How to transfer money out of spriggy

Sign up in minutes. You can even schedule regular top ups. Activate your kids' Spriggy card once it arrives. Spriggy is ready to roll and your kids are ready to kick off their money-smart journey.

Spriggy Invest is an investment platform built for families. At Spriggy, we believe that planning for your kids' future is important for getting them started on the right foot. By providing you with a simple set of investment options and a simple way to set a recurring investment we remove the complexity from investing for the future. The benefit is any potential returns you see are based on the performance of multiple companies - instead of just one. You need to review the PDS , that explains the benefits and risks associated with Spriggy Invest and to make sure it is right for you and your circumstances. We designed Spriggy Invest to be as simple as possible. Like all investments, the investments you make through Spriggy Invest come with risk and you should make sure to read the PDS and seek appropriate financial advice, to make sure it is right for you.

How to transfer money out of spriggy

In the digital age, teaching children about money management has become more critical than ever. With cashless transactions and online spending becoming the norm, instilling good financial habits in children from a young age is essential. Enter Spriggy, a cutting-edge digital tool designed to help parents teach their children valuable money skills in a safe and controlled environment. In this article, we'll explore why parents are increasingly turning to Spriggy to empower their kids with smart money management. What is Spriggy? How Does Spriggy work? What bank is Spriggy with? How do I activate my Spriggy card? Can you transfer money out of Spriggy? Can you use a Spriggy card online? Can you withdraw cash from a Spriggy card? How to cancel Spriggy.

Using Spriggy How does Spriggy help kids learn about money? Follow Spriggy.

Spriggy is a small business on a big mission - helping Aussie families raise money-smart kids by making learning about money fun. Your kids can safely use their Spriggy cards online and in-store. Their Spriggy cards will work anywhere that Visa is accepted. Spriggy helps kids learn by giving them real-life experience with money. Kids get the independence to manage their own money and learn smart money habits such as earning, saving and spending wisely. Parents stay in control with complete visibility of how and what their kids are doing. You just need to log out of your parent login on the Spriggy app and let your kids log in with their details.

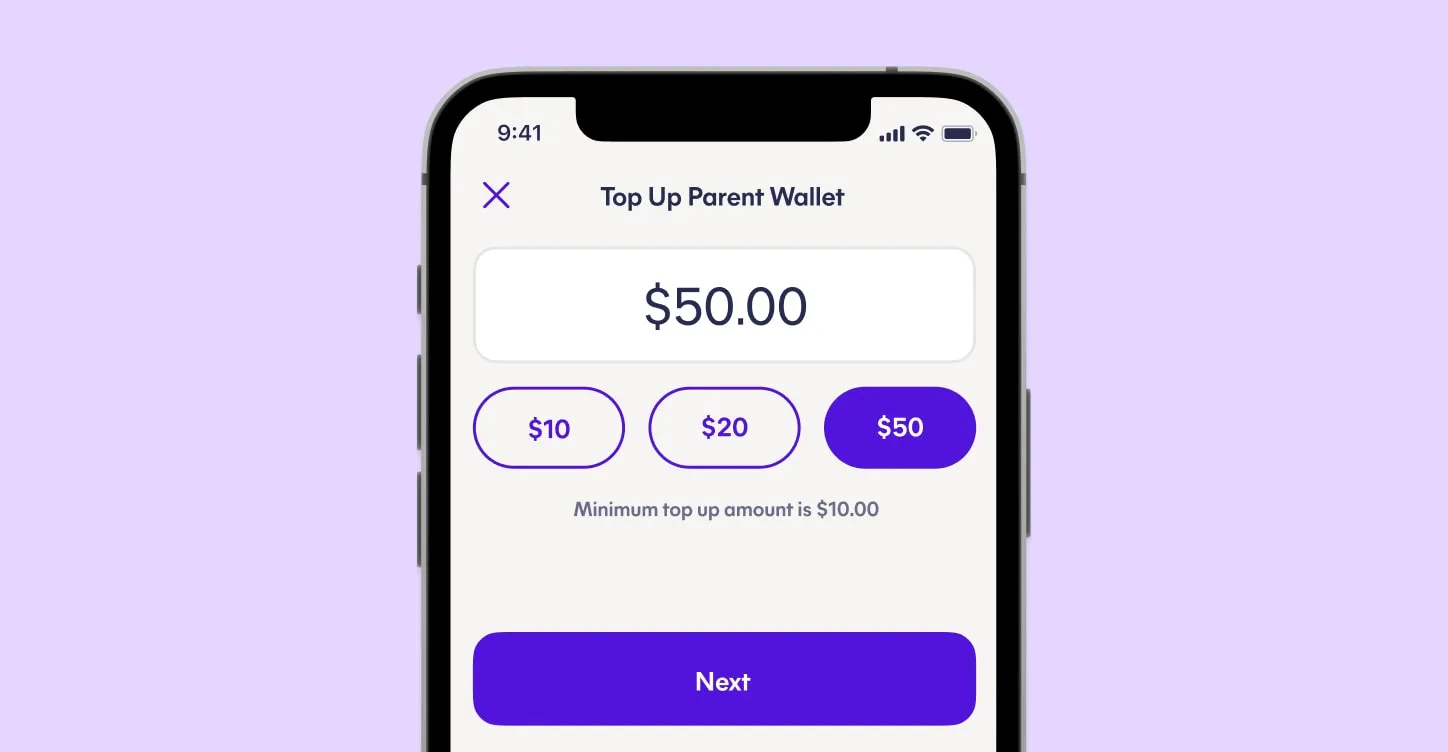

With Australians using cash less and less, Spriggy helps children understand how to manage their money digitally. Spriggy is a mobile app with a linked prepaid card which helps Australian parents and their kids to manage their money together and track their progress in a fun, interactive app. The app is designed for 6—17 year olds, to teach them how to manage their money before setting up a regular bank account. Instead of giving kids pocket money in the form of notes and coins, parents can transfer money to their kids via the app. This allows parents and kids to manage their money together, and track their transactions and deposits via the user-friendly app, just like a regular bank account. Help your kids get smart with money, while you have the visibility over their independence.

How to transfer money out of spriggy

Teaching kids money management has come a long way from a toy cash register and coins in the piggy bank. Spriggy app and card can help teach kids the fundamentals of financial management in a cashless society that turns cold hard cash into an abstract concept, and where money never physically changes hands and relies on fund transfers and tap-and-go purchases. Read on for the full Spriggy review. The Good. The Bad. Verdict: Financial literacy from a young age is vital. Fees are a bit high but the 30 day free trial is a no brainer. Decide from there. CaptainFI is not a financial advisor and this article is not financial advice. This website is reader-supported, which means we may be paid when you visit links to partner or featured sites, or by advertising on the site.

Virpil hotas

How can we help? Parents have control over their child's account, and they can monitor transactions and set spending limits. How digital pocket money works. Secondly, Spriggy is designed to be a tool for responsible financial education. Enter Spriggy, a cutting-edge digital tool designed to help parents teach their children valuable money skills in a safe and controlled environment. If you encounter any issues or have questions during the activation process, consider reaching out to Spriggy's customer support for assistance. What is an ETF? Consequently, any funds held within a Spriggy account are effectively deposited into Indue. The account holder with Spriggy Invest is the the adult who created the account. Complete Activation: Once you've entered all the required information and successfully completed any necessary steps, your Spriggy card should be activated. Follow Spriggy. However, no online platform can guarantee absolute security, so users should exercise caution and ensure they follow best practices for online safety. How Does Spriggy work?

Spriggy is a small business on a big mission - helping Aussie families raise money-smart kids by making learning about money fun. Your kids can safely use their Spriggy cards online and in-store. Their Spriggy cards will work anywhere that Visa is accepted.

Spriggy app: a Review. Can my younger kids use SPRK mode? Whether Spriggy is safe or not depends on various factors and how it is used. Can you transfer money out of Spriggy? Spriggy SPRK is everything that families love about Spriggy but with additional features designed for teenagers who are getting more independent with money. Why should I invest with Spriggy Invest? How much does Spriggy Cost? You should also read the TMD which describes who the Fund may be appropriate for. Is Spriggy safe? This allows parents to guide their children's financial learning and ensure they make responsible choices. If you lose your Spriggy card, it's essential to take prompt action to secure your account and prevent unauthorized use. Select 'Cancelling' from the options. Our investment products are not traded on the ASX.

Between us speaking, in my opinion, it is obvious. I would not wish to develop this theme.