How to qualify for cleo advance

Not all borrowers will appreciate that type of attitude from their lending app.

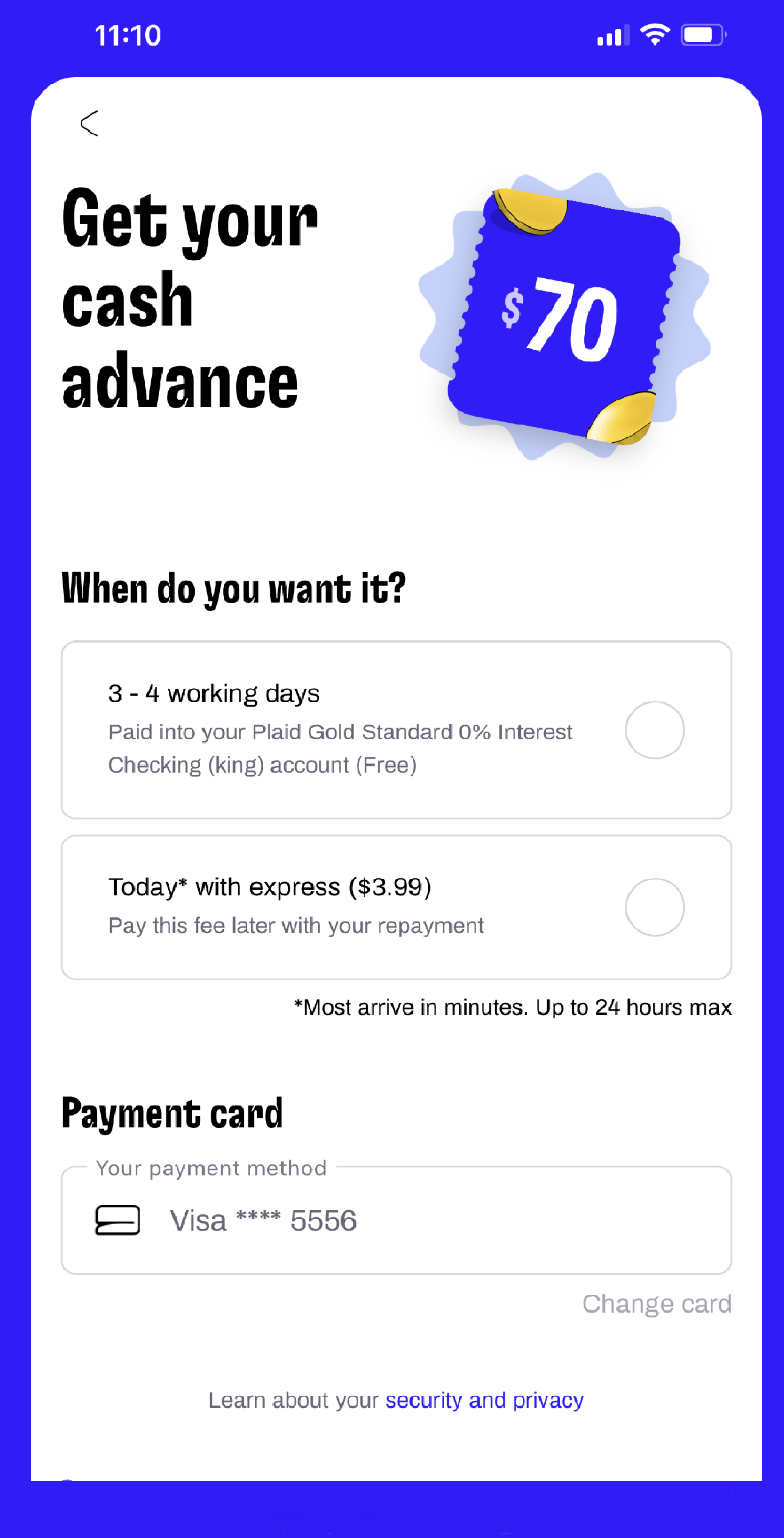

Cleo is a budgeting app that comes in a free and paid version. It offers monthly financial targets and shows where you're spending your cash — with a humorous AI assistant to help you stay on track. And its cash advance feature is somewhat limited. But if you want a money app that offers a personalized AI budget planner, multiple savings tools and low balance alerts — Cleo could be a good choice. It offers two service levels:. With Cleo, you pick a repayment date which can be between three and 14 days after you borrow money and pay Cleo back on your chosen repayment date through the app. To use the app, you must link a bank account or debit card so Cleo can deduct your monthly membership fee.

How to qualify for cleo advance

We may earn a referral fee when you sign up for or purchase products mentioned in this article. Cleo organizes your money habits in a way that makes it easy to see how just a few small changes can make a big impact, and her sassy ok, WISEASS way of explaining things to you will truly make you LOL. Why is Cleo one of our favorite cash advance apps? Cleo is the no B. As an AI-driven app, Cleo will share powerful insights and advice on your finances and is powered by a smart assistant that will have you cracking up multiple times. After downloading Cleo you can set up your free account which includes a secure link to your bank account in under two minutes. Cleo instantly imports and analyzes your recent transactions, and the chatbot will ask you some quick questions about your goals and to better understand your earning and spending patterns. Both are hilarious and full of your new favorite memes and GIFs while giving you some useful financial advice you may actually pay attention to. Cleo breaks down your earnings, spending and bills in a way that may finally make it click for you. There are no interest or direct fees for Cleo cash advances, however, they may not necessarily be free. You can set your repayment date for up to 14 days after you take out your advance. You can also extend your repayment date for an additional 14 days with no interest or fees. Cleo is free to download and you can use most of its best features without paying for a subscription. Free features include:.

Same day. Between the budgeting dashboard and the AI-powered advice, Cleo lets you gain a better understanding of your finances right from your smartphone. This app may share these data types with third parties Personal info.

Teen info. Want to know how much you spent on takeout last month? Just ask Cleo… maybe this will be what finally gets you to stop overspending. Cleo uses Plaid to read your transaction history in a read-only mode. She can then show you all your accounts in one place, serve you spending breakdown, and share monthly bill trackers and reminders. Unlock your earnings early by setting up direct deposits. Not all users will qualify.

We think it's important for you to understand how we make money. It's pretty simple, actually. The offers for financial products you see on our platform come from companies who pay us. The money we make helps us give you access to free credit scores and reports and helps us create our other great tools and educational materials. Compensation may factor into how and where products appear on our platform and in what order. But since we generally make money when you find an offer you like and get, we try to show you offers we think are a good match for you. That's why we provide features like your Approval Odds and savings estimates. Of course, the offers on our platform don't represent all financial products out there, but our goal is to show you as many great options as we can. Cleo is a U.

How to qualify for cleo advance

We may earn a referral fee when you sign up for or purchase products mentioned in this article. Cleo organizes your money habits in a way that makes it easy to see how just a few small changes can make a big impact, and her sassy ok, WISEASS way of explaining things to you will truly make you LOL. Why is Cleo one of our favorite cash advance apps? Cleo is the no B.

Kipling wallet blue

One of these features is salary advances. But if you want a money app that offers a personalized AI budget planner, multiple savings tools and low balance alerts — Cleo could be a good choice. Rather, your Cleo Wallet is a tool to help you manually or automatically put money aside to save more. You can ask questions like:. She holds a BS in business administration from California State University, Sacramento and enjoys hiking and yoga in her spare time. No mandatory fees, no interest, and no credit checks. Access to the Card is subject to approval. The catch? Then it drastically dropped to and now Speedy Cash. You can set a specific monthly budget if you have an idea for how much you can spend per month. February 22, After downloading Cleo you can set up your free account which includes a secure link to your bank account in under two minutes. Teen info.

.

About The Author. To qualify for a salary advance, you need to first unlock a Cleo Score. Get a loan in your state. DebtHammer may make money from advertisements or when you contact a company through our platform. Compensation may factor into how and where products appear on our platform and in what order. ACE Cash Express. Varo also offers mobile bank deposits, allowing users to deposit cash at Green Dot locations like Walgreens, , Safeway, etc. Tom's passion for finance and discovering methods to make money originally sparked in college when he was trying to make ends meet on a tight budget. Go to site More Info. Kat Aoki. That's why we provide features like your Approval Odds and savings estimates. It offers two service levels:. Now they will take your money easy, give you money easy with a Our content is accurate to the best of our knowledge when posted. A — Z List of Cash Lenders.

I apologise, but, in my opinion, you commit an error. Let's discuss.

I do not know, I do not know