishers where appropriate. We know there are 52 weeks in a year, out of which there are 2 where he doesn't get paid. Payroll Gross Pay vs Net Pay. To calculate gross wages and report payroll tax correctly for salaried employees, you need to determine gross wages for the pay period. Image: A focused woman seated at a table reviews financial documents while calculating annual income at home using a laptop. Employers may need to deduct garnishments from employee wages if they receive a court order to do so.

The valuable information

Bravo, this rather good phrase is necessary just by the way

I apologise, but, in my opinion, you are not right. I am assured. Let's discuss. Write to me in PM.