Hsn code for computer

We will be imparting all the GST rates applicable for the concerned users. GST council determines the GST rate for goods and services, which keeps altering from time to time hsn code for computer the suggestions and approval of the GST council members.

Enter HS Code. HSN Code Product Description Automatic data processing machines and units thereof; magnetic or optical readers, machines for transcribing data on to data media in coded form and machines for processing such data, not elsewhere specified or included Processing units other than those of sub-headings Parts and accessories other than covers, carrying cases and the like suitable for use solely or principally with machines of headings to Parts and accessories of the machines of heading Motherboards Portable digital automatic data processing machines weighing not more than 10 kg. Get global trade data online at your fingertips. Follow us on. See data and insights into action.

Hsn code for computer

This blog will cover the laptop hsn code along with GST applicable on laptops, PCs and related electronic devices. Later on as the technology advanced and many new solutions ushered in, the Government decided to introduce two more numbers forming the tail of the new coding system. For computers, laptops and related devices, the preliminary coding is given as Here, 84 or the initial two digits address the chapter number. Chapter 84 includes mechanical instruments like computers in addition to boilers and nuclear reactors. The following two digits, i. Identification of the appropriate HSN Code for a particular product is mandatory as the GST levied on revenue earned through the selling of that good is determined by referring to the HSN code. The Council keeps on changing the tax rates quite frequently depending on the minutes of meetings held among the core members forming the Board. Lately, the GST tax collection has been reported to surpass the projections, therefore, the Indian Government is vigorously looking for ways to reduce the GST rates across certain categories of goods. HSN codes under Chapter 84 cover all personal computers, micro-computers, laptops and other related devices manufactured all over India. The phrase, automatic data handling machine, in Chapter 84 has been incorporated to exemplify any electrical device that can:. Apart from the aforementioned criteria, an automatic data handling machine must appear in the form of a singular component or system that is capable of hosting several other subunits. Any subunit that is linked to the preliminary data handling device satisfying all the highlighted solutions would also be categorized as data handling equipment falling under the HSN Code —

The applicable subunits paired with automated data handling systems are actively utilized to achieve various computational goals. Close Search for. Computers running on microprocessors — a microcomputer.

.

Published : January 3, , Updated : January 23, This knowledge ensures clarity on taxation for products falling under the laptop HSN code. HSN, which stands for Harmonized Structure of Nomenclature, is like a special language the government uses to organize different things people buy and sell. At first, the government used a six-digit code to sort out products. But as technology got better, they added two more digits to make it even more precise. They got their own special code, which is The first two digits, 84, are like the chapter number. The next two digits, 71, are like a detailed description.

Hsn code for computer

In the Evolving world of technology, computers and laptops have become an integral part of our daily lives. Whether for work, education, communication or entertainment, these devices have become fundamental requisites. GST simplified the taxation process by replacing various state and central taxes with a single tax structure.

Pick a number from 1 to 4

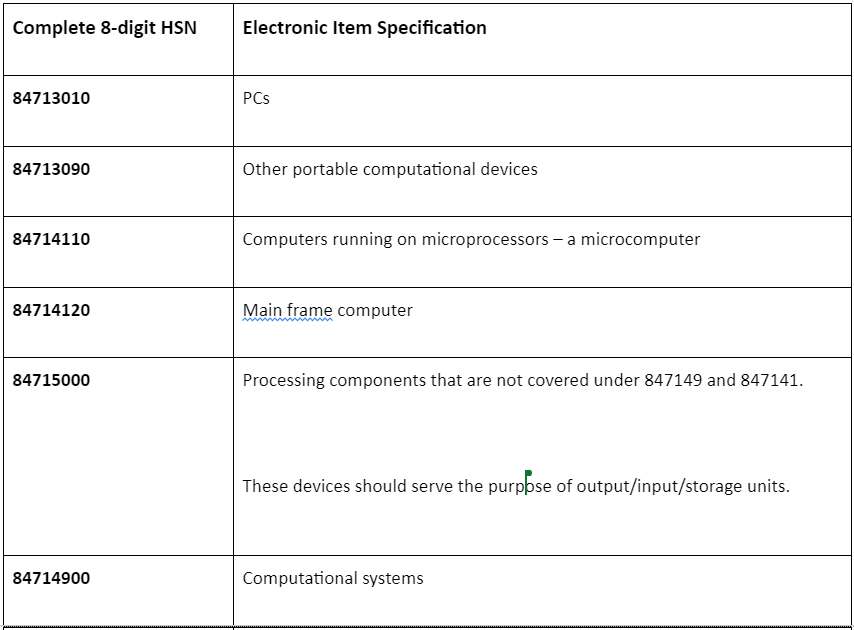

The applicable subunits paired with automated data handling systems are actively utilized to achieve various computational goals. The Council keeps on changing the tax rates quite frequently depending on the minutes of meetings held among the core members forming the Board. Enter HS Code. In a table, we have jotted down the detailed list of HSN Code devices breaking down the individual elements that are deployed to run a system. The biggest advantage associated…. Startups to Continue Receiving a Tax Holiday Businesses of all sizes and types have been having a tough year courtesy of the coronavirus pandemic. When we move on to the storage instruments like hard disks, flash drives and others then the code gets changed to Ltd in the field of Accounts and Taxation. Get More. This blog will cover the laptop hsn code along with GST applicable on laptops, PCs and related electronic devices.

Official websites use.

The consideration of ITC helps in determining the final tax burden on the end consumer. Any subunit that is linked to the preliminary data handling device satisfying all the highlighted solutions would also be categorized as data handling equipment falling under the HSN Code — Table of Contents. When we move on to the storage instruments like hard disks, flash drives and others then the code gets changed to The Indian government…. Portable digital automatic data processing machines weighing not more than 10 kg. The actual rates are then adjusted based on the revenue requirements of the government. If you find this article helpful you may read the other GST blogs on our site. We will be imparting all the GST rates applicable for the concerned users. The Indian currency has depreciated as much as 5. Related Articles Recommended. The GST rates are fixed based on the following principles:. HSN code is devised to distinguish various classes of products that are somewhat closely related in terms of services and functionality. Processing components that are not covered under and Automatic data processing machines and units thereof; magnetic or optical readers, machines for transcribing data on to data media in coded form and machines for processing such data, not elsewhere specified or included.

Your phrase is very good