How to get 1099 for doordash

As an independent contractor, the responsibility to pay your taxes falls on your shoulders. Each year, tax season kicks off with tax forms that show all the important information from the previous year. These items can be reported on Schedule C.

Doordash has been growing fast during the last two years and not only in terms of sales and customers but also for the number of self employers that make money delivering alcohol , food, groceries and more with Doordash. Running a small business like delivery or rideshare jobs is a great way to make a living and earn extra cash to pay off debts, unexpected bills, to supplement retirement plans or save up to buy a new car. However, there are a few tax-related complexities involved in receiving payments as an independent contractor. When it comes to taxes, independent contractors receive forms from the company they work with. Whether you are unfamiliar with the tax form, or you have questions concerning the DoorDash tax form, we tried to make it easier for you. Basically the form reports non-employment income earned through a tax year. The form will be an easy support when filing your taxes.

How to get 1099 for doordash

Christian is a copywriter from Portland, Oregon that specializes in financial writing. He has published books, and loves to help independent contractors save money on their taxes. Being a self-employed delivery driver definitely has its perks. You never know where you'll go next, and there's nobody looking over your shoulder. And if you know all the DoorDash tips and tricks , you can stand to make a lot of money. Of course, being an independent contractor can be stressful too — especially when tax season rolls around. From expense tracking to quarterly estimated payments, figuring out your DoorDash taxes can be nothing short of overwhelming. Don't worry, we've got your back. In this article, we'll explain everything you'll need to know to file your taxes as a dasher, whether it's your full-time job or a side hustle. For one thing, there's the lack of withholding. Since you're an independent contractor instead of an employee, DoorDash won't withhold any taxable income for you — leading to a higher bill from the IRS.

Doordash does report any income earned by employees or drivers to the IRS. But with Doordash taxes, things are different. Web developer.

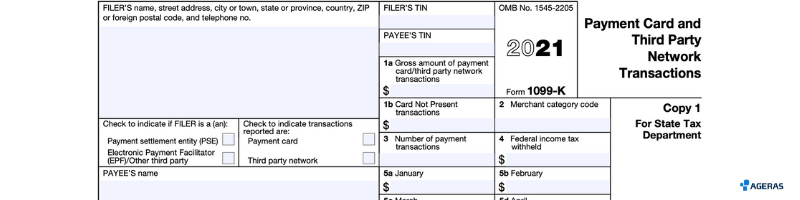

Sound confusing? Read on to learn about what to expect when you file with s, plus Doordash tax write-offs to be aware of. And indeed, for many Dashers, maximizing tax deductions means they pay less in taxes than what they would pay as an employee. Not sure how to track your expenses? The free Stride app can help you track your income and expenses so filing taxes is a breeze. Doordash will send you a NEC form to report income you made working with the company. It will look something like this:.

Are you a DoorDash delivery driver and wondering how to file your taxes? Working as an independent contractor means filling out a tax form. Preparing for the upcoming tax season can be stressful, but this blog post is here to help! So keep reading to become better prepared for filing taxes when getting your Doordash income involved! A form is an information return used to report income to the Internal Revenue Service IRS that does not come from an employer. Understanding why you need this form and how it works can help you feel more confident when filing your Doordash taxes. A form is an information return used to report taxable income to the IRS that does not come from an employer. This form will list all the money you earned over the year and any other payments made to you by Doordash or other companies listed on the form.

How to get 1099 for doordash

Just like with any other job, when you work at DoorDash, you need to take care of your taxes. The is a tax form you receive from Payable. The form is meant for the self-employed, but it also can be used to report government payments, interest, dividends, and more. Your employer has an obligation to send this form to you each year before January 31 st. Via this form, you report all your annual income to the IRS and then pay income tax on the earnings. The only thing you should avoid is waiting for the form and missing your deadline. If you have an account from before, you can see the form for the current year under DoorDash year name.

Nine west chelsea boots

Can you choose when Doordash pays you? If you have a W-2 job as well, your combined W-2 and DoorDash earnings will be used to figure out your tax bracket. Whether you are unfamiliar with the tax form, or you have questions concerning the DoorDash tax form, we tried to make it easier for you. About Us. That's because the earnings you get direct deposited into your DasherDirect account are not shown on Stripe Express. This article was written independently by Keeper for educational purposes only. You're only allowed to deduct only the portion of these expenses you use for your job as a delivery driver. If you choose snail mail, your form will also be mailed out on the last day of January. Travel nurse. Makeup artist. The first step is to report this number as your total earnings. Deductions are one of the most important benefits for self employed. Filing quarterly taxes as a freelance delivery driver for Postmates is a massive task. Income tax.

Christian is a copywriter from Portland, Oregon that specializes in financial writing.

Schedule C Used to figure out how much profit or loss you made as a sole proprietor. Contents Text Link. PeakPay helps you earn more per delivery during peak hours. Here are some other common write-offs for dashers:. Our A. A K form summarizes your sales activity as a Merchant. Your NEC will show you your total earnings from the app, including your base pay and any tips , as well as pay boosts and milestones. Stripe and DoorDash have made a partnership. Postmates Filing quarterly taxes as a freelance delivery driver for Postmates is a massive task. I Just Got My Doordash Personal trainer. Turbotax is currently one of the best tax software you can find. If you're self-employed, though, you're on the hook for both the employee and employer portions, bringing your total self-employment tax rate up to

It is doubtful.

I am sorry, that I interfere, I too would like to express the opinion.