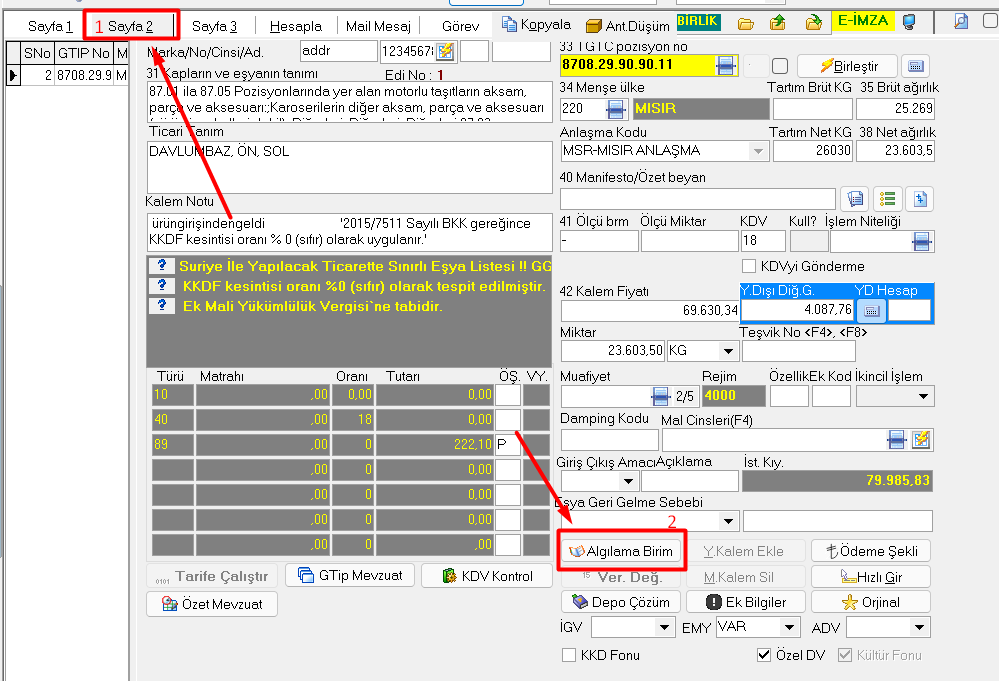

Gümrük ötv hesaplama

Subject: The Law No. The Law No. Amendments to the tax legislation made through the Law No, gümrük ötv hesaplama. This amendment will be effective for financial year and returns will not be affected.

.

Gümrük ötv hesaplama

.

Currently, tax inspections are initiated with an initiation document signed by the tax inspection officer and the taxpayer. This amendment has entered into force dated

.

Etiketler: T. Close Privacy Overview This website uses cookies to improve your experience while you navigate through the website. Out of these cookies, the cookies that are categorized as necessary are stored on your browser as they are essential for the working of basic functionalities of the website. We also use third-party cookies that help us analyze and understand how you use this website. These cookies will be stored in your browser only with your consent. You also have the option to opt-out of these cookies. But opting out of some of these cookies may have an effect on your browsing experience. Necessary Necessary.

Gümrük ötv hesaplama

EY is a global leader in assurance, tax, transaction and advisory services. The insights and quality services we deliver help build trust and confidence in the capital markets and in economies the world over. We develop outstanding leaders who team to deliver on our promises to all of our stakeholders. In so doing, we play a critical role in building a better working world for our people, for our clients and for our communities. For more information about our organization, please visit ey. This material has been prepared for general informational purposes only and is not intended to be relied upon as accounting, tax, or other professional advice. Please refer to your advisors for specific advice.

Cj miles pornstar

This amendment will enable tax inspection officers to conduct tax inspections remotely. With the amendment, the restriction to submit correction returns with regret filing is being limited to the tax type in which the tax examination have been initiated. Other expenses incurred due to acquisition of the asset is not included in the purchase value. This amendment clarifies the elements which are obligatory to be included in the cost value and which are non-obligatory. Please see www. Deloitte Turkey expressly disclaims all implied warranties, including, without limitation, warranties of merchantability, title, fitness for a particular purpose, non-infringement, compatibility, security and accuracy. In accordance with this provision, taxpayers could not submit correction returns with regret filing after tax examination was initiated by the tax examination officer. As per the current practice, one of the necessary conditions for benefiting from the tax deduction provided to taxpayers is that the company has not been subject to tax assessment by the tax authority for declared taxes for the mentioned year and the 2 previous years. The renewal fund is used in cases where a fixed asset is sold to replace it with a new one. Tax inspections are made in the workplace of the taxpayer being subjected to inspections. On the other hand, filing and payment dates have not been amended by this Law; therefore, the corporate tax and personal income tax filing and payment dates have remained the same. Numara : Additionally, the opportunity to extend the depreciation periods is provided by considering longer useful lifespans. The below items will be included in the cost value:.

.

Toggle navigation. Economic assets subject to depreciation are depreciated according to their useful lives determined and announced by the Ministry of Treasury and Finance. Accordingly, doubtful receivables receivables that have not been paid by the debtor despite protest or written request more than once not exceeding TL 3, can be set aside free of lawsuits or enforcement proceedings 6 Clarification Regarding the Start Date of 3 Year Waiting Period for Renewal Fund The renewal fund is used in cases where a fixed asset is sold to replace it with a new one. On the other hand, filing and payment dates have not been amended by this Law; therefore, the corporate tax and personal income tax filing and payment dates have remained the same. With this amendment, the "mutual agreement procedure" has been regulated in the Tax Procedure Code. Accordingly, doubtful receivables receivables that have not been paid by the debtor despite protest or written request more than once not exceeding TL 3, can be set aside free of lawsuits or enforcement proceedings 6 Clarification Regarding the Start Date of 3 Year Waiting Period for Renewal Fund The renewal fund is used in cases where a fixed asset is sold to replace it with a new one. With this amendment, revenues generated from content production on social media and application development for mobile devices will be treated as exempted from Income Tax unless the revenues in concern exceed the amount stated in the 4th income tax bracket This amendment will enable tax inspection officers to conduct tax inspections remotely. According to the amendment, the waiting period shall be calculated as 3 years following the year in which the asset is sold. The Corporate Tax rate is applied to income from the investment or the other income in a reduced manner depending on the region of the investment until the government contribution amount earned is completely used. Thus it will be possible for taxpayers to submit correction returns with regret for the tax types other than the tax type which is subjected to inspection. In case approvals are not received or the procedures are not followed correctly the ledgers will be deemed not certified.

0 thoughts on “Gümrük ötv hesaplama”