Hedgeye twitter

Tale of the tape: Hedgeye is an investment research hedgeye twitter that has evolved into a producer of its own online media content.

The information contained herein is the property of Hedgeye, which reserves all rights thereto. Redistribution of any part of this information is prohibited without the express written consent of Hedgeye. Hedgeye is not responsible for any errors in or omissions to this information, or for any consequences that may result from the use of this information. Fireside Chats and written reports from industry professionals ranging from C-level executives, private companies and advertising agencies. Get latest insights in mobile app download data and proprietary industry surveys. Covering over names across the internet, media and telecom industry. Our bi-month proprietary scorecard fuses sell-side and buy-side sentiment with valuation and price, and is designed to serve as both a risk management tool and contrarian resource for idea generation.

Hedgeye twitter

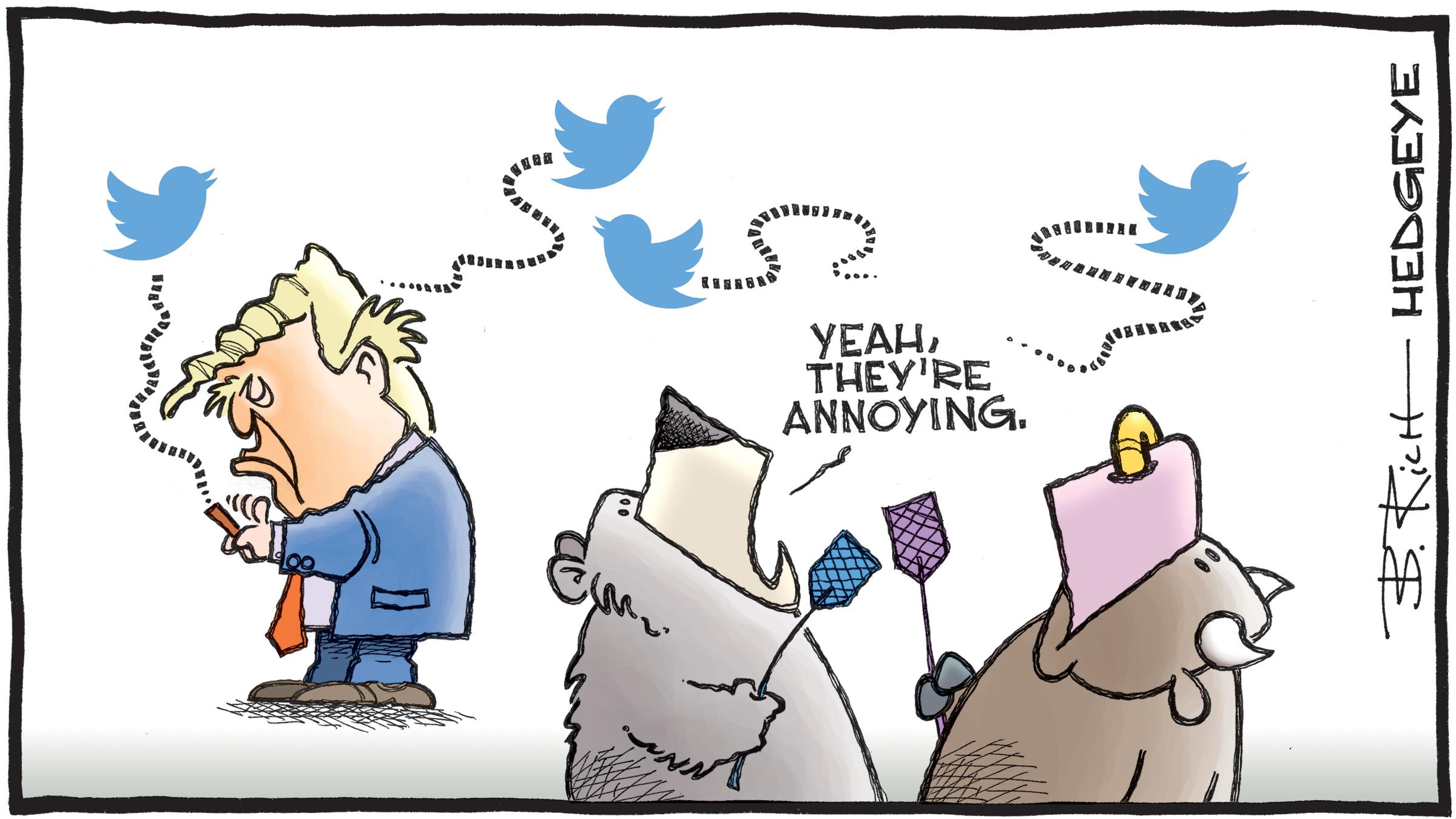

Two of Twitter's most notorious characters, Keith McCullough, the CEO of Hedgeye, and anonymous financial blogger ZeroHedge got in an epic spat on Twitter last night and it's still continuing this morning. McCullough is known for trumpeting his endless timestamps, and for attacking the traditional Wall street system. ZeroHedge started the fight when he called out McCullough on his year-old energy analyst Kevin Kaiser's bearish call last week on Kinder Morgan. ZeroHedge snapped back by hinting that they got the idea from The Value Investors Club, a website where people post different investment picks. Then McCullough whipped out his classic "timestamp" phrase on ZeroHedge telling him to timestamp his trade ideas. ZeroHedge used that opportunity to make a swipe at Hedgeye's business model saying that they are "based on daytrading hedge fund hotel ideas without capital at risk. The fight continues to get nasty. You can see all of the Tweets below:. Read next. US Markets Loading Close icon Two crossed lines that form an 'X'.

Read next.

In the last week Cramer has gone to war on Twitter and on his website, The Street, to respond to attacks from buy-side researcher Keith McCullough, of Hedgeye. The problem with that, according to Barron's and McCullough's Hedgeye, is that Linn's annual dividend will increase after it merges with another energy company, Berry Petroleum. Barron's and Hedgeye as the firm said in a call last week both believe that the increased dividend will be hard for the company to support. Cramer disagreed. Now on Wall Street, when two non-billionaire hedge fund manager individuals have a disagreement about a stock, they politely wait and see talk smack amongst themselves what happens. Perhaps it was to call attention to their research, perhaps it's because we don't have the Libor scandal to entertain us all this summer. Not to outdone Cramer took to his website to explain his position, and accused McCullough and co.

The information contained herein is the property of Hedgeye, which reserves all rights thereto. Redistribution of any part of this information is prohibited without the express written consent of Hedgeye. Hedgeye is not responsible for any errors in or omissions to this information, or for any consequences that may result from the use of this information. A 5-minute daily morning market note with core Macro ETF positions and buy low, sell high signals. By joining our email marketing list you agree to receive marketing emails from Hedgeye. You may unsubscribe at any time by clicking the unsubscribe link in one of the emails.

Hedgeye twitter

The information contained herein is the property of Hedgeye, which reserves all rights thereto. Redistribution of any part of this information is prohibited without the express written consent of Hedgeye. Hedgeye is not responsible for any errors in or omissions to this information, or for any consequences that may result from the use of this information. When you subscribe to Hedgeye Risk Manager you'll receive 8 core Hedgeye products in addition to our Quarterly Investment Outlook and access to Macro Select which will give you an unparalleled edge on Wall Street consensus. Hosted by Hedgeye CEO Keith McCullough at am ET, this special online broadcast offers smart investors and traders of all stripes the sharpest insights and clearest market analysis available on Wall Street. This monthly macro strategy update is designed to select 10 to 20 essential ETF exposures within each of the seven major asset classes to keep you and your clients ahead of the next big market move. In addition, each week we also deliver Keith McCullough's quantitative levels for each of our favorite ETFs for added risk management.

Sonos white light flickering

Toggle menu. In that sense he's smarter than all of us," Pirone wrote of McCullough in a post. Communications Pro. Hassell considered subscribing to real-time alerts. We revealed his identity. It also reports "no material changes as of October Surely people are on to this, but I was watching and [McCullough] seems to be suckering these people in," he said. Keith twitter. In the simplest terms, Pirone thinks McCullough and his company don't tell the whole truth about their real-time alerts' recommendations. On top of that, Pirone says, McCullough doesn't accurately report his "trades" — he picks and chooses what wins to tell his followers. That I have never heard in the industry, as well. It has come from on high — from the hallowed halls of Omega Advisors.

Hedgeye is an investment research and financial media company founded in

Date Range. A comprehensive suite of investing tools and data trackers, including app download and usage trends, valuation and sentiment monitor, proprietary survey insights and other alternative data. US Markets Loading This isn't about women or wives — this is about two people defaming, lying, and deceiving While corroborating with a Nefarious thief! Sign up. Digital Advertising. Instead, Hedgeye claimed that it was actually Wilson who violated rules of law. Perhaps it was to call attention to their research, perhaps it's because we don't have the Libor scandal to entertain us all this summer. At some point — Business Insider hasn't confirmed when — Hedgeye appeared to change the language explaining its real-time alerts as CalibratedConfidence noted on ZeroHedge via screenshot. Potentially addressing the recent controversy, McCullough has even tweeted screenshots of exactly what subscribers see. I, personally, think that there are a lot of big firms right now that are running mutual funds that look a lot like Real-Time Alerts," Famigletti said. Communications Pro boils down a universe of tickers into top investment ideas that include, but are not limited to:. Blum mablum December 15, Pirone republished his allegations again on April 7.

0 thoughts on “Hedgeye twitter”