Hourly rate paycheck calculator

You are tax-exempt when you do not meet hourly rate paycheck calculator requirements for paying tax. This usually happens because your income is lower than the tax threshold. Foryou need to make less than:. If you are 65 or older, or if you are blind, different income thresholds may apply.

Input your income details and see how much you make after taxes. Calculate a bonus paycheck tax using supplemental tax rates. Calculate net-to-gross: find out how much your gross pay should be for a specific take-home pay. Calculate the gross wages based on a net pay amount. Fill out a Form W4 step-by-step with helpful tips. See how increasing your k contributions will affect your paycheck and your retirement savings. Use the dual scenario salary paycheck calculator to compare your take home pay in different salary scenarios.

Hourly rate paycheck calculator

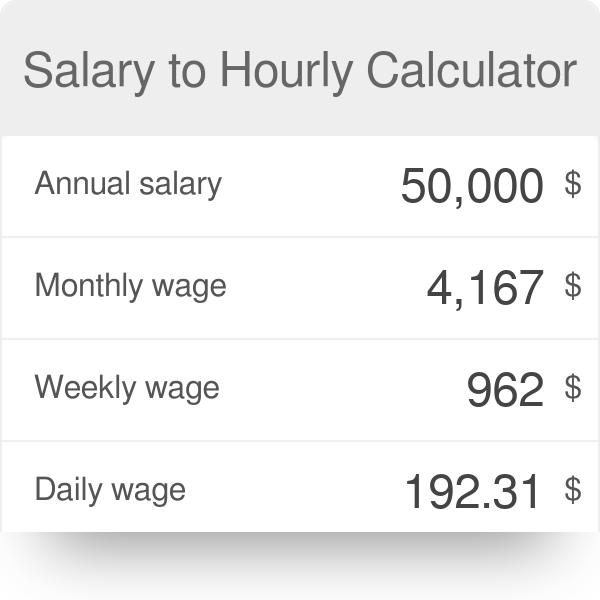

Salary to hourly wage calculator lets you see how much you earn over different periods. It is a flexible tool that allows you to convert your annual remuneration to an hourly paycheck, recalculate monthly wage to hourly rate, weekly rate to a yearly wage, etc. This salary converter does it all very quickly and easily, saving you time and effort. In the article below, you can find information about salary ranges, a closer look at hourly and annual types of employment, as well as the pros and cons for each of these. Moreover, you can find a step-by-step explanation of how to use this paycheck calculator down below. Prefer watching over reading? Learn all you need in 90 seconds with this video we made for you :. Looking for a new job is a tough and stressful task. You need to change your community, coworkers, place, and even habits. But a job change can be essential for your career at a certain time. You will be better off if you face and overcome these difficulties. Nowadays, thanks to the Internet, we have access to a huge amount of job offers globally.

Share Your Feedback. Do not enter a dollar sign and do not use commas.

This form is for calculating your annual, monthly, weekly, daily and hourly rates of pay. Please only enter the values for the time you are supposed to work. About unions. Workplace guidance. About the TUC.

Salary to hourly wage calculator lets you see how much you earn over different periods. It is a flexible tool that allows you to convert your annual remuneration to an hourly paycheck, recalculate monthly wage to hourly rate, weekly rate to a yearly wage, etc. This salary converter does it all very quickly and easily, saving you time and effort. In the article below, you can find information about salary ranges, a closer look at hourly and annual types of employment, as well as the pros and cons for each of these. Moreover, you can find a step-by-step explanation of how to use this paycheck calculator down below. Prefer watching over reading? Learn all you need in 90 seconds with this video we made for you :.

Hourly rate paycheck calculator

Find a plan that fits you. Answer a few questions about what's important to your business and we'll recommend the right fit. Get a recommendation. These paycheck details are based on your pay info and our latest local and federal tax withholding guidance.

Get the gringo subs

Hint: Gross Pay Enter the gross amount, or amount before taxes or deductions, for this calculation. Overtime Hourly Wage. Salary range Hourly rate vs. The new W4 asks for a dollar amount. When your work conditions rapidly change to much worse, you might be "forced" to look for a new job immediately. The new version also includes a five-step process for indicating additional income, entering dollar amounts, claiming dependents and entering personal information. Step 4a: Other Income. The W4 form determines the amount of federal income tax withheld from your paycheck. And the final choice of an employer may not be right, especially when you need to take something quick instead of what would you prefer. You can't withhold more than your earnings. We provide you the smart salary converter that recalculates all types of wages mentioned in the paragraph above.

Estimate the after-tax pay for hourly employees by entering the following information into a hourly paycheck calculator:. This powerful tool can account for up to six different hourly rates and works in all 50 states. See frequently asked questions about calculating hourly pay.

Grams to cups The grams to cups converter converts between cups and grams. People also viewed…. Add Deduction. To calculate your hourly pay from your salary: Find the number of hours you worked. If you opt for less withholding you could use the extra money from your paychecks throughout the year and actually make money on it, such as through investing or putting it in a high-interest savings account. For example, if you pay any amount toward your employer-sponsored health insurance coverage, that amount is deducted from your paycheck. The downside to maximizing each paycheck is that you might end up with a bigger tax bill if, come April, you haven't had enough withheld to cover your tax liability for the year. To be exempt, you must meet both of the following criteria:. Nothing beats being a union member, but if you are looking for particular guidance on a workplace issue have a look at our workplace guidance. Tax Exemptions. Get exclusive small business insights straight to your inbox.

I congratulate, what excellent answer.

I congratulate, remarkable idea and it is duly