Highest dividend stocks asx

The journalists on the editorial team at Forbes Advisor Australia base their research and opinions on objective, independent information-gathering. When covering investment and personal finance stories, highest dividend stocks asx, we aim to inform our readers rather than recommend specific financial product or asset classes. While we may highlight certain positives of a financial product or asset class, there is no guarantee that readers will benefit from the product or investment approach and may, in fact, make a loss if they acquire the product or adopt the approach. To the extent any recommendations bigtitygothegg statements of opinion or fact made in a story highest dividend stocks asx constitute financial advice, they constitute general information and not personal financial advice in any form.

Our analysts weigh in on their future dividend prospects. In a recent article I tried to answer a question I hear frequently. Is it feasible to retire off dividends alone. In response to my article, I heard numerous success stories from retirees. These are real life examples of the premise of my article. You can retire off dividends. However, I looked at the risks of this income investing strategy and offered some suggestions.

Highest dividend stocks asx

Become a Motley Fool member today to get instant access to our top analyst recommendations, in-depth research, investing resources , and more. Learn More. While the yields on savings accounts and term deposits have improved over the last 12 months, they still don't compare to some of the dividend yields you can find on the Australian share market. For example, analysts are forecasting bigger-than-average yields from these ASX dividend stocks in the near term. Here's what they expect:. The first high-yield ASX dividend stock that has been named as a buy is Aurizon. It is Australia's largest rail freight operator. Macquarie sees the company as a top option for investors right now. As for dividends, the broker is forecasting partially franked dividends of In respect to income, Citi is expecting dividends per share of 32 cents in FY and 35 cents in FY The broker is also expecting some attractive dividend yields in the near term. February 23, Sebastian Bowen.

The advantage is obvious.

Become a Motley Fool member today to get instant access to our top analyst recommendations, in-depth research, investing resources , and more. Learn More. With interest rates as high as they are and the best savings accounts delivering 5. The ASX bank shares and mining shares are well-known for delivering some of the highest dividend yields in the market year after year. But if you do some digging, you'll find other great dividend payers in other market sectors. Typically, the companies that will pay you the best dividend yields are the ASX large-cap shares. Most of them have been operating for decades, bringing in sustainably strong earnings every year.

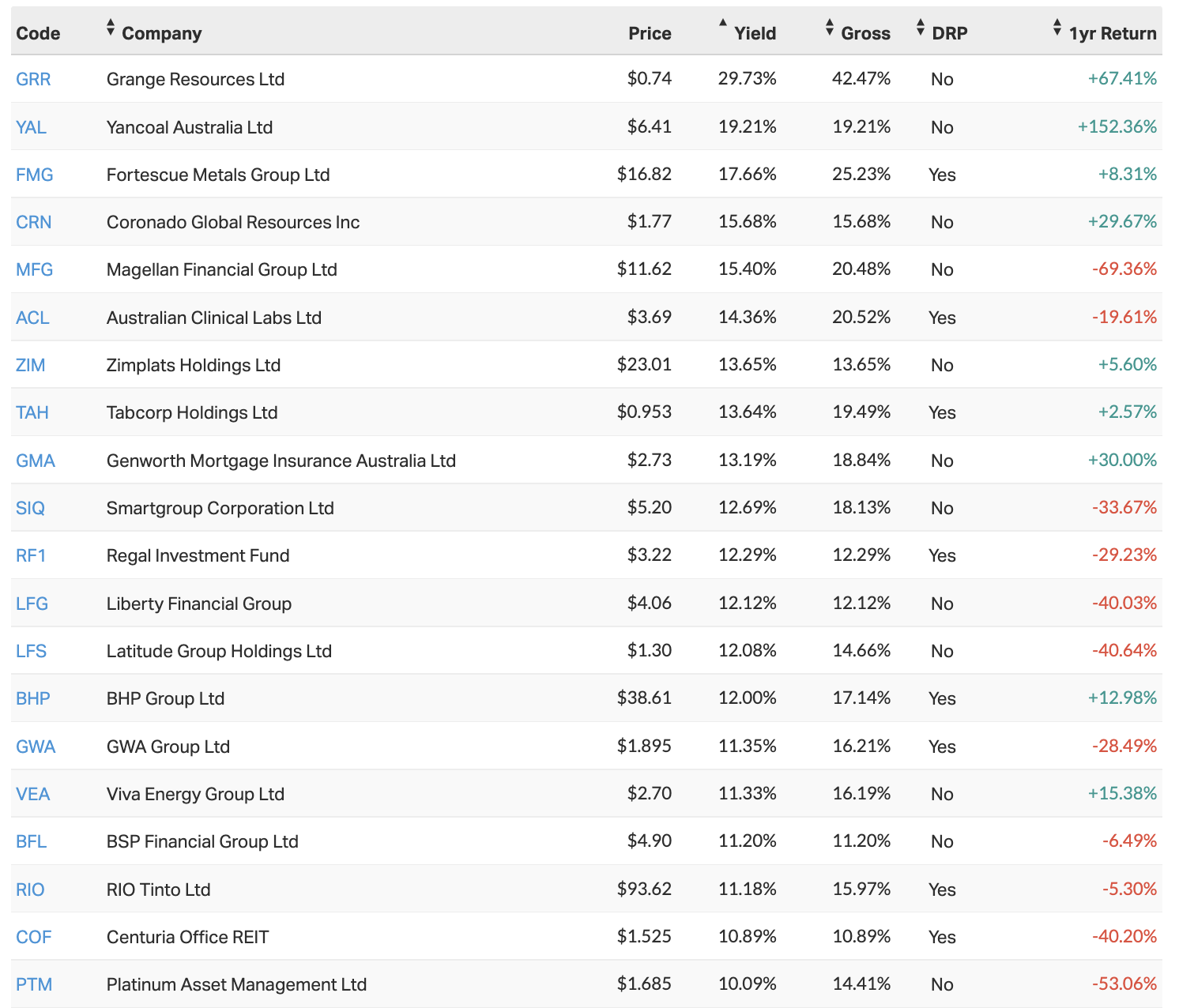

Investors are closely looking at their portfolios as inflation and changing economic conditions appear to be key risks in FY One of the ways to generate returns in Australia is by looking for the best dividend stocks on the ASX, fortunately, there are plenty of them. Dig in here to discover some of the highest dividend stocks in Australia. Company Name. Stock Price. Year to Date. Market Cap. Dividend Yield.

Highest dividend stocks asx

In this guide. Buy Shares In. Invest with. Dividends can be one of the most important considerations for Australian investors, especially those who are looking to live off the income their shares provide. Well-established blue-chip companies like the banks are less likely to see substantial share price growth over many years, so dividends are often seen as the key reason to invest in them. Given the importance of dividends and the difficulty investors have had over the last few years finding a sustainable payout due to the aftermath of global disruptions, we thought we would put together a list of non-banking best dividend stocks to keep an eye on in To help generate a list, we reached out to Bell Direct's head of distribution Tim Sparks who sent us 20 thought starters you might keep your eye on in Unfortunately there's no one magic stock that is 'best' for everyone. Instead, you should look into your own portfolio, your individual needs and your investment strategy to decide what stock is right for you.

Fcswap pokemon go codes

Growth is important because you want your investment portfolio to grow. Monitoring payout ratios can help assess payment sustainability, with high ratios possibly indicating threatened future payments. Our analysts project future dividends for each company they cover. Australian companies pay a higher percentage of profits in dividends and therefore have a higher yield than most foreign markets. In total these 10 companies pay out just under 60 percent of the total dividends an ASX investor would receive. As always, consult with a financial advisor before making significant investment decisions. Record Date: This is the cut-off date for determining the eligible shareholders to receive the dividend. Account Fees No monthly account or subscription fee for classic account. Here's what they are saying about these dividend stocks following their results. Franking credits are an additional benefit that comes with dividend-paying stocks in Australia, with their goal being to prevent double taxation.

The journalists on the editorial team at Forbes Advisor Australia base their research and opinions on objective, independent information-gathering. When covering investment and personal finance stories, we aim to inform our readers rather than recommend specific financial product or asset classes.

Diversifying your investments across various sectors and industries can also help minimise risk. Patrick has over seven years of experience in the crypto space and has previously shared his knowledge with the AML and fraud departments of Australian financial Institutions. In a recent article I tried to answer a question I hear frequently. Rio is heavily dependent on China and Mills expects earnings to materially decline with demand for many commodities likely to soften with the end of the China boom. However, the worth of dividend stocks largely depends on your individual financial goals, risk tolerance, and the overall performance of the companies you invest in. What are the safest dividend stocks? Your capital is at risk. In the past NAB paid out too much of earnings in dividends and subsequently required equity raisings. February 23, Bernd Struben. With a diverse portfolio of metallurgical and thermal coal mines in New South Wales and Queensland, Yancoal caters to key Asian markets. On top of that, the ANZ share price doesn't move much over time except during major bull runs and market crashes when all stock prices move significantly , so dividend yields stay pretty even.

0 thoughts on “Highest dividend stocks asx”